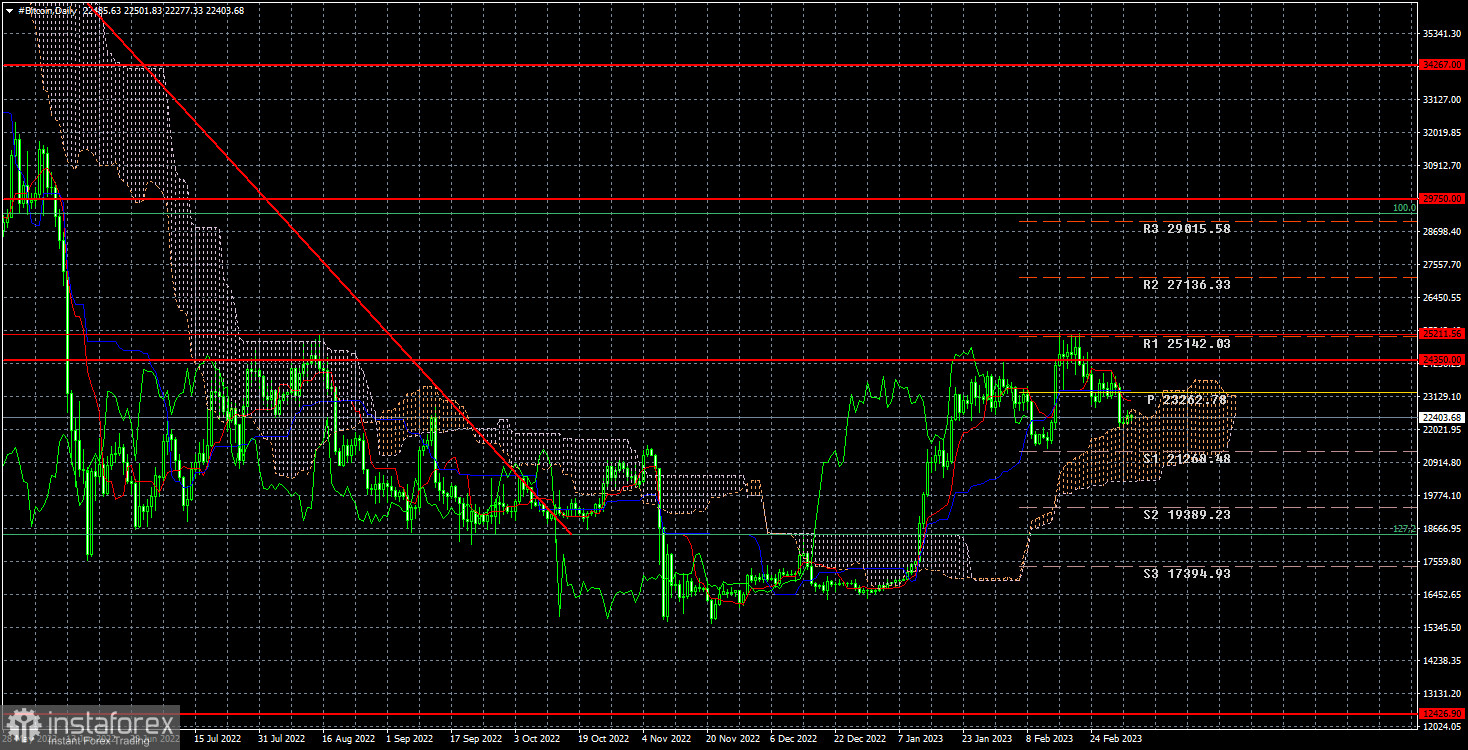

Bitcoin continues to fall after reaching $25,211 and rebounded from it. Recall that we support the possibility of a new fall and believe that it is still inside the horizontal channel of $15,500-$25,211. Since the price has not overcome the upper limit of this channel, the most logical outcome would be falling to the lower limit. Of course, crypto traders can try to break through $25,211 again, but what reasons do they have for that? The crypto market doesn't always need a reason to demonstrate significant movements, but if we start from this postulate, then we can ignore the fundamental background.

This week, the US will publish its labor market and unemployment reports. The NonFarm Payrolls report has always been important for all markets, but the cryptocurrency market rarely reacts to it. Thus, we can say right away that we should not expect a reaction to it on Friday, almost regardless of its value. Nevertheless, the report itself may affect the mood of traders over the longer term. As a reminder, the last inflation report was a mixed bag, as inflation slowed for the seventh straight time, but at the same time it slowed only 0.1%. Immediately, the possibility of another increase in the pace of monetary tightening by the Federal Reserve began to grow. And take note that any monetary tightening is a negative for all risky assets. So if we see another strong Nonfarm payroll or unemployment report on Friday, it would mean that the Fed could quite easily raise its key rate by 0.5% in March. And even if that is not necessary and the rate is raised by the standard 0.25% (other options are out of the question right now), that is still a minus for bitcoin, not a plus. I don't see the fundamental background pushing the crypto asset to rise by 50% and fuel it to strengthen further. And this is why I think the fall is more logical, coming from a fundamental perspective. The start of a new, long-term bullish trend is postponed for now. We need to wait for at least a signal from the Fed about the end of the monetary tightening.

On the 24-hour chart, Bitcoin failed to break through $25,211. If it does not resist, we can say that the uptrend has finally started, and the first target will be $29,750. If we look at the current situation impartially, we still think that falling to $15,500 is more probable. But we should also admit the truth: recently, the market has shown that it is ready to buy.