You require the following to open long positions on the GBP/USD:

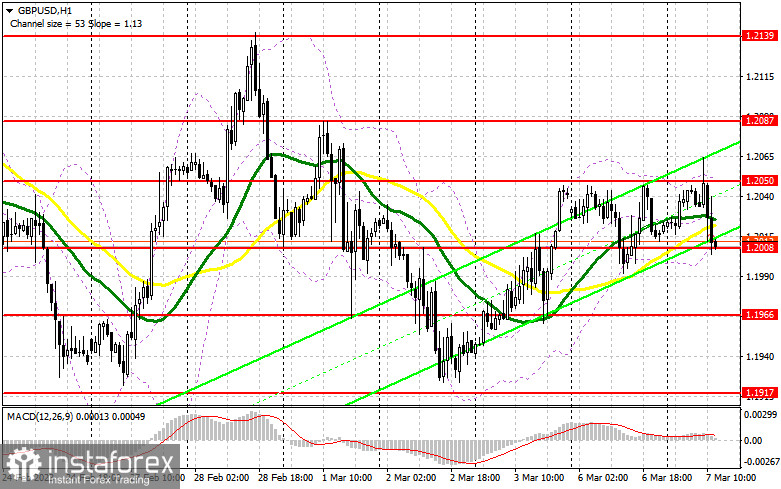

Many people are afraid of the critical remarks that Jerome Powell, chairman of the Federal Reserve System, would make at the impending meeting at the end of this month regarding the committee's future strategy. Powell's address before the US Senate will undoubtedly be fairly hawkish because the inflation situation is dire; its next upward surge is anticipated to occur in the spring of this year. All of this could result in further strengthening of the US dollar's position relative to the British pound. In light of this, it is recommended to wait for a drop and the development of a false breakout in the 1.2008 area, which will result in a great entry opportunity for a purchase and another movement of the pound up to 1.2050. I will only wager on the movement of the GBP/USD up to a new maximum of 1.2087 once fixing and testing from top to bottom 1.2050, which was not possible in the first part of the day, has been completed. The maximum of the previous week, where I am fixing profits, is around 1.2139, and an exit above this area will also open up growth opportunities there. A test of this area will likewise show that the buyers' market has returned. Things will get worse if the bulls are unable to complete the tasks assigned and miss 1.2008, which is quite possible. In this situation, I suggest against making hasty purchases and only starting long positions around 1.1966 and only in the event of a false drop. To correct 30-35 points within a day, I will buy GBP/USD as soon as it rises from the month's low of 1.1917.

For opening short positions on the GBP/USD, you will need:

Sellers first appeared around 1.2050 and are now obviously aiming for 1.2008. The development of a false breakout at 1.2050 will serve as a signal to enter the market with the expectation of a decrease in the support area of 1.2008 if the pound rises abruptly in the afternoon. Buyers' expectations of a correction will be dashed if the market moves to 1.2008 with a breakout and a bottom-up test during Jerome Powell's speech, returning the market to a bearish character with a sell signal and a decline to 1.1966. The area around 1.1917 will be my farthest target, and that's where I'll set the profit. The situation will stabilize if GBP/USD rises and there are no bears above 1.2050, which is doubtful. In this scenario, the bears will pull back, and an entry point into short positions will only come from a false breakout at the next resistance level of 1.2087. If there isn't any activity there, I'll sell GBP/USD right away at its highest price of 1.2139, but only if I think the pair will fall back by 30-35 points over the day.

Signals from indicators

Moving Averages

Trade occurs in the area of the 30 and 50-day moving averages, which indicates market volatility before significant news.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located around 1.2000, will serve as support in the event of a decline.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

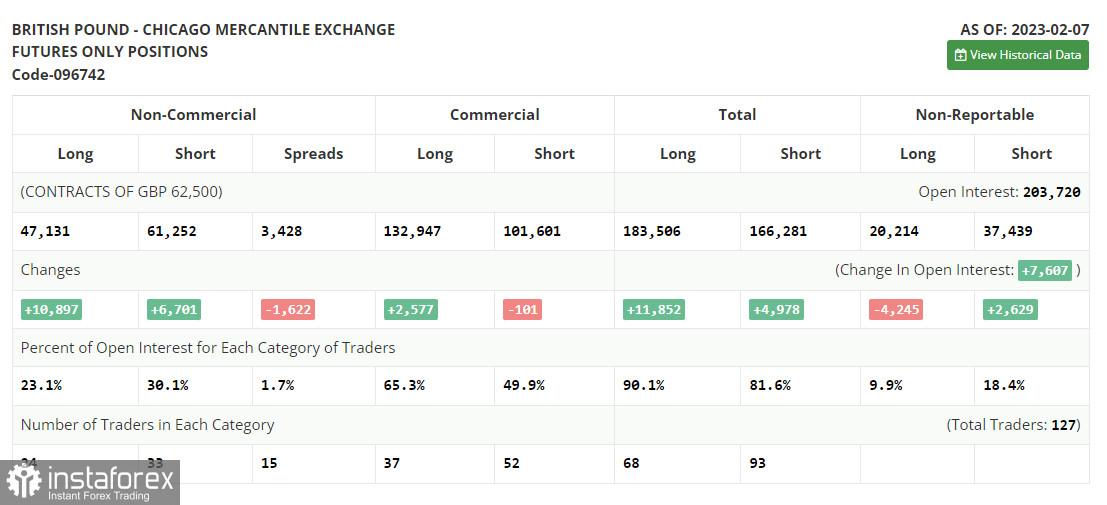

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.