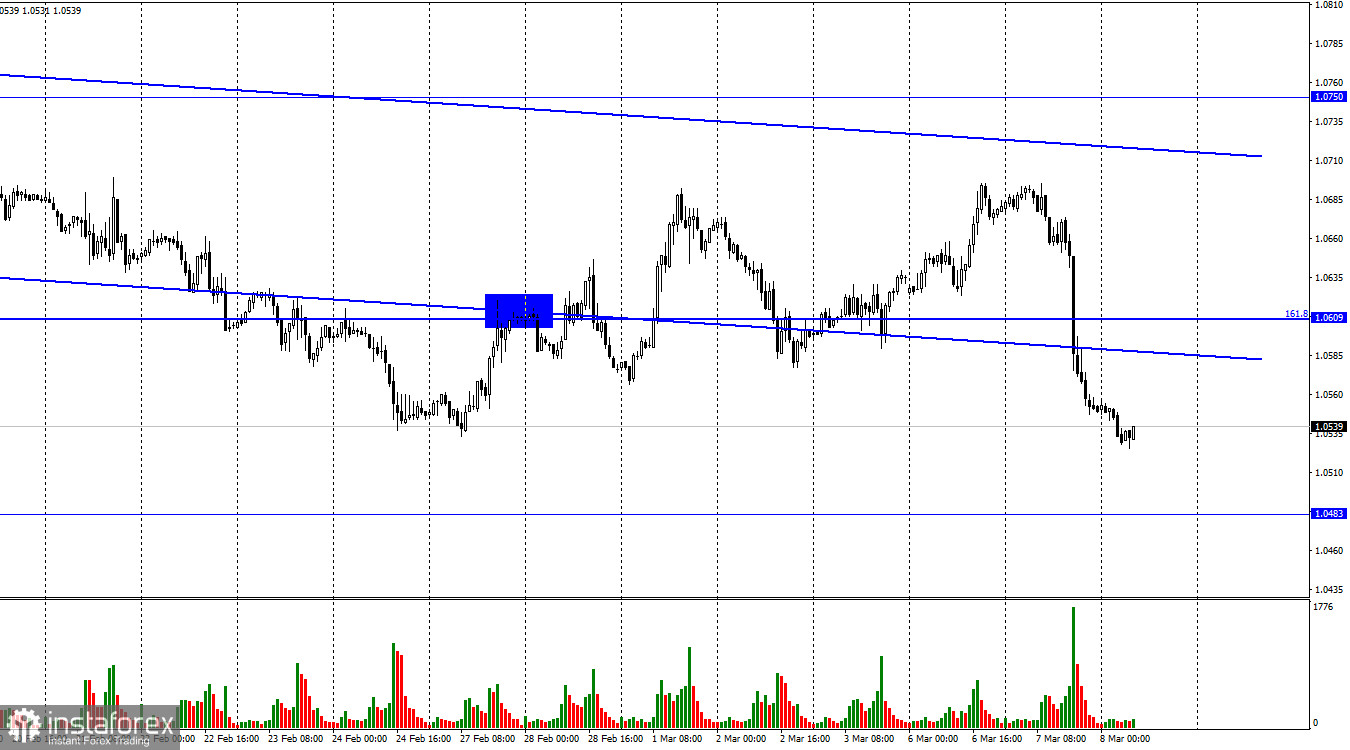

Hi, everyone! The EUR/USD pair performed a downward reversal on Tuesday. It settled below the downtrend corridor and 1.0609, the Fibonacci correction level of 161.8%. Thus, it may drop to 1.0483. The pair reached the previous swing low. There could be a rebound from this level.

On Tuesday, Jerome Powell made a speech at the Senate Banking Committee. He said that the Fed could raise interest rates more aggressively than expected. He noted that the Fed remains committed to returning inflation to 2%. However, it is unlikely to occur in the near future. Inflation will hardly return to the target level in 2023. He also admitted that the regulator may take extra measures to cap soaring inflation. This is why it might accelerate the pace of monetary tightening. "If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes," Powell pointed out.

The US dollar rose sharply amid such comments. Traders are now looking forward to the Nonfarm Payroll report which is on tap on Friday. If the figure turns out to be strong again, the Fed rate will hike the key rate by 0.50% in March. This will be the factor Powell hinted at when talking about new aggressive rate hikes. Perhaps he will mention this likelihood again in his speech today. The labor market remains tight. The unemployment rate is the lowest on record. Inflation is declining rather slowly. If NFP data is strong on Friday, the Fed may raise the key rate more aggressively on March 21-22. If this assumption is correct, the US dollar is sure to jump higher

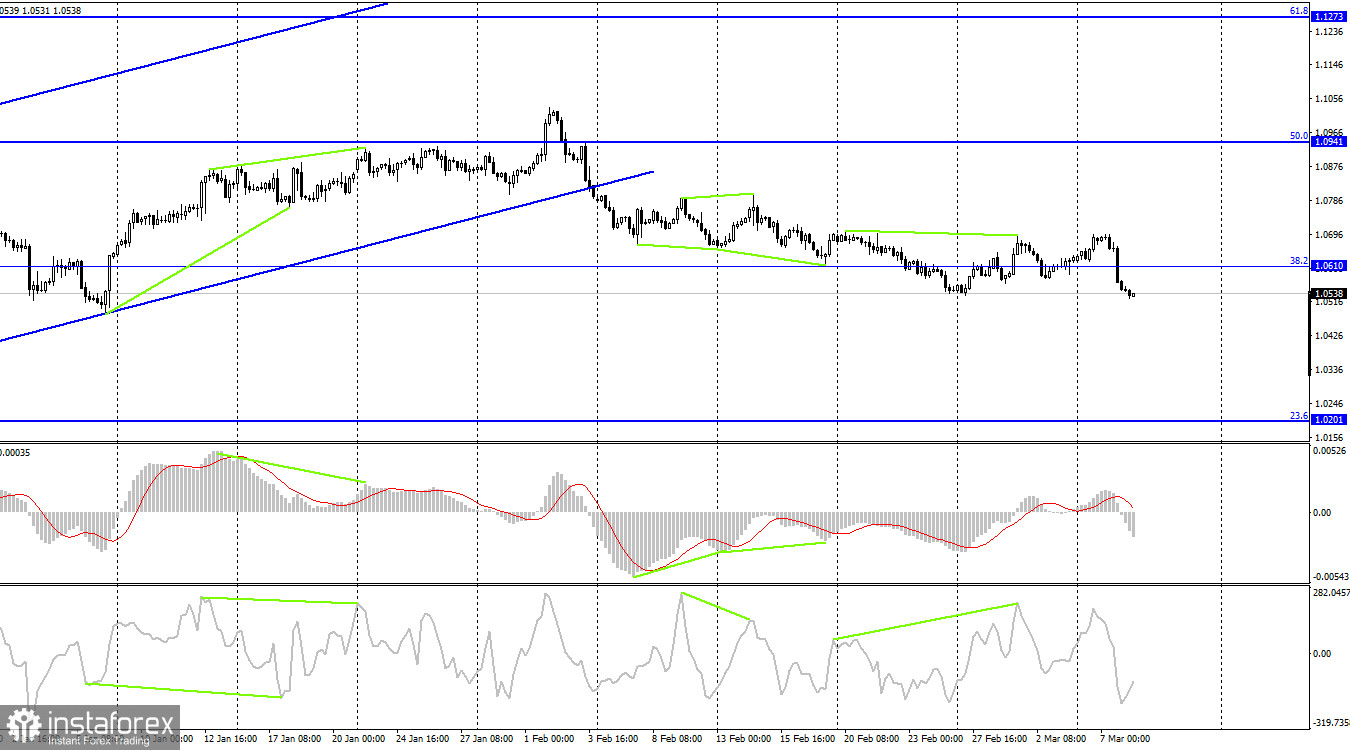

On the 4H chart, the pair dived below the uptrend corridor. It signals a further fall as the pair has left the narrow corridor for the first time since October. The overall sentiment is bearish. so, the greenback could climb to 1.0201. No divergences have been seen in any indicators.

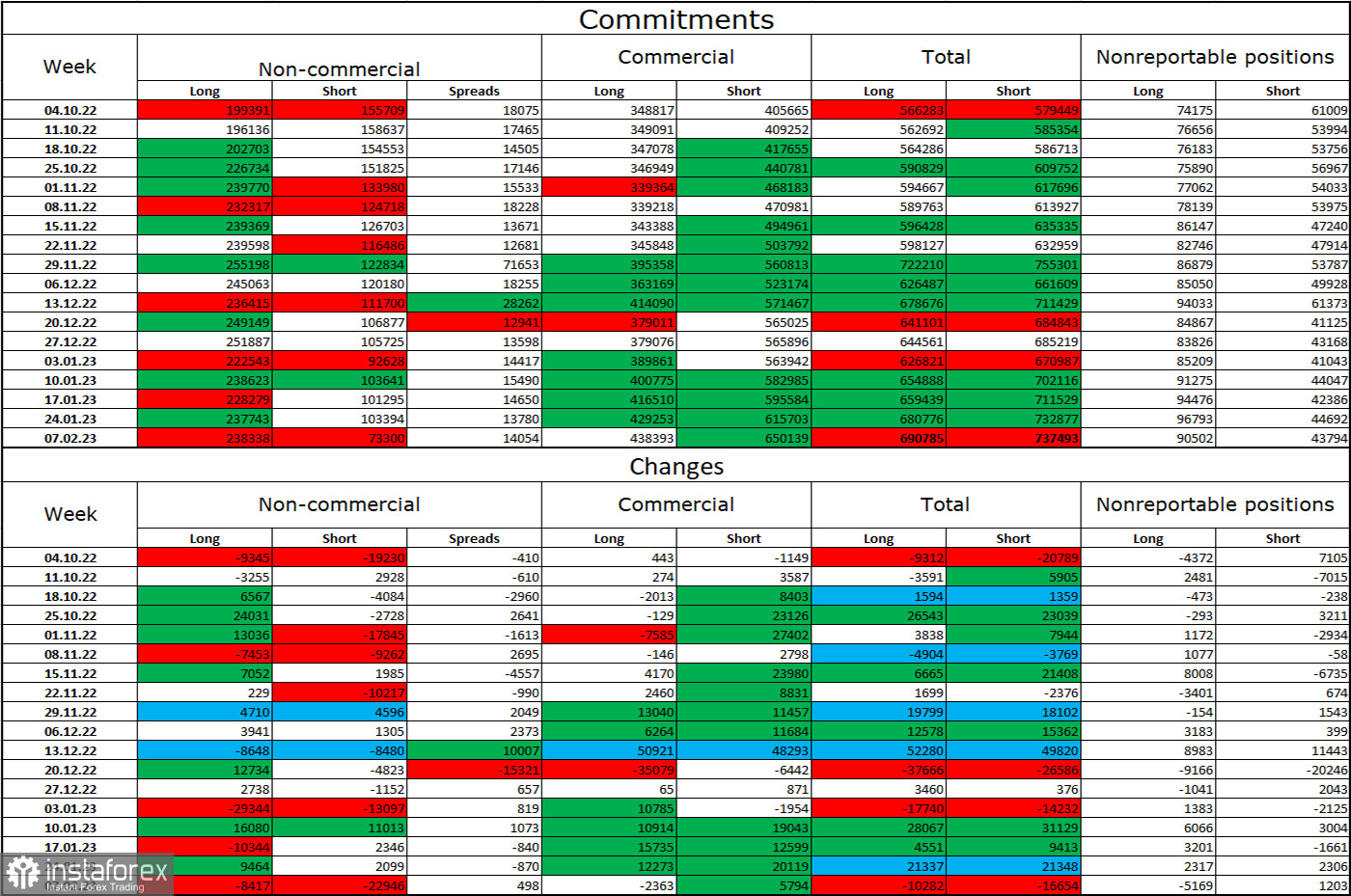

Commitments of Traders (COT):

Last week, speculators closed 8,417 long positions and 22,946 short ones. The mood of large traders remains bullish. However, please note that the last available report was unveiled on February 7. In early February, the bullish mood may have intensified. Currently, the situation is a bit different. The total number of long positions now amounts to 238,000 and the number of short ones totals 73,000. The euro has been falling for several weeks but at there is no fresh COT data. In the last few months, the euro has been gradually climbing higher although fundamental factors have not always been favorable. Now, there are plenty of drivers for its growth. So, its prospects are quite bright at least as long as the ECB continues to raise the interest rate by 50 basis points.

Economic calendar for US and EU:

EU – GDP for the fourth quarter, 10:00 UTC.

EU– Christine Lagarde's speech, 10:00 UTC.

US –ADP data, 13:15 UTC.

US– Jerome Powell's speech, 15:00 UTC.

On March 8, the economic calendar for the European Union and the United States includes several crucial events. The impact of fundamental factors on market sentiment may be strong today.

Outlook for EUR/USD and trading recommendations:

Traders are recommended to open short positions if the pair drops below 1.0609 on the 1H chart with a target of 1.0483. Now, one may keep these positions open but be careful with the 1.0532 level. The pair could perform a rebound from it. It is better to open long positions if the euro grows from 1.0483 on the 1H chart with a target of 1.0609.