The recently released industrial production data in Germany was ignored by markets even though the figure was better than expected. The revised Q4 GDP of the eurozone also passed by, most likely because traders are more focused on the upcoming US labor market report. Should employment figures from ADP exceed expectations, euro and pound will decline further, which will result in a prolonged bear market. And even if the data disappoints, traders are unlikely to rush buying, so don't expect any optimism in the two currencies.

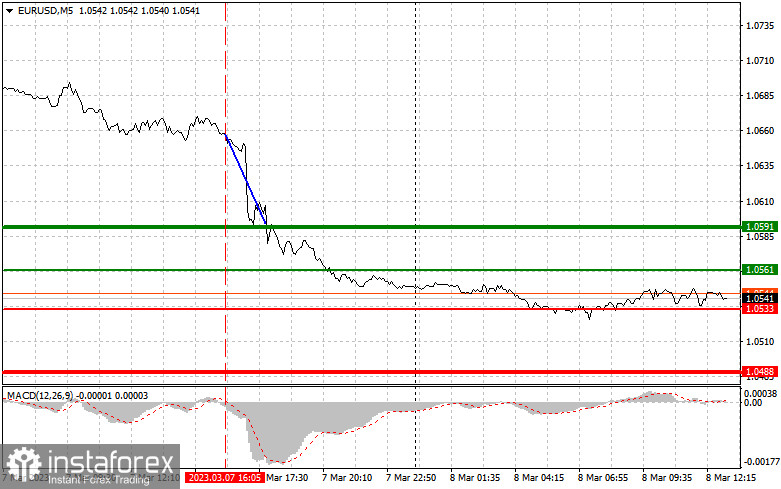

EUR/USD

For long positions:

Buy euro when the quote reaches 1.0561 (green line on the chart) and take profit at the price of 1.0591.

Euro can also be bought at 1.0533, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0561 and 1.0591.

For short positions:

Sell euro when the quote reaches 1.0533 (red line on the chart) and take profit at the price of 1.0488.

Euro can also be sold at 1.0561, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0533 and 1.0488.

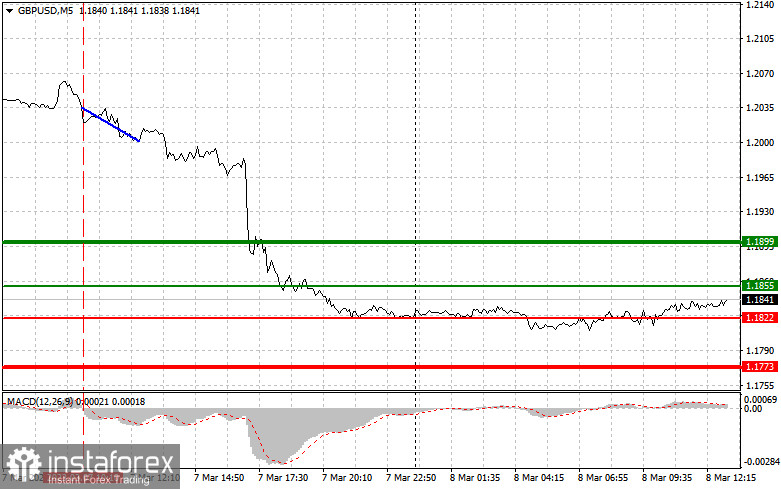

GBP/USD

For long positions:

Buy pound when the quote reaches 1.1855 (green line on the chart) and take profit at the price of 1.1899 (thicker green line on the chart).

Pound can also be bought at 1.1822, but the MACD line should be in the oversold area as only by that will the market reverse to 1.1855 and 1.1899.

For short positions:

Sell pound when the quote reaches 1.1822 (red line on the chart) and take profit at the price of 1.1773.

Pound can also be sold at 1.1855, but the MACD line should be in the overbought area as only by that will the market reverse to 1.1822 and 1.1773.