Against the background of Jerome Powell's speech before Congress, the EURUSD plummeted as fast as it did during trading on February 3. But then the financial markets were shaken by the growth of the employment in the United States by 517,000, almost three times higher than the Bloomberg experts' forecast. Now the Fed Chairman simply said what investors already knew, but the reaction was just as violent. What's the big deal?

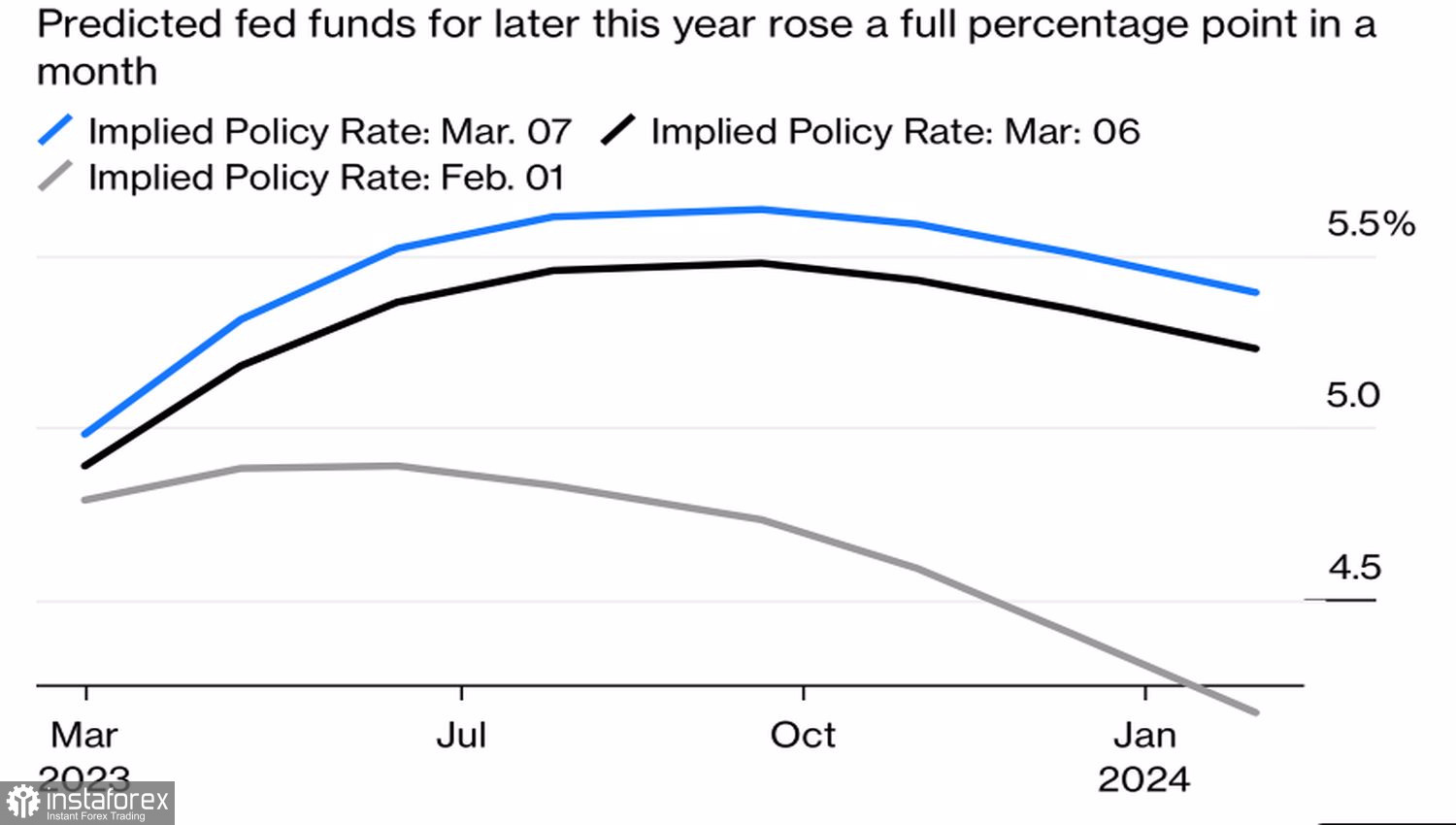

Yes, the data turned out to be stronger, so the federal funds rate at its peak will be higher than the last FOMC forecast provided. In fact, there is nothing new in this phrase. Before Powell's speech, the ceiling on the cost of borrowing expected by the futures market was at the level of 5.5%, after which it slightly rose to 5.6%. Both numbers are above the peak rate of 5.1% indicated in dot plot. Why such a violent reaction of EURUSD?

Estimated dynamics of the Fed rate

Powell may seem to have said something new, saying that if the statistics continue to improve, the Fed will accelerate the monetary restriction. Indeed, derivatives are now predicting that the federal funds rate will rise by 50 bps in March, not 25 bps. But after all, the central bank has long adopted a data-dependent policy. If they were to deteriorate sharply, investors would argue for a pause in the process of tightening monetary policy. So what happened on March 7?

In my opinion, there were two surprises at once. Firstly, the markets did not expect Jerome Powell to be so outspoken on the eve of important employment statistics for February. The basic scenario was his cautious tone with a slight "hawkish" bias. Secondly, the Fed retreated from its position not to pay attention to a single report. Previously, FOMC officials have stated many times that 2–3 data streams are needed to make decisions. However, a single job growth of 517K was enough to push the Fed funds rate ceiling higher than previously thought and accelerate monetary tightening.

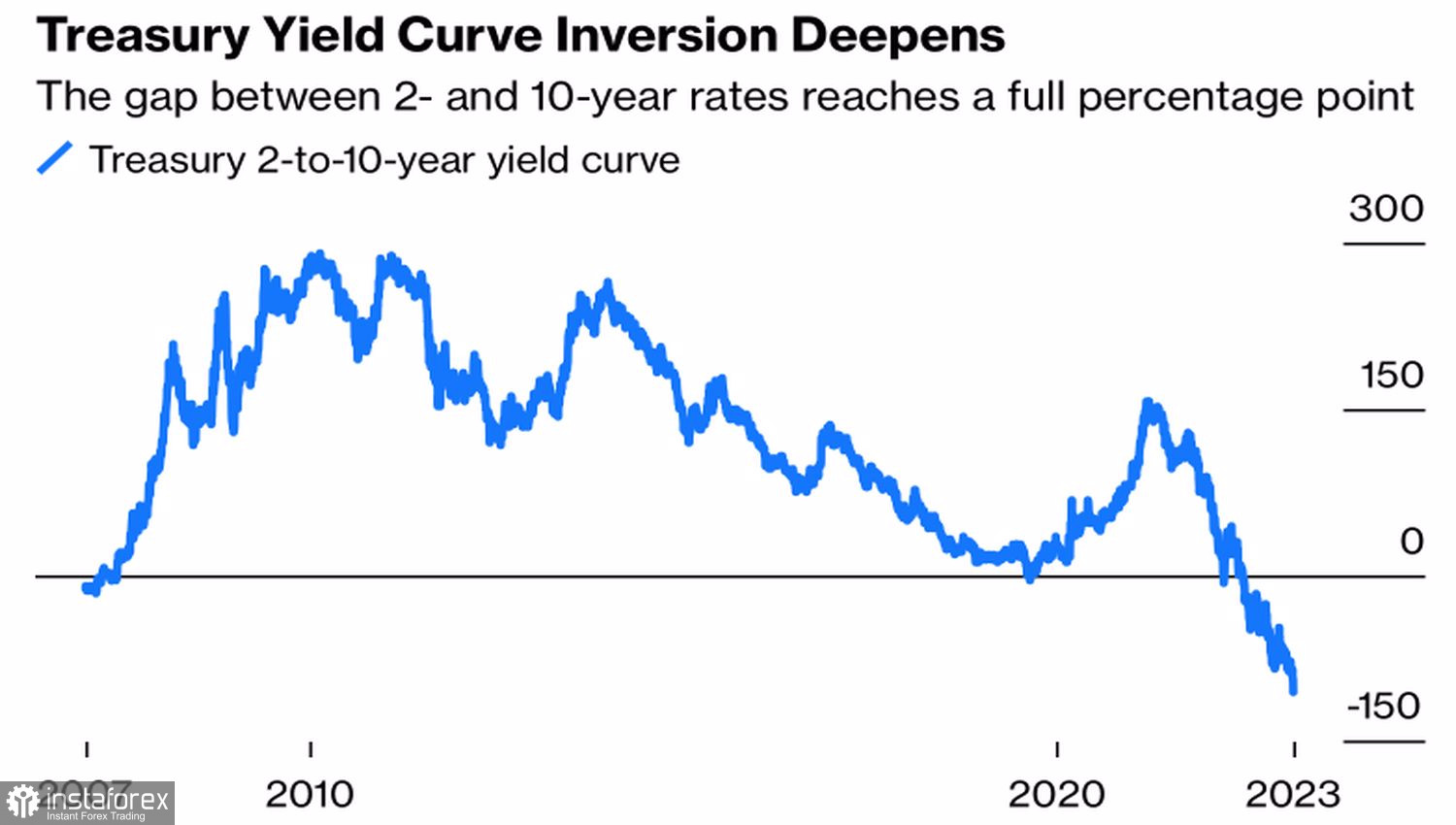

The markets were seriously scared by Powell's hawkish rhetoric. While at the beginning of February they were hopeful that they could slow inflation to 2% even with a soft landing, they now realize that they cannot do without a recession. This is evidenced by the deepest inversion of the yield curve since 1981. 2–year bond rates have outperformed 10-year rates by as much as 100 bps.

US yield curve dynamics

Looks like whatever the February labor market report is, the Fed has already made a decision. It will raise the cost of borrowing by 50 bps in March. Indeed, even with zero employment, the two-month average will exceed 250k, which is close to the late 2022 figure.

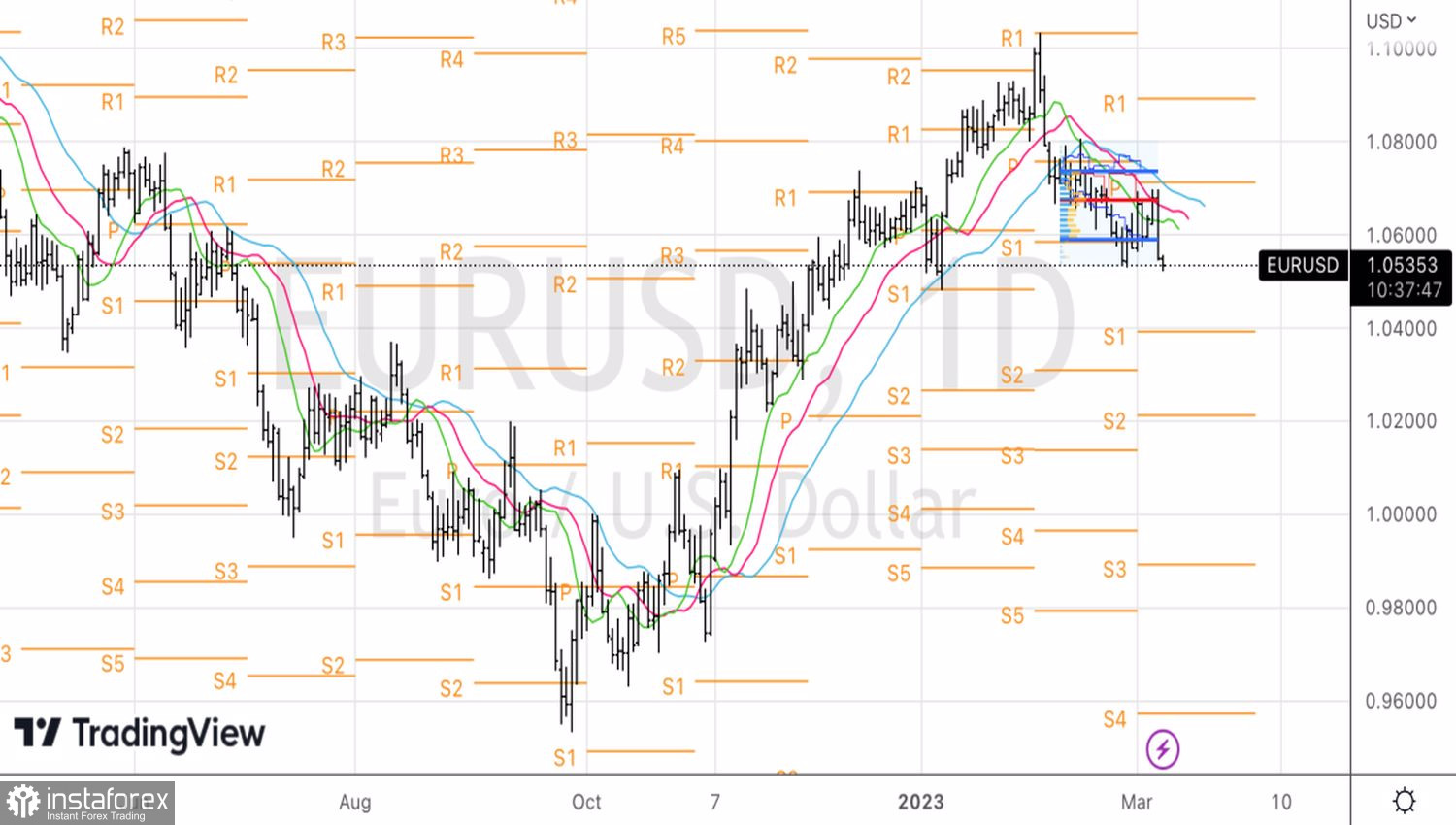

Technically, we managed to catch a false breakdown of resistance at 1.0675. The EURUSD selling strategy on the rise won back, and if the "bulls" fail to return to the boundaries of the fair value range of 1.059–1.074, the downward movement will continue.