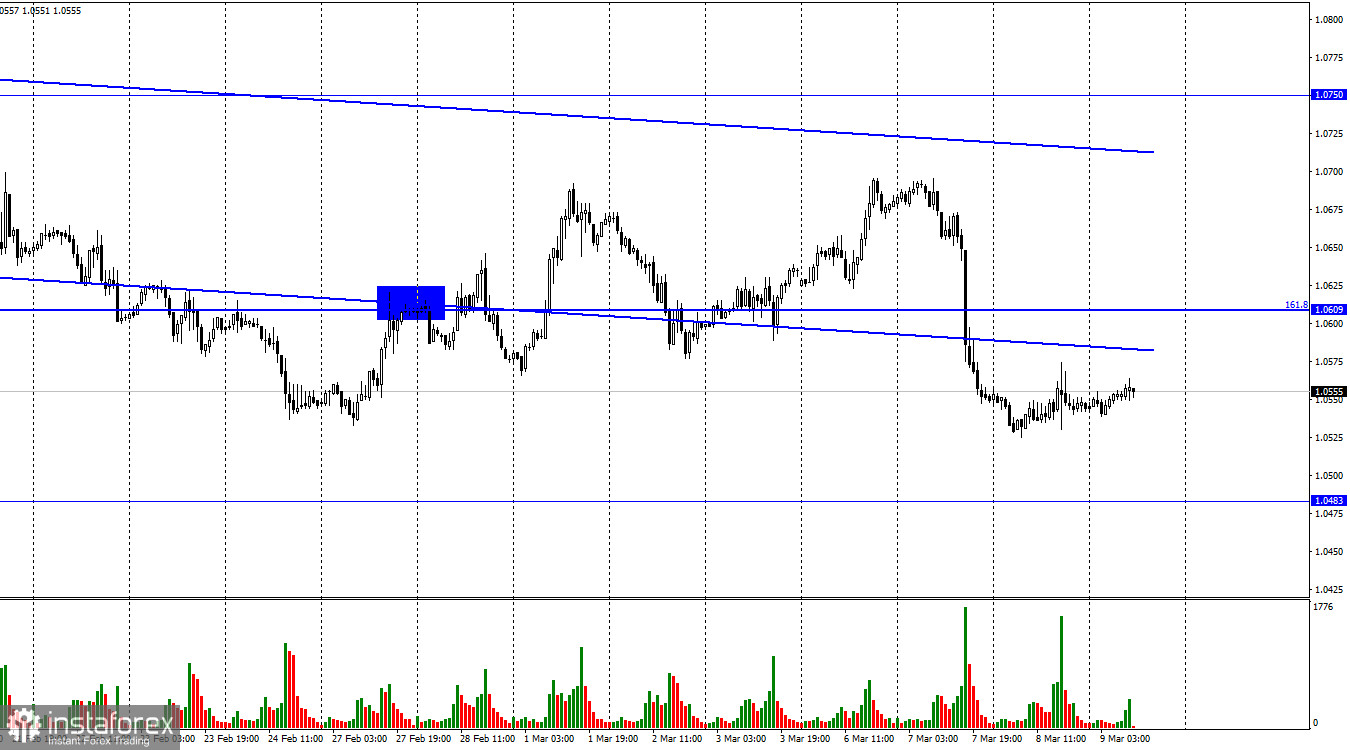

On Wednesday, the EUR/USD pair reversed in favor of the euro, and growth toward the corrective level of 1.0609 has been slow and sluggish ever since. Yesterday's growth was so minimal that it hardly merits discussion. The speeches by Christine Lagarde and Jerome Powell or the ADP report had no discernible impact on the traders' disposition. As a result, we are currently dealing with a technical recovery of quotes following a sharp decline. Nevertheless, Friday is quickly approaching, and extremely significant figures in the United States may entice bears back into the market.

President of the Fed Jerome Powell delivered his second speech to the US Congress yesterday. Powell's speech had no new information, which was to be expected, although some experts noted that Powell's rhetoric appeared to be softening. This time, Powell stated that the Fed has not yet made a decision on the rate and will wait for information regarding inflation and the labor market before doing so. Powell was far more direct the day before, almost promising to increase the rate by 0.50% in March. Powell's comments on Wednesday, however, received no response from the market. His rhetoric sounded like an effort to "give back." Investors are already certain that the rate will lengthen and strengthen, that there will be a 0.50% hike in March, and that these factors will likely continue to support the dollar's growth. Trading participants have plenty of time to purchase US dollars because the Fed meeting is scheduled for March 21–22.

In the UK, there is also no news. On that same Friday, a lot of intriguing reports will be provided, but they might be quickly forgotten since a few hours later, much more significant data will be presented that will directly affect the FOMC's decision-making. Of course, for traders, they are far more important.

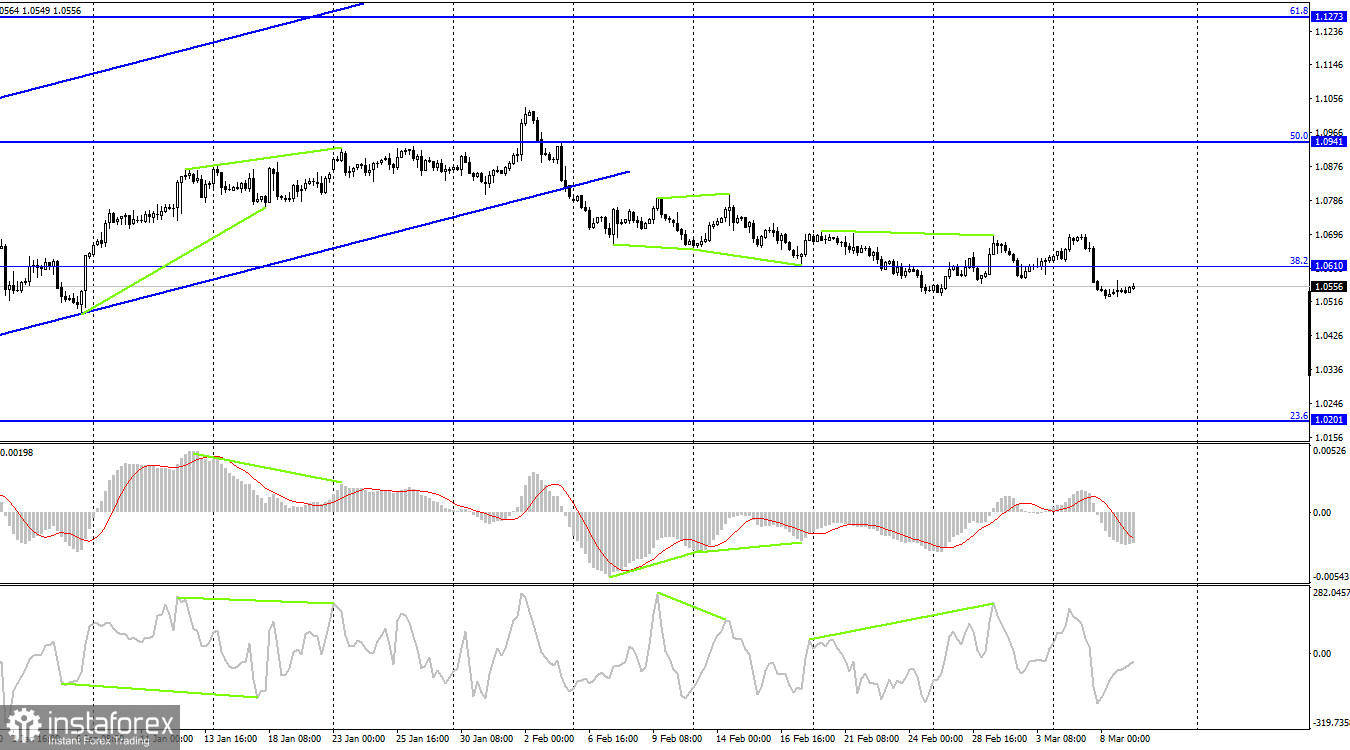

The pair has stabilized under the upward trend corridor on the 4-hour chart, allowing us to still anticipate a further decline even if the pair has left the channel it has been in since October. Trader mood is described as "bearish," which creates strong growth opportunities for the US dollar with a target of 1.0201. No new emergent divergence in any indication has yet been seen.

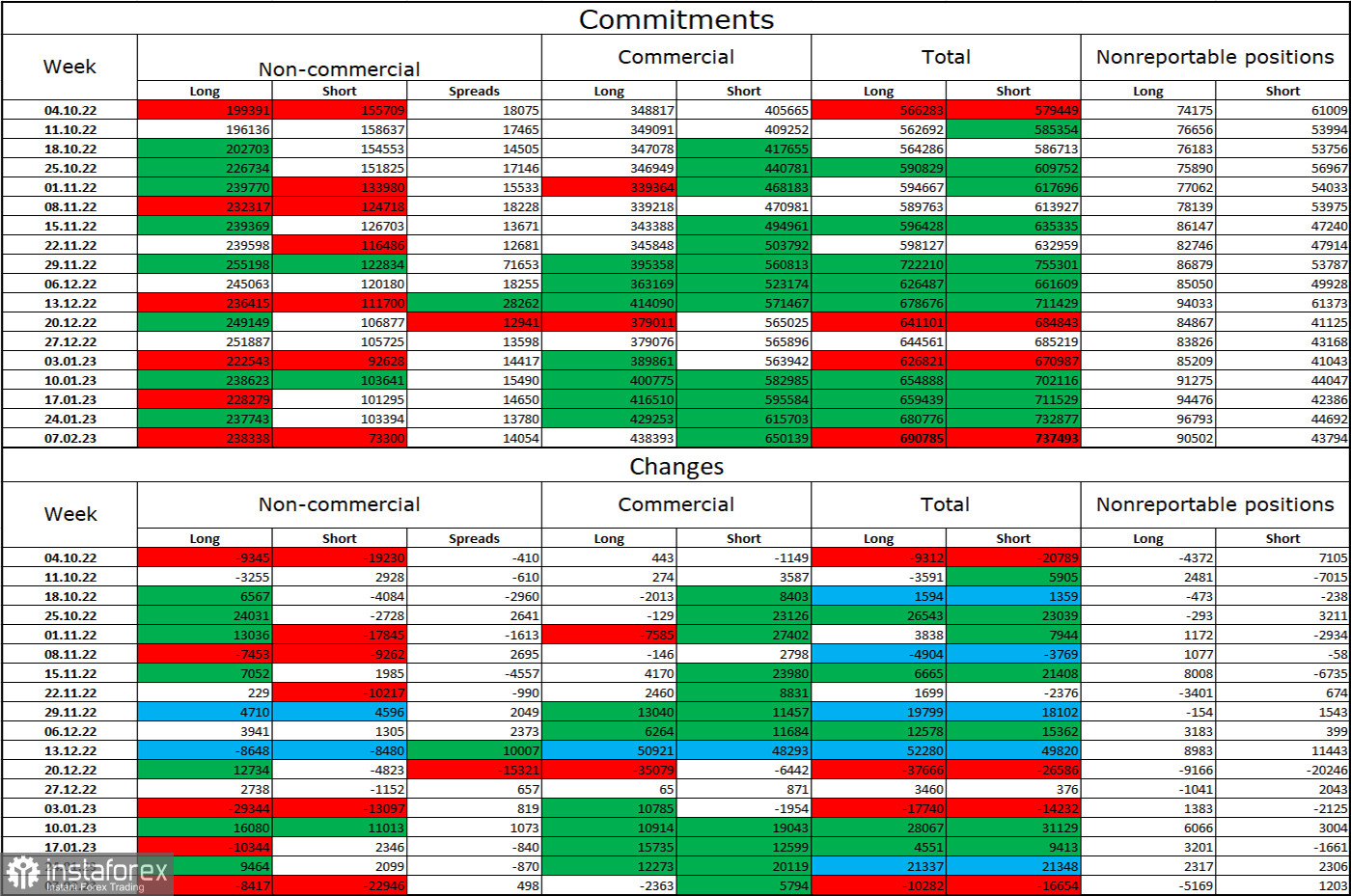

Report on Commitments of Traders (COT):

Speculators closed 8,417 long contracts and 22,946 short contracts during the most recent reporting week. The positive sentiment among large traders is still present and getting stronger. Please be aware, though, that the most recent report is from February 7. The "bullish" mood may have grown stronger at the start of February, but how are things now? Speculators now have 238 thousand long contracts, while just 73 thousand short contracts are concentrated in their hands. While the value of the euro has been declining for some weeks, we are currently without new COT data. The likelihood of the euro's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "dark time," the situation is still in the euro's favor, and its prospects are strong. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

News calendar for the USA and the European Union:

US – number of initial applications for unemployment benefits (13:30 UTC).

On March 9, there is a single entry for two economic events on the calendars of the European Union and the United States. The background information may not affect what traders are experiencing right now.

Forecast for EUR/USD and trading advice:

On the hourly chart, new sales of the pair might be initiated at a close below the level of 1.0609, with a target price of 1.0483. These trades could be completed since there was a rebound from the 1.0532 level. On the hourly chart, purchases of the euro currency are probable when it recovers from the level of 1.0483 with a target of 1.0609. Or if the price closes over 1.0609 with a target 70–80 points higher.