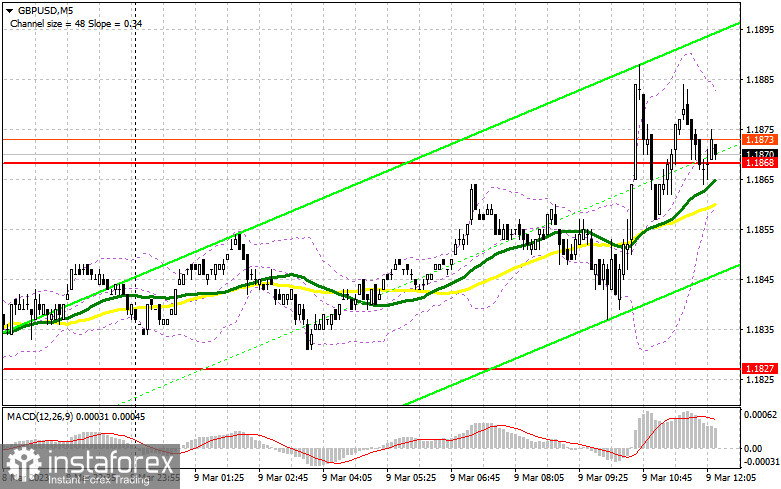

I focused on the level of 1.1868 when I made my morning forecast and suggested trading actions based on it. Let's take a look at the 5-minute chart and see what happened. We were unable to obtain a typical entry point into the market due to the growth of this range and subsequent trading either higher or lower. As a result, the technical picture was entirely changed in the afternoon.

You require the following to open long positions on the GBP/USD:

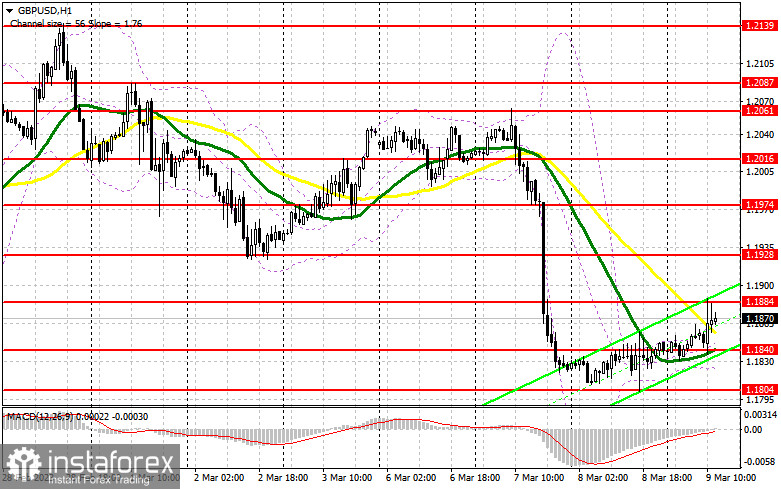

Since the weekly number of initial applications for unemployment benefits is anticipated within the average forecast of economists, it will be impossible to rely on statistics on the US labor market to sustain the dollar. The market was likewise ignored during FOMC member Michael S. Barr's address; all of the information that interested us was covered by Fed Chairman Jerome Powell over the previous two days. Because of this, I am placing a wager on the continuation of the pound's upward correction, but I won't purchase it unless there is a decline and a false breakout in the area of 1.1840, which is a support established by the day's first half of results. This will result in another effort to move the pound up to 1.1884—a new resistance that also developed during the European session—and an excellent entry point to purchase. I won't wager on GBP/USD moving up to a new maximum of 1.1928 until I fix and test from top to bottom of this range. Also, an exit above this level will create opportunities for growth at 1.1974, where I've fixed profits. A test of this area will likewise show that the buyers' market has returned. The trade will go into the limits of a side channel, from which we are unlikely to leave until tomorrow if the bulls are unable to complete the tasks assigned and miss 1.1840, which is quite possible. In this situation, I urge you to wait before making any purchases and to only start long positions around 1.1804 and only in the event of a false drop. I'll buy GBP/USD as soon as it rises from the low of 1.1757 with the intention of a correction of 30-35 points during the day.

For opening short positions on the GBP/USD, you will need:

Sellers don't require it and aren't in a rush to make themselves known just yet. Tomorrow will see the release of significant data on the US unemployment rate, and higher prices are always more profitable. I'm not going to hurry into sales today. A signal to enter the market in short positions with the expectation of a decline to the area of new support 1.1840 will only be given by the development of a false breakout at the level of 1.1884, which was formed in the early half of the day. A breakthrough and bottom-up test of this range will occur only against the backdrop of unusual statistics on the number of applications for unemployment benefits, which will result in a new significant sale in the area of 1.1804 - at least for a month. The area around 1.1757 will be my farthest target, and that's where I'll set the profit. The possibility of GBP/USD growth and the absence of bears at 1.1884, which is highly plausible, will encourage bulls to keep driving the market higher. In this scenario, sellers will retreat, and an entry point for short positions will only be formed by a false breakout at the next resistance level of 1.1928. In the absence of action, I will sell GBP/USD immediately from the high of 1.1974, but only if the pair falls by 30-35 points within the day.

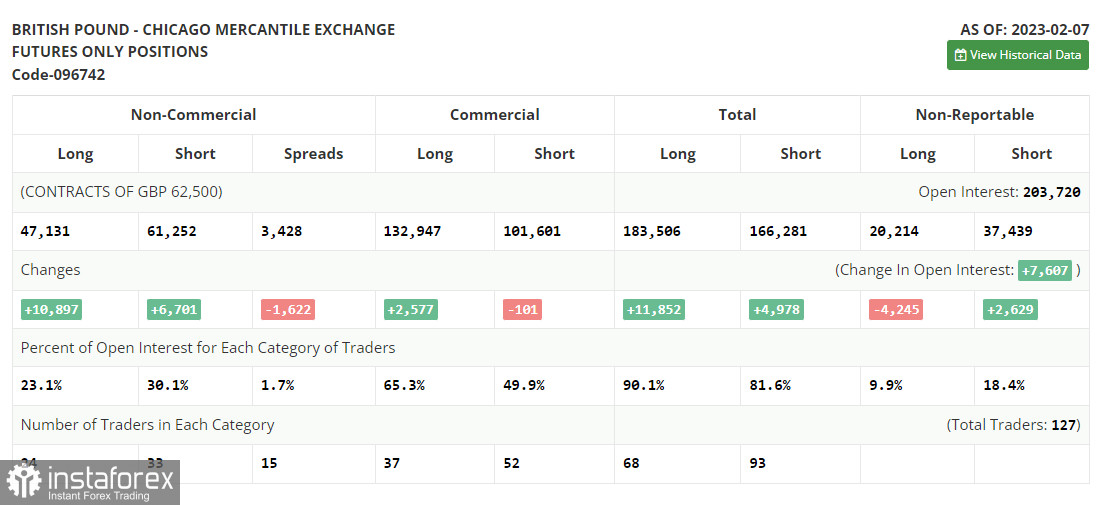

Long and short positions increased in the COT report (Commitment of Traders) for February 7. Given the rise in long positions, it is clear that traders were pleased with the Bank of England's plans. Others, on the other hand, decided to seize the opportunity and sell the more expensive pound in the hopes that the Fed would continue its aggressive monetary policy this year. Except for a few reports, there are no significant fundamental indicators for the UK this week, so the pressure on risky assets may slightly lessen, which theoretically may result in an upward correction of the pound relative to the US dollar. As Jerome Powell, the chairman of the Federal Reserve, gets the markets ready for the committee meeting at the end of March this year, his remarks are crucial. According to the most recent COT data, short non-commercial positions increased by 6,701 to 61,252, while long non-commercial positions increased by 10,897 to 47,131. As a result, the non-commercial net position's negative value decreased to -14,121 from -18,317 the previous week. In comparison to 1.2333, the weekly ending price dropped to 1.2041.

Signals from indicators

Moveable Averages

The fact that trading occurs around the 30- and 50-day moving averages suggests that the market is lateral.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located at 1.1825, will serve as support in the event of a downturn.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.