Analysis of Wednesday's trades:

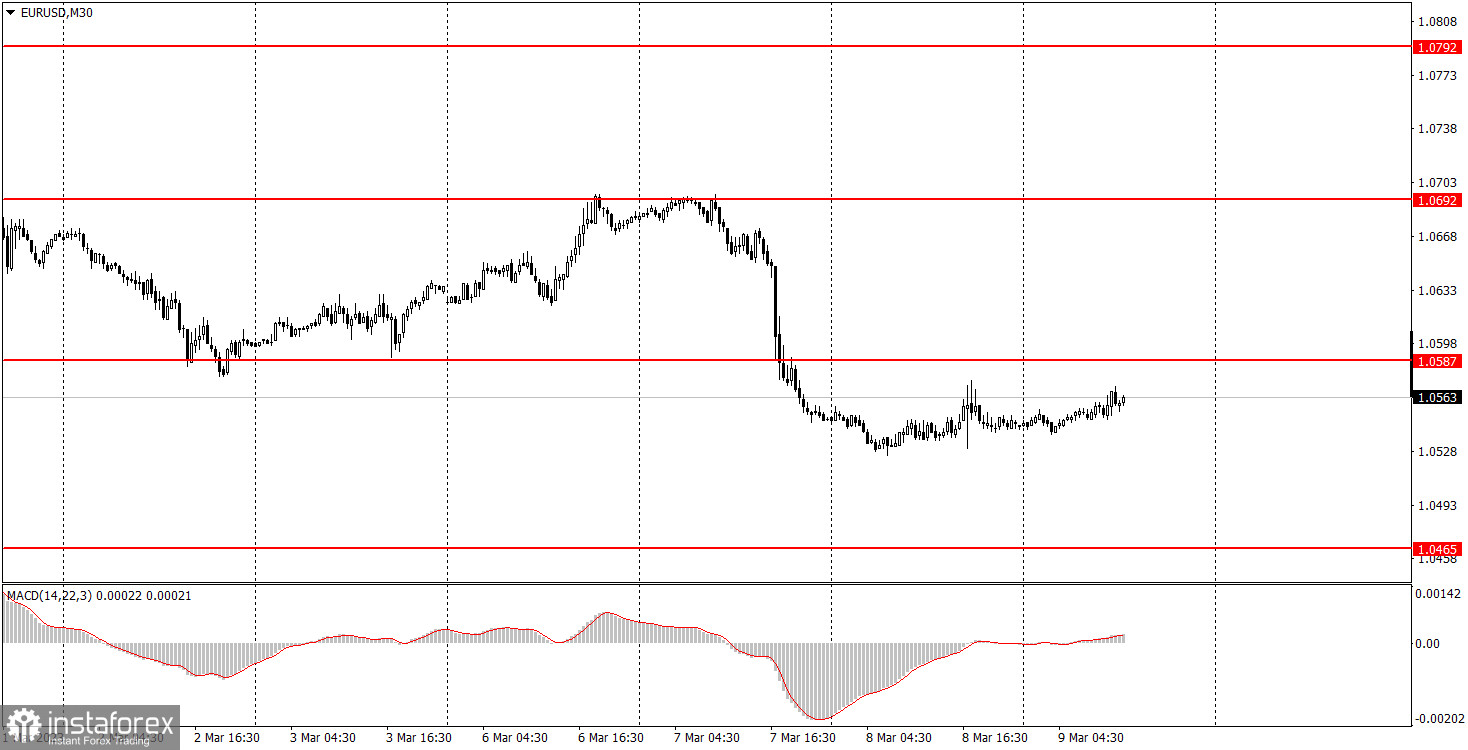

30M chart of EUR/USD

On Wednesday, EUR/USD was in a flat trend. After an ultra-volatile Tuesday, when Jerome Powell triggered a surge in the US dollar with his speech in Congress, the market decided to take a break on Wednesday. Volatility totaled some 50 pips, the pair attempted to retrace slightly upwards. In fact, all the macroeconomic and fundamental events of the day went unnoticed by the market, including Powell's second-day testimony in Congress. He had made practically the same remarks on Wednesday, so there was nothing to react to. At the same time, ECB President Christine Lagarde's speech did not carry any new information either. The ADP report rarely triggers market jitters. Meanwhile, Q4 GDP in the eurozone came in line with the previous forecasts. Generally speaking, all four important events on Wednesday did not provoke any reaction. If it had not been for Powell's speech, we would not have seen even a small increase in volatility.

M5 chart of EUR/USD

In the M5 time frame, the pair traded near the 1.0535 level all day. Novice traders saw a series of typical buy signals coming yesterday. When the price bounced for the second and then the third time, it became clear that a flat trend is impending. So, beginners had a chance to open a sole trade because all the signals coming afterward were similar. Every time the price returned to the 1.0535 level. So, the buy trade was likely closed at the breakeven point when a Stop Loss was triggered. All in all, Wednesday brought neither profits nor losses, which is good for a flat day.

Trading plan for Thursday:

In the 30M time frame, the pair is still trying to form a medium-term downtrend. Neither fundamental nor macroeconomic factors will have an effect on the market today. Traders have taken a break and are probably gathering strength ahead of data on Nonfarm Payrolls and US unemployment of Friday. The target levels in the 5M time frame are seen at 1.0433, 1.0465-1.0483, 1.0535, 1.0587-1.0607, 1.0692, 1.0792, and 1.0857-1.0867. A Stop Loss order should be set at the breakeven point once the price moves 15 pips in the right direction. On Thursday, no macro releases are scheduled in the eurozone and the US. The pair is likely to hover around 1.0535 in the European session. There is no reason to expect an increase in trading activity in the American trading session although the situation in the forex market changes regularly.

Basic principles of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades are opened at some level after false signals, i.e. signals that do not drive the price to the Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During a flat trend, any currency pair may form a lot of false signals or may not produce any signals at all. In any case, a flat trend is not the best condition for trading.

4) Trades are opened in the time interval between the beginning of the European session and the middle of the American one when all trades should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), this is a support or resistance area.

How to interpret charts:

Support and resistance levels can serve as targets when buying or selling. You can place a Take Profit order near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginner traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management is the key to success in long-term trading.