Cryptocurrency fans did not have time to rejoice at their stormy start in 2023. Bitcoin is poised to close the first full week of March with its worst performance since November amid panic in financial markets over the Fed's ongoing monetary tightening, the bankruptcy of crypto-friendly Silvergate bank, and attacks from regulators. Massive lawsuits undermine the credibility of the system and contribute to the fall of BTCUSD.

In November, Bitcoin collapsed 23% in a week due to FTX crash, now it is poised to lose more than 10% of its value because of Silvergate. The bank itself declared bankruptcy, but it is the environment in which it happened that matters. Numerous inspections of financial institutions related to the crypto industry, accusations of crypto exchange KuCoin operating without a license, and the classification of individual tokens as securities are causing a stir in the crypto market. If it is unknown how it will be regulated, it is better to get rid of assets for a while.

The fall of BTCUSD is facilitated by the flight of investors from risk. Fed Chairman Jerome Powell has warned that the federal funds rate will rise more than expected. At the same time, the Fed may accelerate the monetary restriction if the new data on employment and inflation turn out to be hot. Unsurprisingly, Treasury yields are skyrocketing in such an environment, pushing up the cost of acquiring stocks and other risky assets and driving them down. Bitcoin is no exception.

Bitcoin and U.S. Treasury yields

At the same time, despite the downfall of cryptocurrencies, there are still many optimists in the market. In particular, Europe's largest asset manager, Amundi, believes that if inflation remains above central bank targets, investor attention to Bitcoin will increase. Despite the fact that in the context of consumer prices soaring in 2021–2022, the crypto winter has fallen on the digital asset market, the situation may change in 2023.

If inflation is high but not rising, so will nominal bond yields. It could even fall, which would create a favorable environment for cryptocurrencies. Their supply is limited, and the main attraction lies in future potential, not the current state.

In my opinion, weak U.S. employment statistics and a slowdown in U.S. inflation will improve investor appetite for risk, allowing Bitcoin to find a bottom. Obviously, regulatory pressure on the cryptocurrency sector will remain elevated, but this factor is secondary. Such a speculative asset as BTCUSD is driven by the price, and if it starts to rise again, there will be no shortage of buyers.

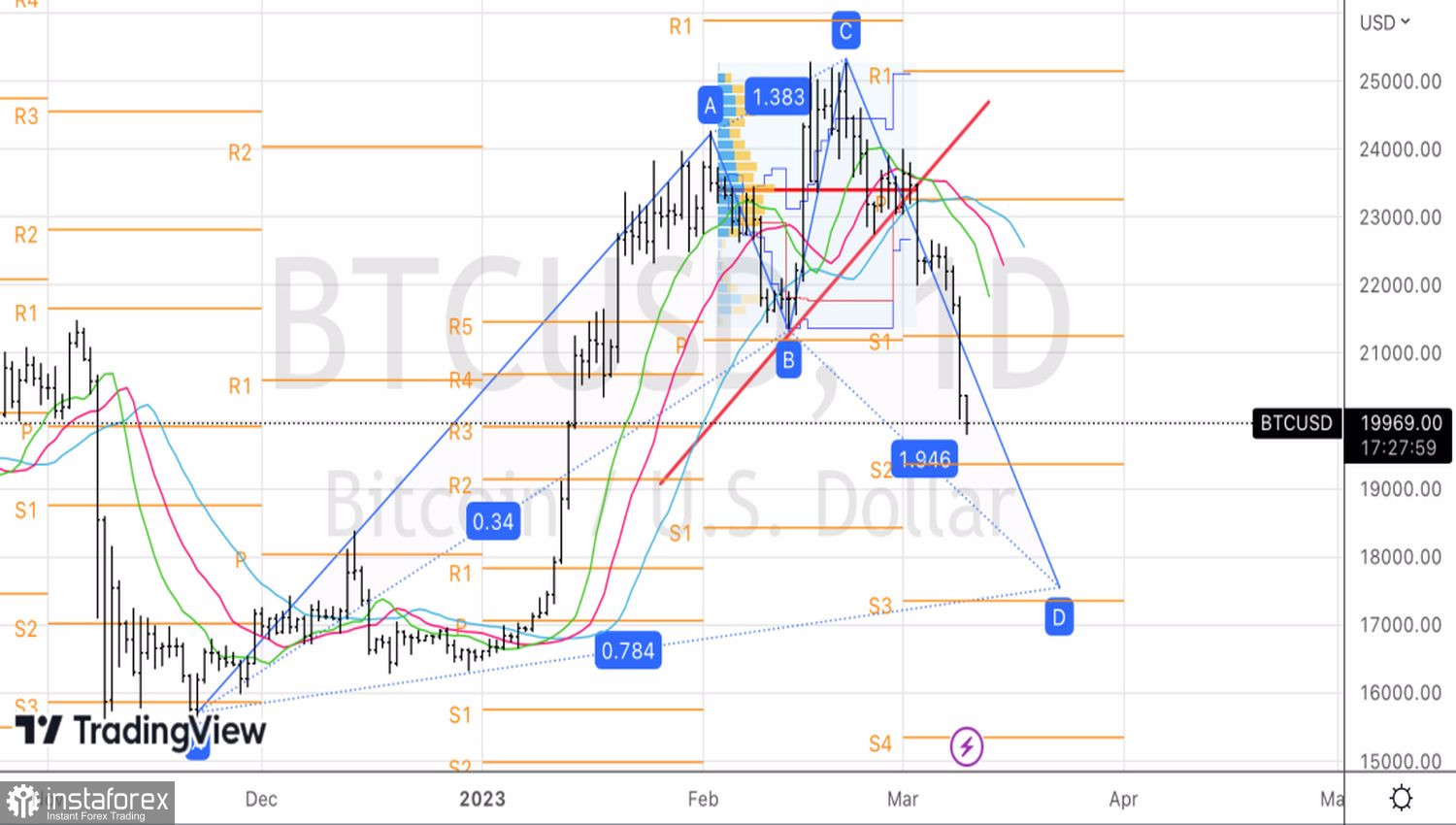

Technically, on the daily chart, the Shark pattern is playing out as expected. Selling from the level of 23,275 managed to build up on a breakout of supports at 21,450 and 21,250. Now we start looking for a rebound from the 19,360–19,900 area, which will allow us to reverse.