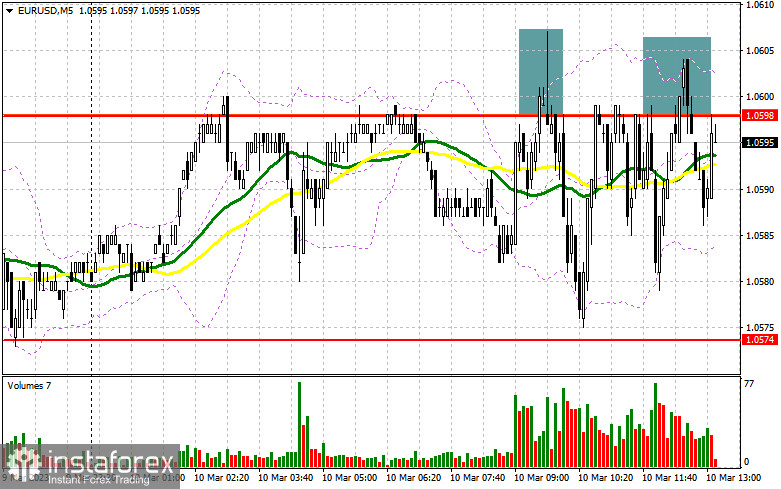

I focused on the 1.0598 level in my morning forecast and suggested making considerations about entering the market from there. Let's take a look at the 5-minute chart and see what happened. Growth and a false breakout at this level gave us a signal to sell the euro, which caused a decline of more than 20 points but prevented us from reaching the target price of 1.0574. The technical picture did not change in the afternoon because the pair didn't go beyond the side channel.

If you want to trade long positions on EUR/USD, you will need:

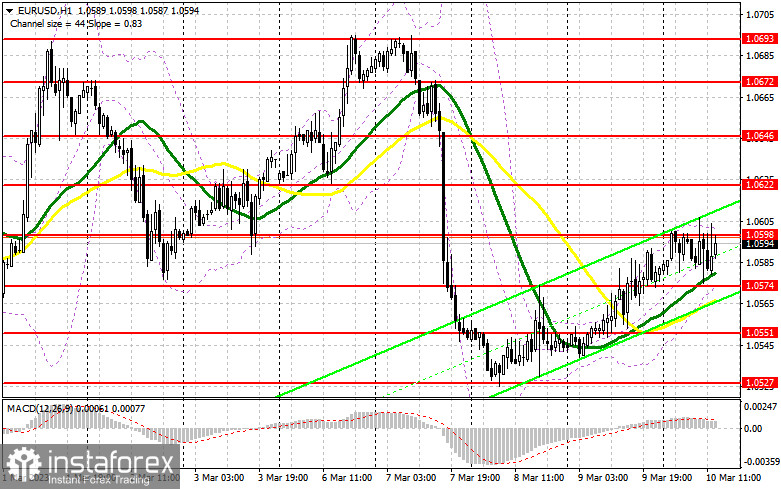

The US labor market reports will decide everything, as I've said numerous times today. If the unemployment rate remains steady and the number of people employed in the non-agricultural sector continues to surprise everyone, the pair will fall sharply in the afternoon. The report on the change in the average hourly wage may have an impact on US dollar buyers. The euro will have a chance for further growth at the end of the week if the statistics come in worse than expected or in line with them. The support level of 1.0574 will be the best place to buy if the pair declines after the data. The formation of a false collapse there will serve as a signal to enter the market to push over the resistance level of 1.0598, which was repeatedly challenged in the morning. A breakout and top-down test of this level against the backdrop of weak US data creates an extra entry point for building long positions with a move to 1.0622, where it will be challenging for bulls to advance. The collapse of 1.0622 won't happen unless we observe a decline in the number of new jobs, which will hit the bears' stop orders and send another signal with a potential move to 1.0646, where I'll fix profits. The bear market will come to an end if this level is tested. The pressure on the pair will return if EUR/USD declines and there are no buyers around 1.0574 in the afternoon, which is more likely. A break of this level will cause a drop to the next support area of 1.0551. The only indication to buy the euro will be the development of a false collapse there. For a rebound from the low of 1.0527 or even lower, around 1.0487, I will open long positions right away with the target of an upward correction of 30-35 points during the day.

If you want to trade short positions on EUR/USD, you'll need:

In the second half of the day, protecting the nearest resistance level of 1.0598 will be the key target for sellers because they have done everything they can. The best scenario for starting new short positions will be growth and the formation of a false breakout at this level, which will result in a decrease in the euro and an update of the nearest support level of 1.0574, just below which the moving averages are on the bulls' side. Strong data will compel the Fed to raise rates further, thus a breakout and reversal test of this range will serve as another signal to start short positions with an exit around 1.0551, returning the market to its bearish state. A more dramatic decrease to the area of 1.0527, where I will take profit, will result from fixing below this range. If the EUR/USD rises during the American session and there are no bears below the level of 1.0598, I suggest delaying opening short positions until 1.0622. Moreover, you can only sell there following a failed consolidation. In anticipation of a rebound from the high point of 1.0646, I will open short positions right away with a 30- to 35-point corrective in mind.

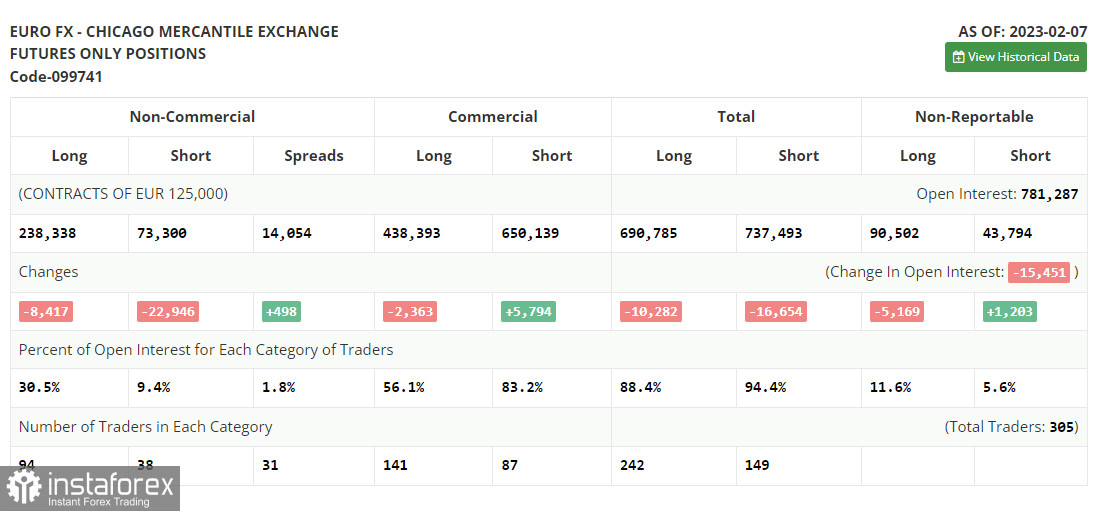

Long and short positions were down in the COT report (Commitment of Traders) for February 7. This undoubtedly took place after the Federal Reserve System and the European Central Bank decided on interest rates. However, it should be noted that these data are of no importance right now because statistics are only just starting to catch up following the cyberattack on the CFTC and the information from a month ago is not very pertinent right now. They'll hold off until new reports are out before turning to more recent data. We are anticipating Fed Chairman Jerome Powell's significant speech in the near future, which could influence the direction of the dollar for the next month up until the Fed meeting at the end of March. Hawkish remarks on inflation and monetary policy will increase demand for the dollar and cause the euro to decline. The demand for the dollar will most certainly decline more if we don't hear anything new. According to the COT data, the number of long non-commercial positions fell by 8,417, to 238,338, while the number of short non-commercial positions fell by 22,946, to 73,300. The total non-commercial net position rose to 165,038 from 150,509 after the week. The weekly closing price fell from 1.0893 to 1.0742.

Signals from indicators

Moving Averages

Trade is taking place slightly above the 30 and 50-day moving averages, indicating the market's lateral nature.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.