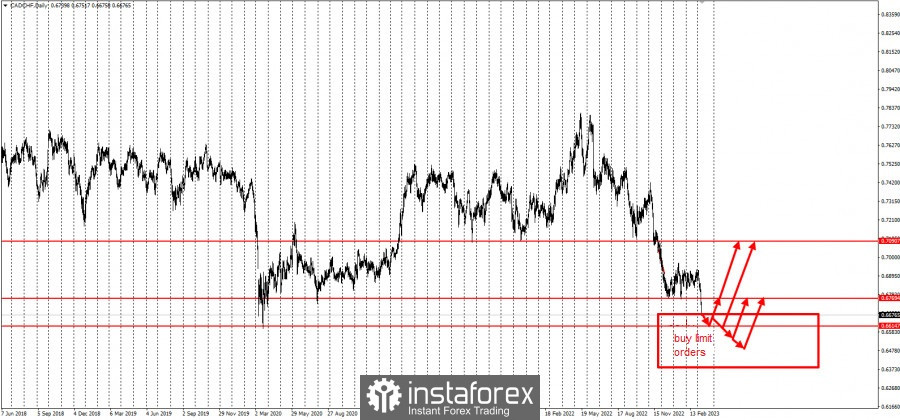

With this, traders, starting from current prices, can place a grid of limit orders in increments of 500 pips. Exit the market upon the breakdown of 0.68 and 0.71, or after a 1,000-pip rise from the first order.

This strategy is called grid trading, which is usually used on cross rates. It involves holding positions that are significant in time and distance. For that reason, it is recommended to use swap-free accounts, not increasing the volumes in the grid (0.01 standard lot for every $1,000 of the deposit), and monitoring price movements, which could reach as much as 6,000 pips.

Good luck and have a nice day! Don't forget to control the risks.