In the early hours of the New York trade, the US Labor Department released the highly-anticipated nonfarm payrolls. Traders responded abruptly to a higher unemployment rate and wage component which played against the US dollar. These metrics happened to be in the red. At the same time, the market neglected employment growth. As a result, the US dollar lost ground across the board. Its index dashed downward so that EUR/USD has been able to recover to 1.06. The mixed nonfarm payrolls complemented by the Friday's factor enabled the euro bulls to win back earlier losses. However, in my viewpoint, long positions are still risky because the upward retracement is of a correctional nature.

Dry statistics

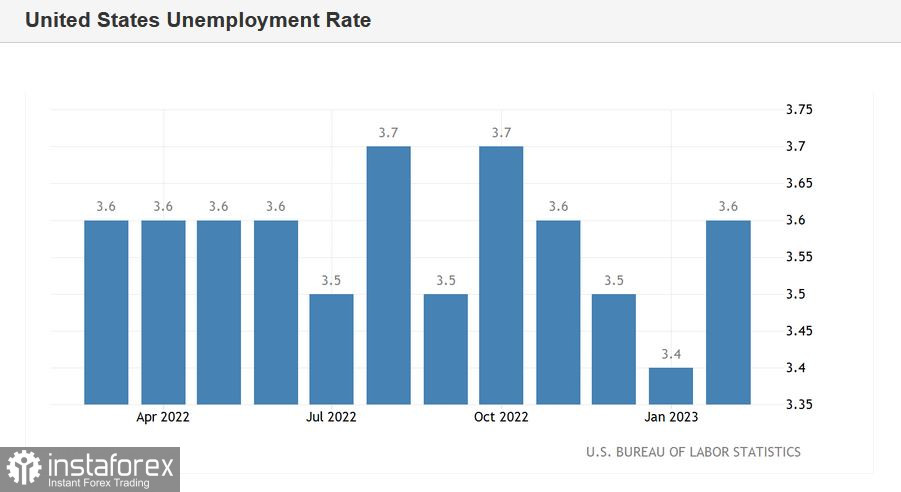

The US Labor Department reported that the unemployment rate grew to 3.6% in February from 3.4% in January. The median forecast suggested the flat reading at 3.4%. Nevertheless, the jobless rate remains at multi-year lows, but it is the trend that matters. The unemployment rate had been declining for three previous months in a row, but it went up in February.

As we already mentioned above, the wage component also discouraged traders. Average hourly earnings rose by 0.2% on month and climbed by 4.6% on year. Analysts had projected a more significant growth of 0.4% on month and 4.7% on year.

The other side of the coin is other metrics in the report. For example, the US public and private sectors added 311K jobs, excluding farm employment, in February, much stronger than the consensus of 205K new jobs. The figure for January was slightly downgraded to 504K from 517K in the flash estimate. The participation rate increased to 62.5% in February, more than the expected 62.3% growth.

Response from forex traders

In light of the nonfarm payrolls, the US dollar nosedived across the board. Yields of US Treasuries fell to new lows. For instance, yields of 10-year Treasuries updated a 4-week low. Futures on the S&P 500, the Nasdaq 100, and the Dow Jones went up moderately.

Obviously, traders make their conclusion from the nonfarm payrolls for February complemented by recent remarks from Jerome Powell. He surprised market participants this week with his hawkish rhetoric. Though he softened his wording during the second testimony in Congress, the key message remains the same. The Federal Reserve is ready to speed up the pace of further rate hikes so that the ultimate size of the official funds rate will be higher than anticipated provided that inflation accelerates in the future.

The important factor to determine a further agenda for monetary tightening is the labor market. Testifying on Capitol Hill, the Fed Chairman said that the labor market was too tense, thus driving inflation up. Jerome Powell supposed that the labor market needs softer hiring in order to contain inflation. Citing Jerome Powell, it is a forceful measure to bring inflation down in the broad service sector, the labor-consuming part of the national economy, where prices are still on the rise.

Bearing in mind this preview, no wonder that the NFPs for February put pressure on the greenback. De-factor unemployment in the US began growing and rebounded to the rate of November. Besides, the wage component rose weaker than expected. The employment went in the green, albeit the growth was less than in the previous month. By and large, the labor market revealed some signs of cooling down.

Logically, the Federal Reserve will have fewer arguments for a sharp rate hike by 50 basis points instead of 25 basis points. According to the CME FedWatch Tool, the scenario of a rate hike by 50 basis points is now assessed at 41%. Yesterday, the chance was measured at 75%.

Amid this information environment, the US dollar came under selling pressure. By the way, Jerome Powell enabled a sell-off when he pointed out before the House Financial Services Committee that Fed policymakers had not made a unanimous decision for the vote at the policy meeting in March. The actual vote will depend on incoming data. Nevertheless, he softened his own wording given the day before.

Conclusion

The US dollar lost the challenge today. The market responded to the nonfarm payrolls against the US currency. The market revised hawkish expectations and the greenback was hurt by a wave of selling.

Still, the crucial challenge for the dollar bulls is around the corner. Market participants will get to know the report of major importance: US inflation data for February that will be released on Tuesday, March 14. If the CPI logs an increase again, the scenario of a rate hike by 50 basis points in March will come to the forefront. Therefore, the US dollar will enjoy buoyant demand again. All in all, despite a rapid upward retracement, it is risky to go long on EUR/USD. Indeed, the inflation report is a preferable metric for the Federal Reserve under current economic conditions. So, it is premature to make a conclusion about a trend reversal. Inflation acceleration in the US could provide a completely different fundamental picture for EUR/USD. The mixed nonfarm payrolls will take a back seat. Bearing in mind all the factors above, we should not rush to buy EUR/USD before the weekend.