Markets were shaken last Friday, when Silicon Valley Bank, which specialized in servicing companies in the technology sector, filed for bankruptcy.

Many became worried as this deplorable situation happened because of the Fed's interest rate hike cycle. The possibility of other banks filing for bankruptcy has also risen, so the US Department of the Treasury was forced to announce a 1 year credit line for banks, which is supposed to prevent another banking crisis in the US this century.

Interestingly, the event has raised hopes among investors that the Fed will simply be forced to give up another interest rate hike at its March meeting. Some even speculated that the bank might not only stop raising the cost of borrowing, but begin a gradual decrease in the level of interest rates. Of course, a pause in rate hike is plausible, but the chances of a rate cut amid high inflation is close to impossible.

Markets reacted to the news negatively, causing equities to tumble. Dollar also came under heavy pressure amid a steep fall in Treasury yields. But after the US Treasury's bailout package and the emergency Fed meeting today, US stocks started to rise considerably, while dollar kept falling.

If the Fed announces a pause in interest rate hikes or any easing of lending conditions, there will be a strong rally in equity markets and a further decline in dollar on the back of a similar collapse in treasury yields.

Forecasts for today:

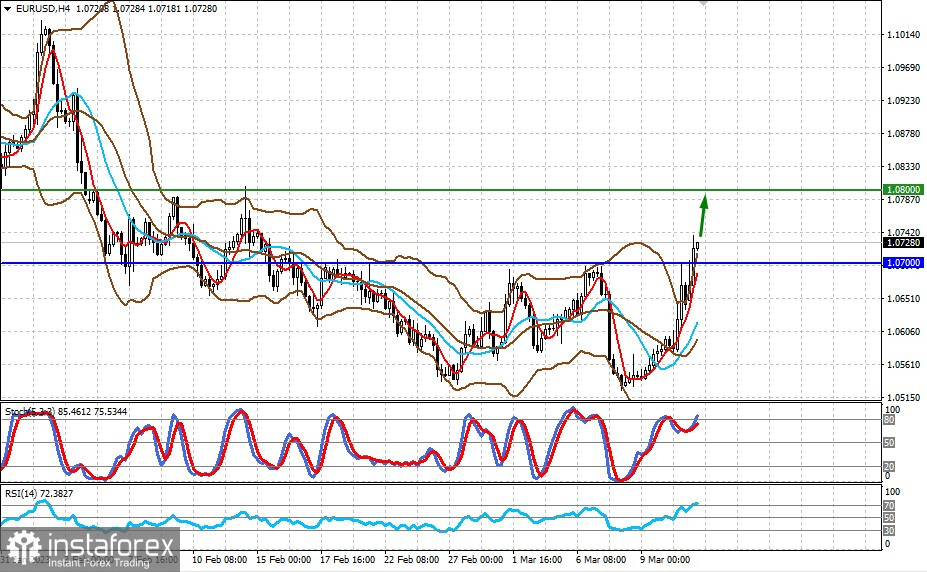

EUR/USD

The pair is trading above 1.0700 as recent events in the US could change the Fed's approach in its rate hike policy. If the ECB continues to raise its interest rate amid a slowdown in inflation in the eurozone, the pair will rise above 1.0700 and go to 1.0800.

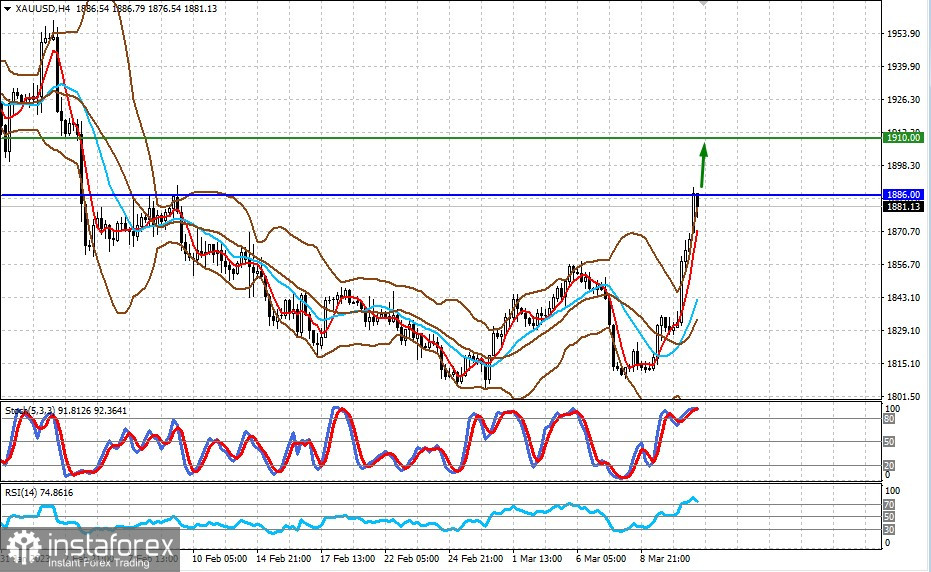

XAU/USD

Gold rose sharply due to the fall in Treasury yields and weakening of dollar demand. If it continued to climb above 1886.00, the quote could hit 1910.00.