Euro ignored the latest eurozone statistics, while pound reacted sluggishly to the news that the UK labor market showed signs of cooling. On the one hand, this is good for the economy, but in the short term, it does not play into the side of buyers as new inputs allow the Bank of England to take a softer stance, especially at a time when the US banking sector is at risk of disaster. Now, a lot depends on what the US CPI data for February will be, as rising inflation will force the Fed to give up raising interest rates as early as the March meeting. A lower inflation will also play on the side of euro and pound in the short term.

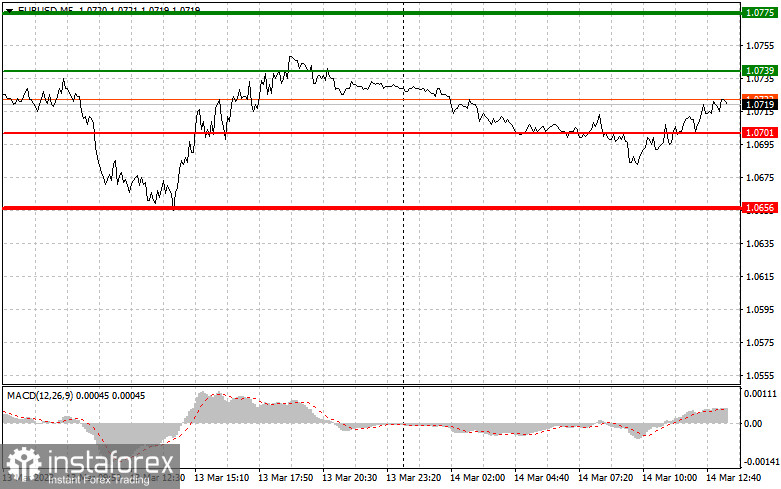

EUR/USD

For long positions:

Buy euro when the quote reaches 1.0739 (green line on the chart) and take profit at the price of 1.0775.

Euro can also be bought at 1.0701, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0739 and 1.0775.

For short positions:

Sell euro when the quote reaches 1.0701 (red line on the chart) and take profit at the price of 1.0656.

Euro can also be sold at 1.0739, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0701 and 1.0656.

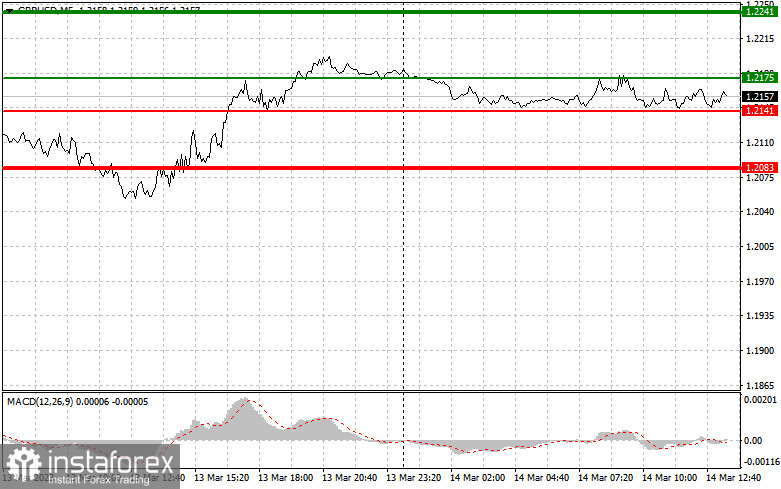

GBP/USD

For long positions:

Buy pound when the quote reaches 1.2175 (green line on the chart) and take profit at the price of 1.2241 (thicker green line on the chart).

Pound can also be bought at 1.2141, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2175 and 1.2241.

For short positions:

Sell pound when the quote reaches 1.2141 (red line on the chart) and take profit at the price of 1.2083.

Pound can also be sold at 1.2175, but the MACD line should be in the overbought area as only by that will the market reverse to 1.2141 and 1.2083.