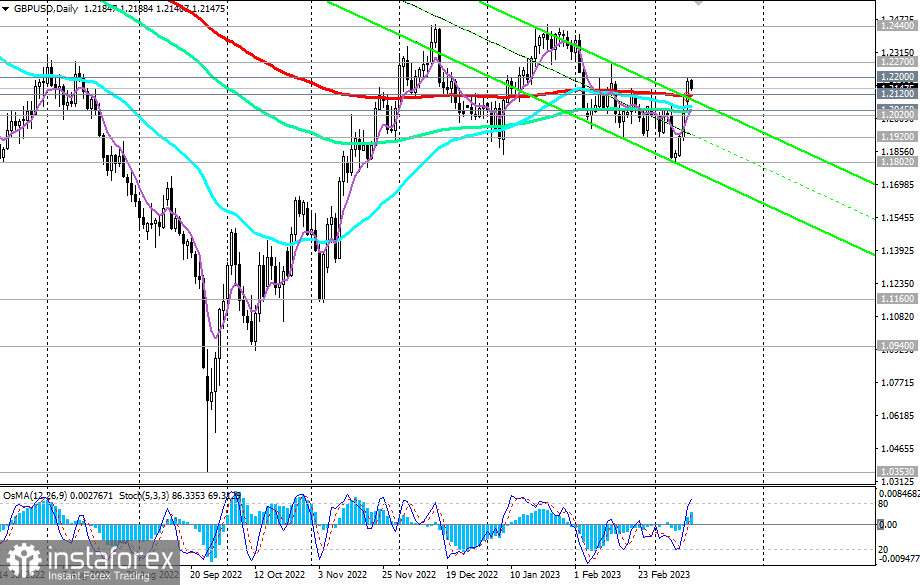

In February, the dollar found support from strong macro data from the U.S. and after the Fed meeting ended. As we know, members of the Federal Reserve expressed their readiness to continue to fight high inflation in the U.S., which is still at the levels of 40 years ago.

At the beginning of this month, the dollar continued to strengthen, and the GBP/USD pair continued to decline. However, the disappointing monthly report of the U.S. Labor Department with February data and the events on the collapse of the Silicon Valley Bank (SVB) and Signature Bank led to a sharp weakening of the dollar late last week and early this week.

The GBP/USD hit a local 4-week high and 1.2200 resistance level on Monday.

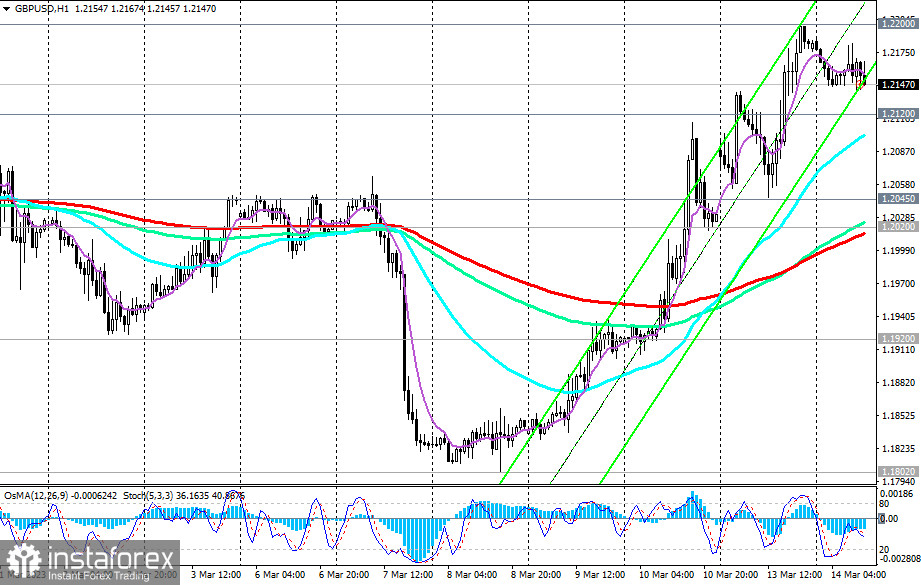

However, today, the pair, like most dollar pairs, is declining amid the strengthening of the dollar. Economists believe that we should not expect growth above 1.2200. Even despite the U.S. banking crisis, the pound remains vulnerable to the dollar, including due to the difference in the positions of the U.S. and UK central banks. The breakdown of the 1.2100 mark may be the starting point for the resumption of downward dynamics. The first signal for the resumption of short positions may be the breakdown of today's low at 1.2140, and the confirmation will be the breakdown of important support levels 1.2045 (144 EMA on the daily and 4-hour charts), 1.2020 (200 EMA on the 1-hour chart).

Alternatively, in case of further rise and after the breakout of the important resistance level 1.2200 (50 EMA on the weekly chart), GBP/USD will head towards the key resistance levels 1.2680 (144 EMA on the weekly chart), 1.2840 (200 EMA on the weekly chart). An increase above these levels is still unlikely, given the fundamental background, which is not in favor of the pound.

Support levels: 1.2140, 1.2120, 1.2100, 1.2045, 1.2020, 1.1920, 1.1900, 1.1842, 1.1160, 1.0940

Resistance levels: 1.2200, 1.2270, 1.2300, 1.2400, 1.2440, 1.2500, 1.2600, 1.2680, 1.2700, 1.2800, 1.2840

Trading scenarios

Sell Stop 1.2130. Stop-Loss 1.2220. Take-Profit 1.2120, 1.2100, 1.2045, 1.2020, 1.1920, 1.1900, 1.1842, 1.1160, 1.0940

Buy Stop 1.2220.Stop-Loss 1.2130. Take-Profit 1.2270, 1.2300, 1.2400, 1.2440, 1.2500, 1.2600, 1.2680, 1.2700, 1.2800, 1.2840