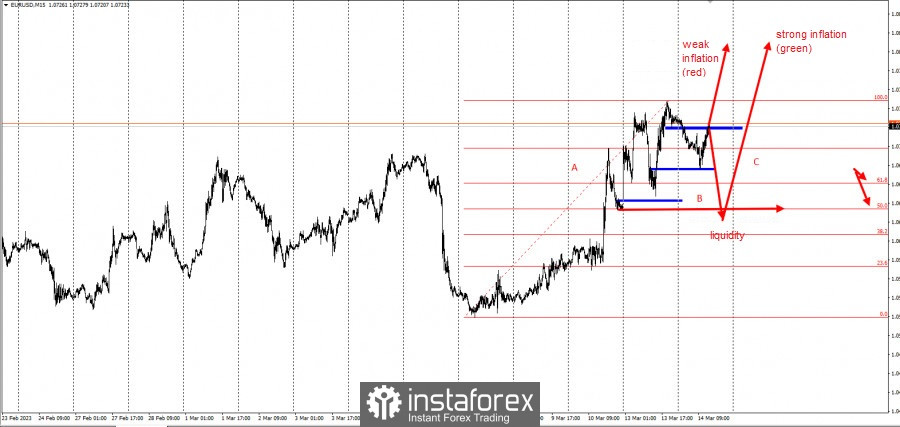

Dollar lost ground after the US released a disappointing unemployment data. It led to a price increase in EUR/USD; however, there is a chance that the situation will shift, depending on what the upcoming US inflation data will be.

1. Should inflation start to decline, dollar will go down sharply, triggering a EUR/USD rally.

2. If inflation continues to strengthen, there could be a brief correction, which would allow a better price entry in the following pattern:

There is currently a three-wave (ABC) pattern, in which wave A represents the buying pressure on March 8-13. Traders could enter the market by opening long positions from the 50% retracement level, with stop loss set at 1.05200 or after a false breakdown of 1.06350. Exit the market by taking profit upon the breakdown of 1.075.

This trading idea is based on the "Price Action" and "Stop hunting" methods.

Good luck and have a nice day! Don't forget to control the risks.