How quickly the scenery in the financial markets changes! Just a couple of days ago, the dynamics of assets was determined by fundamental factors, and now these fundamental factors can change the sentiment. Despite the titanic efforts of the Fed and other regulators to stabilize the banking system after a series of bankruptcies, Credit Suisse's announcement of problems in financial reporting continues to keep the markets in a state of panic. The Treasury yields is staggering from side to side, and with it, the EURUSD.

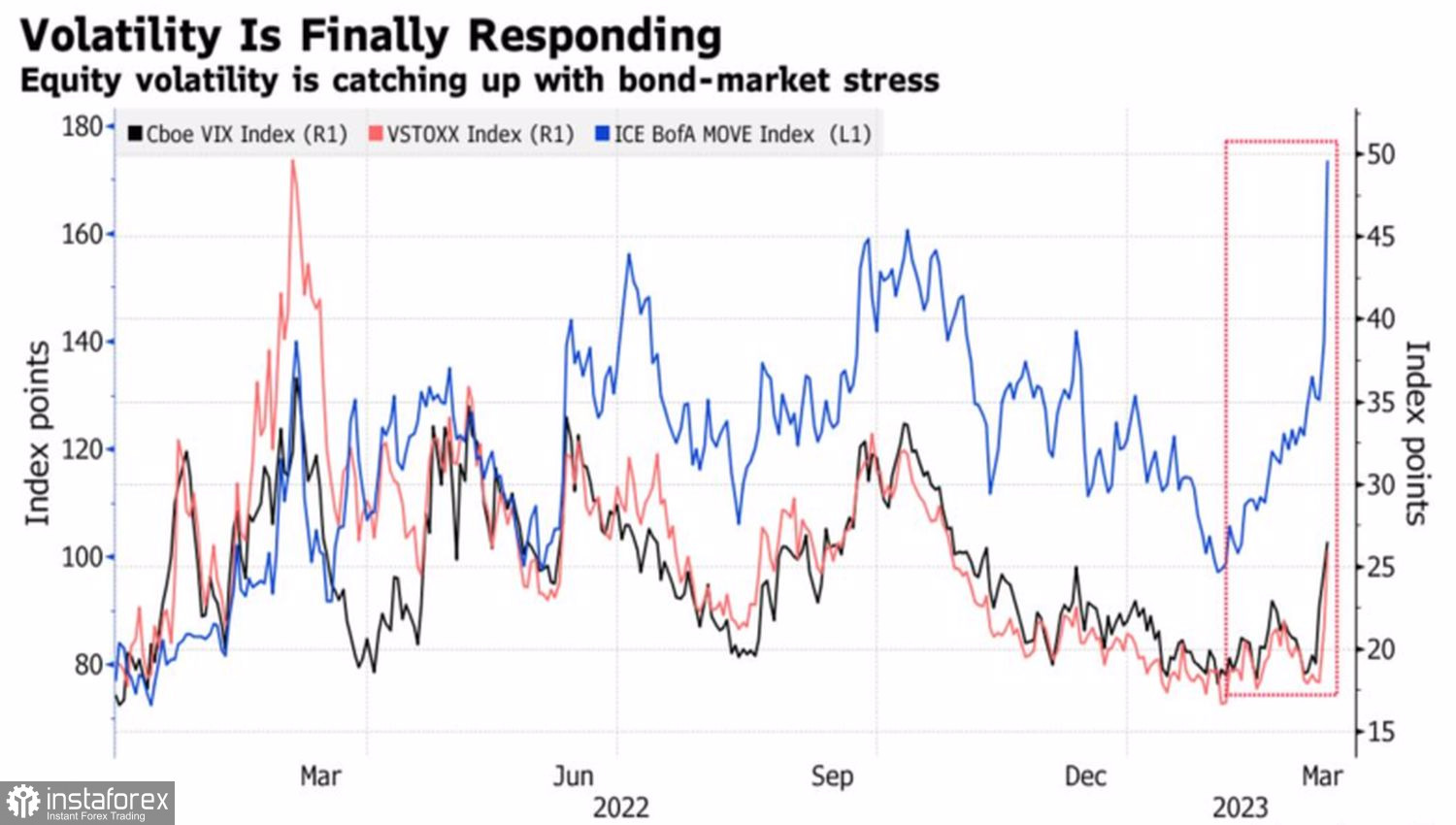

It would seem that the Fed is in control. The central bank was ready to slow the rate of monetary policy tightening as the inflation rate decreased. And conversely, switch to a wider step of 50 bps against the background of improving macro statistics for the United States. The problem is that controlling everything in the market is impossible, even for the Federal Reserve. Due to U.S. bank failures, it faced a conflict of interests: on the one hand, it is necessary to further reduce inflation, on the other, to ensure the stability of the financial system. It is not surprising that the volatility of various assets is growing rapidly, and institutions make opposite forecasts for the federal funds rate.

Dynamics of volatility in financial markets

Goldman Sachs and PIMCO expect the Fed to leave the cost of borrowing unchanged at 4.75% at the March meeting, while Nomura expects it to decline by 25 bps. In contrast, BlackRock thinks the central bank will push for a rate hike to fight inflation. It should not show that the shock waves from cracks in the system have agitated it. That's the only way to calm the markets.

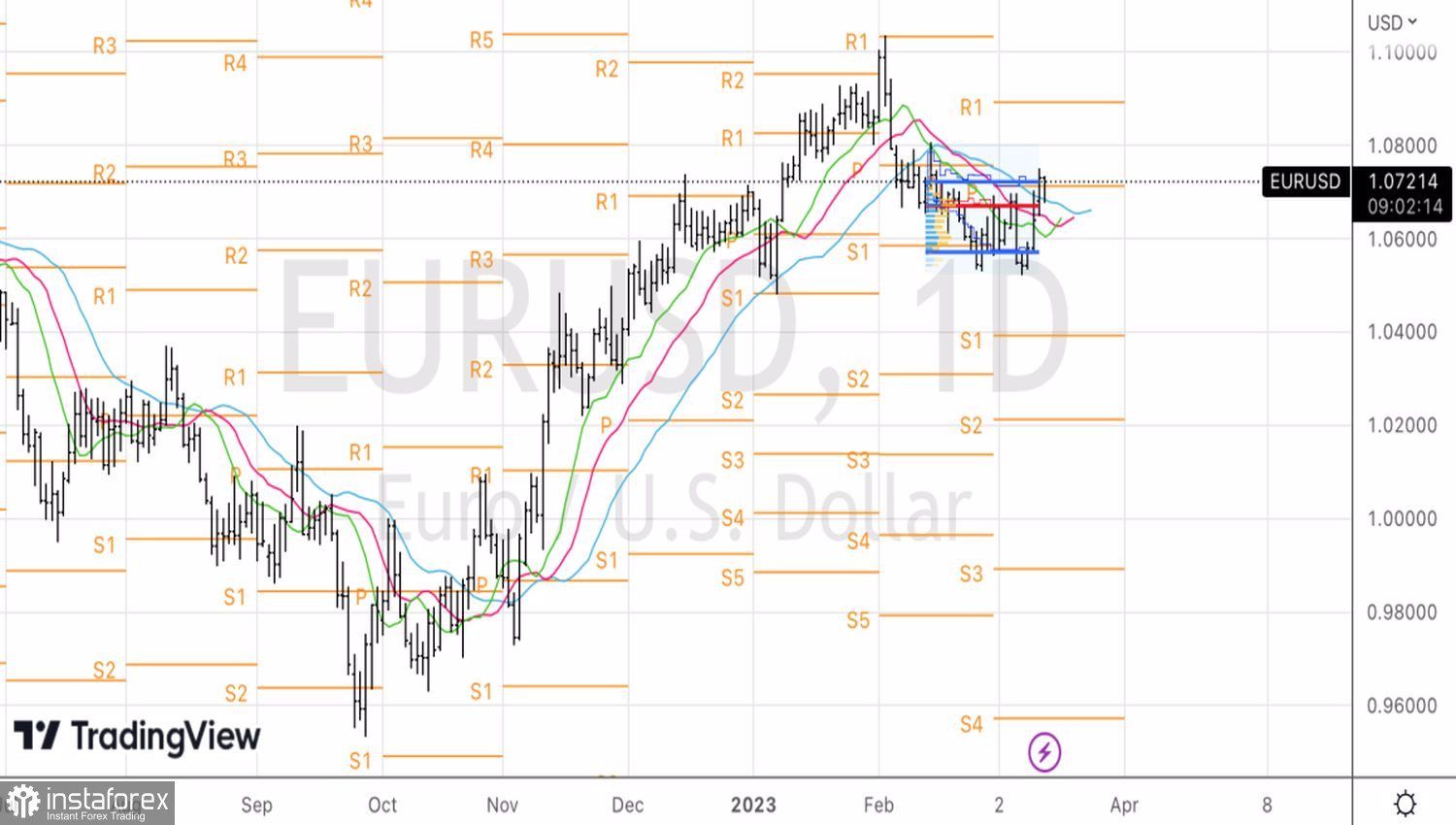

Derivatives, meanwhile, give only a 50% chance that the Fed will continue to move 25 bps in March. The same probability is given to stopping the monetary restriction cycle. At the same time, the size of the "dovish" reversal increased from 50 bps to 100 bps, which cannot but put pressure on the U.S. dollar. After a slight decline, the EURUSD pair returned above 1.07 again.

The lack of consensus leads to nervousness. Investors are ready to accept any information that will clarify the situation and not confuse it even more. The U.S. inflation data for February may do both. Will the acceleration of consumer prices bring back the idea of raising the federal funds rate by 50 bps in March? Or will the CPI slowdown bring calm to the markets?

The ECB meeting may create even more uncertainty. It just happens that the European Central Bank, by the calendar, will be the first to have to respond to shocks in the U.S. banking system. Will they force it to slow down, which will hit the euro?

Technically, as expected, the rise of EURUSD above 1.0675 allowed to build up or form new longs. If the pair manages to break beyond the upper boundary of the 1.0565–1.0725 fair value range, the risks of continuing the rally towards 1.0825 and 1.0895 will increase.