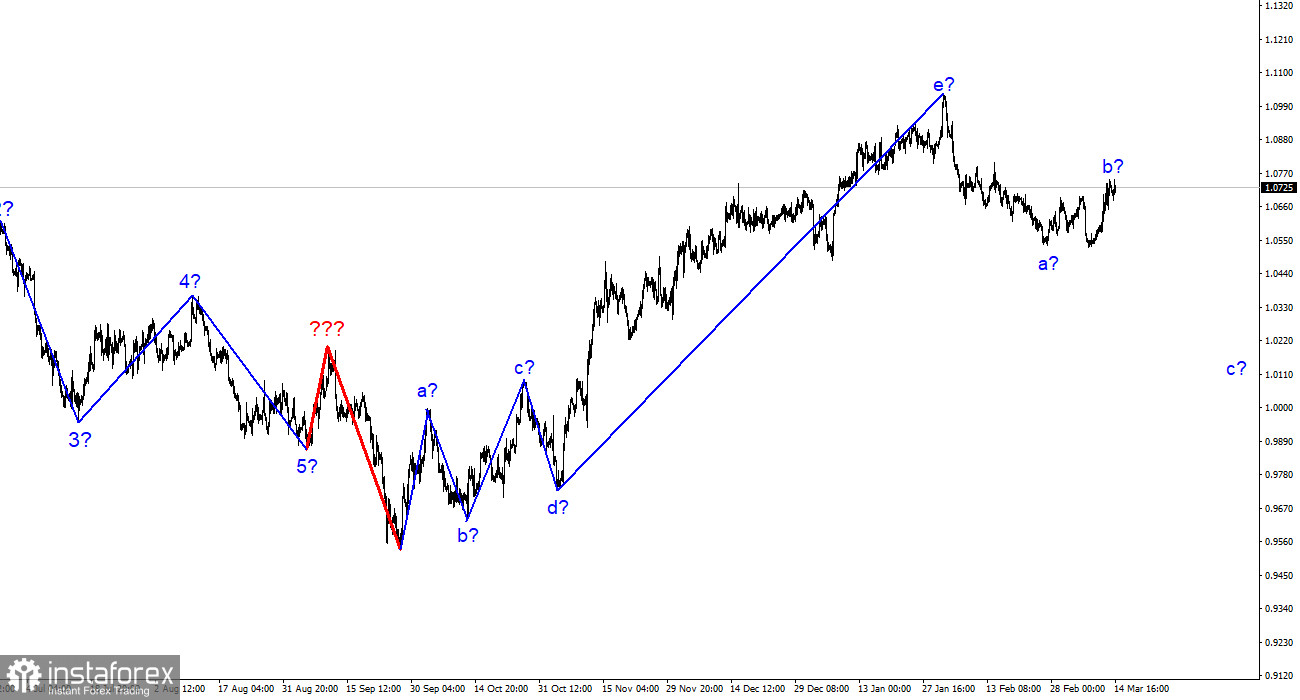

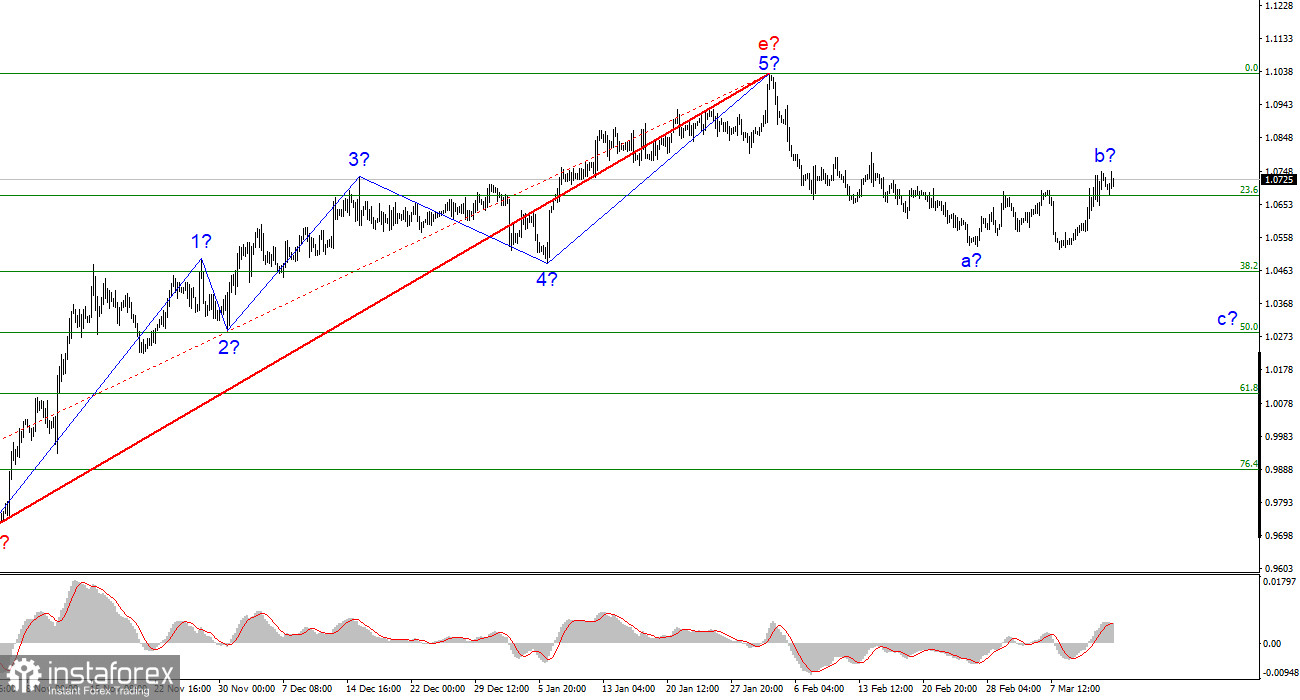

The 4-hour chart for the euro/dollar pair still shows the same wave pattern, which is excellent because it allows us to predict how the situation will develop. It's also encouraging that the movements are almost entirely in line with the wave analysis. The upward part of the trend, which has taken on the pattern a-b-c-d-e, is already finished. I continue to anticipate the pair to decline since, if the wave pattern for the current wave is accurate, we should build at least three waves down. Two of these three waves may already be finished. The proposed wave b, which is now nearing completion once more or has already been completed, has become more complicated as a result of the recent increase in quotes. But I must point out that the movement of last Friday seriously confounds the wave image. Now that quotes are increasing, the current wave scenario can still happen, but there is a risk that the markup of the current wave will change, which we would prefer to prevent. For the time being, I continue to anticipate that the pair will continue to decrease, with targets close to the predicted mark of 1.0283, or 50.0% Fibonacci. To determine if the market may continue developing a downward trend section after working off this level, it will be required to assess the scenario and the wave image.

Inflation confused the market.

On Tuesday, the euro/dollar pair declined by 5 basis points, with an amplitude of roughly 35 points throughout the day. These, in my opinion, are very weak signs that point to the market's lack of a reliable response to a crucial inflation report in the United States, as well as some tightness among its participants. Let me remind you that the pair has been moving quite a bit over the past few days, but today there has been a calm down, and even the report on American inflation, which was exactly in line with forecasts, did not enable the pair to continue to grow or start to decrease. Consequently, the worst has been left behind for the dollar to some extent. The bankruptcy of American banks and unclear statistics have already been included in the market's calculations. According to today's inflation data, there was a 6% decline, which is a positive development. The market now has little reason to anticipate a significant rate increase in March, but there is cause to anticipate a pause in tightening.

Several significant rating agencies and banks stated on Monday that they were anticipating a pause in the Fed's rate hike in March. It is important to note that the following information is based on information from the United States Department of Agriculture (USDA). Reducing the likelihood of a rate hike by 50 basis points is not the best news for the currency. Yet, no one even dared to think that the American regulator may speed up the pace of monetary policy tightening again a few weeks ago. As a result, I believe that the market has had a few restless nights and anxious days, but that things will now resume as usual. The dollar may once more be in higher demand.

Conclusions in general.

I draw the conclusion that the upward trend section's development is finished based on the analysis. As a result, it is now allowed to take into account sales with targets close to the predicted mark of 1.0284, or 50.0% Fibonacci. A corrective wave 2 or b can still be developed at this point; however, it will now take a longer form. Opening sales now on the MACD "down" signals is advised.

On the older wave scale, the upward trend section's wave pattern has grown longer but is likely finished. We observed five upward waves, which we believe represent the a-b-c-d-e pattern. The downward trend's development has already started, and it might have any size or structure.