On Tuesday, commodities and the debt market worked together to finally stop the rise in counter-dollar currencies. Oil was down 4.26% (WTI) yesterday and the yield on 5-year U.S. government bonds rose from 3.68% to 3.85%. The dollar index was up 0.05%.

U.S. inflation data for February showed the potential for a run-up in inflation. The overall and core CPI came in at the forecasted 6.0% (vs. 6.4% y/y in January) and 5.5% y/y (vs. 5.6% y/y in January), but the monthly increase in core CPI was 0.5% vs. the forecast of 0.4% and 0.4% in January. Therefore, the Federal Reserve's expected softness at the March 22 meeting may not be confirmed.

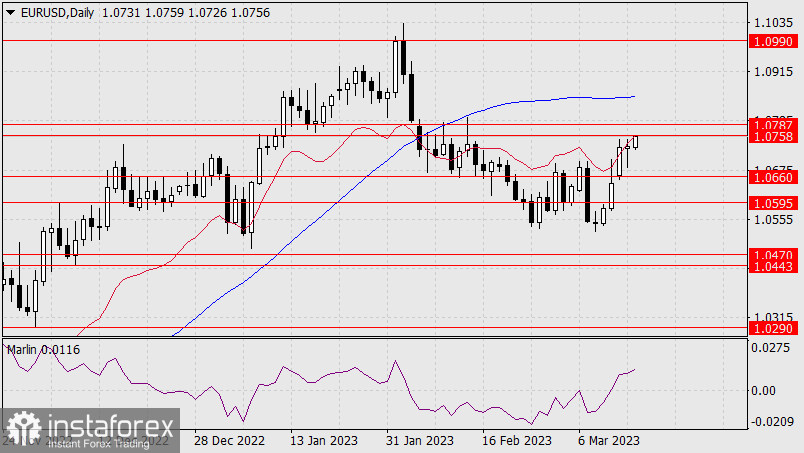

On the daily chart, the euro formed a small candlestick with the large bottom shadow, showing the intention to reverse to the support of 1.0660. But it has not reached the target resistance at 1.0758, so the price may reverse a little later, after the bulls reach their target.

On the four-hour chart, the price does not show a clear intention to enter the target range of 1.0758/87, as the Marlin oscillator has taken a downward reversal course. But this situation also contributes to the subsequent formation of divergence. Therefore, we are waiting for any confirmation of the reversal signs. Falling below the support at 1.0660 will confirm the reversal.