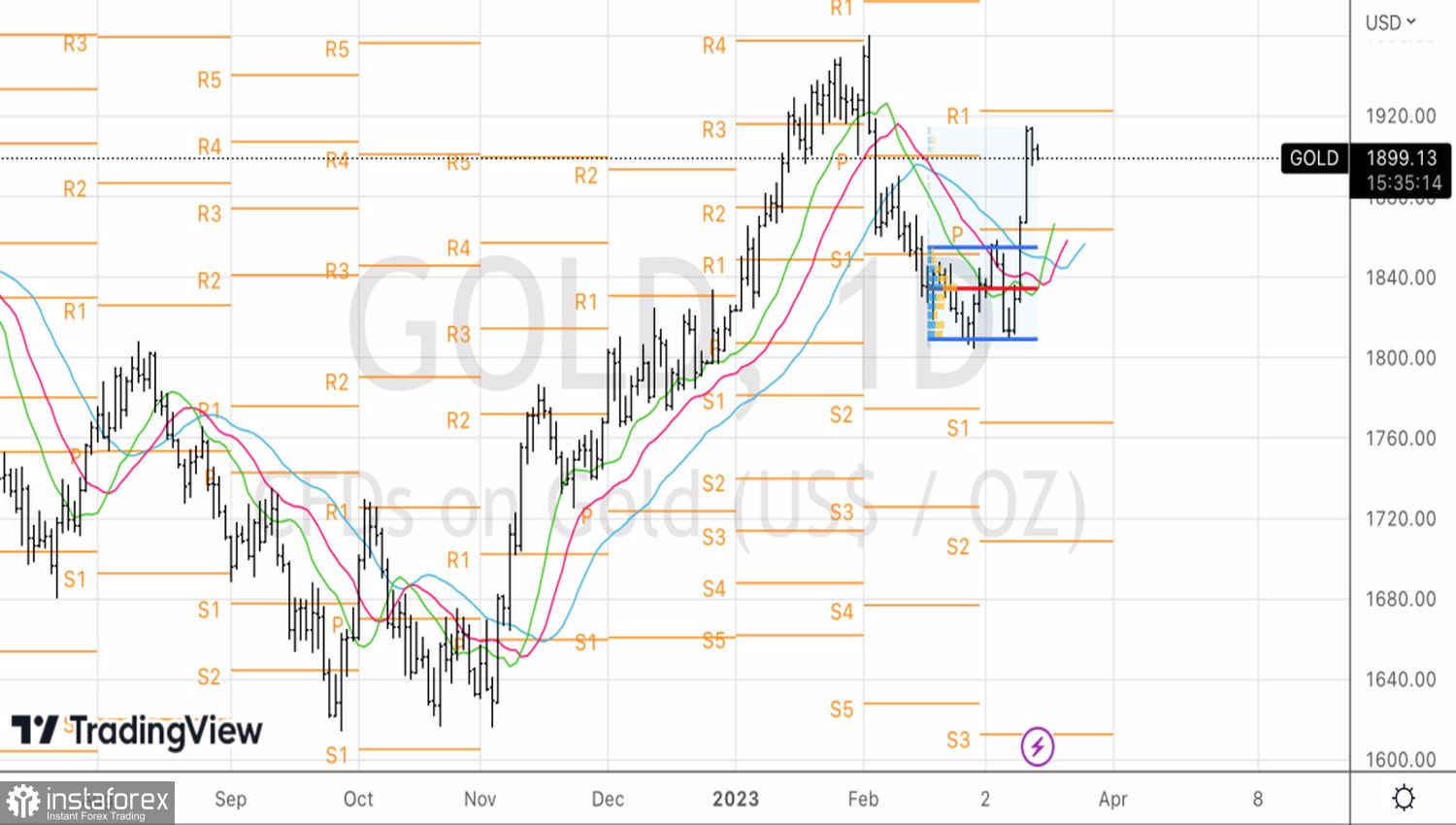

If you like extreme, choose gold! The roller coaster of the precious metal is impressive: after an 8% drawdown in February, it marked a 5% rally in March. It was based on the weakening U.S. dollar and the worst collapse in Treasury yields since Black Monday in the stock market in 1987. Investors began to seriously believe that the Fed would switch from fighting inflation to ensuring financial stability. The conflict of interest proved to be the catalyst for the XAUUSD rally.

It's not hard to guess that a roller coaster of this magnitude becomes possible if investor sentiment changes dramatically. In February, they abandoned the idea of a "dovish" reversal, massively rolled up longs for gold and increased shorts. In March, due to cracks in the banking system, the idea of lowering the federal funds rate in 2023 found a new life. As a result, the reverse process began: speculators got rid of short positions and entered longs.

Just a few days ago, CME derivatives gave out an 80% chance of a 50 bps Fed rate hike in March, and now they have completely abandoned it. Unsurprisingly, Treasury yields fell, with SPDR Gold Trust reporting that its assets rose 1.31% on March 10 from 901.4 to 913.3 tons, equivalent to 29.03 million ounces. We are talking about the suspension of the process of reducing assets, which peaked in April at 35.58 million ounces.

Dynamics of gold and U.S. Treasury yields

Will gold be able to maintain its bullish momentum in the near term? In my opinion, hardly. Yes, the U.S dollar should be weaker than in February, as the futures market no longer sees the peak of the federal funds rate at 5.75%. However, monetary tightening is likely to continue.

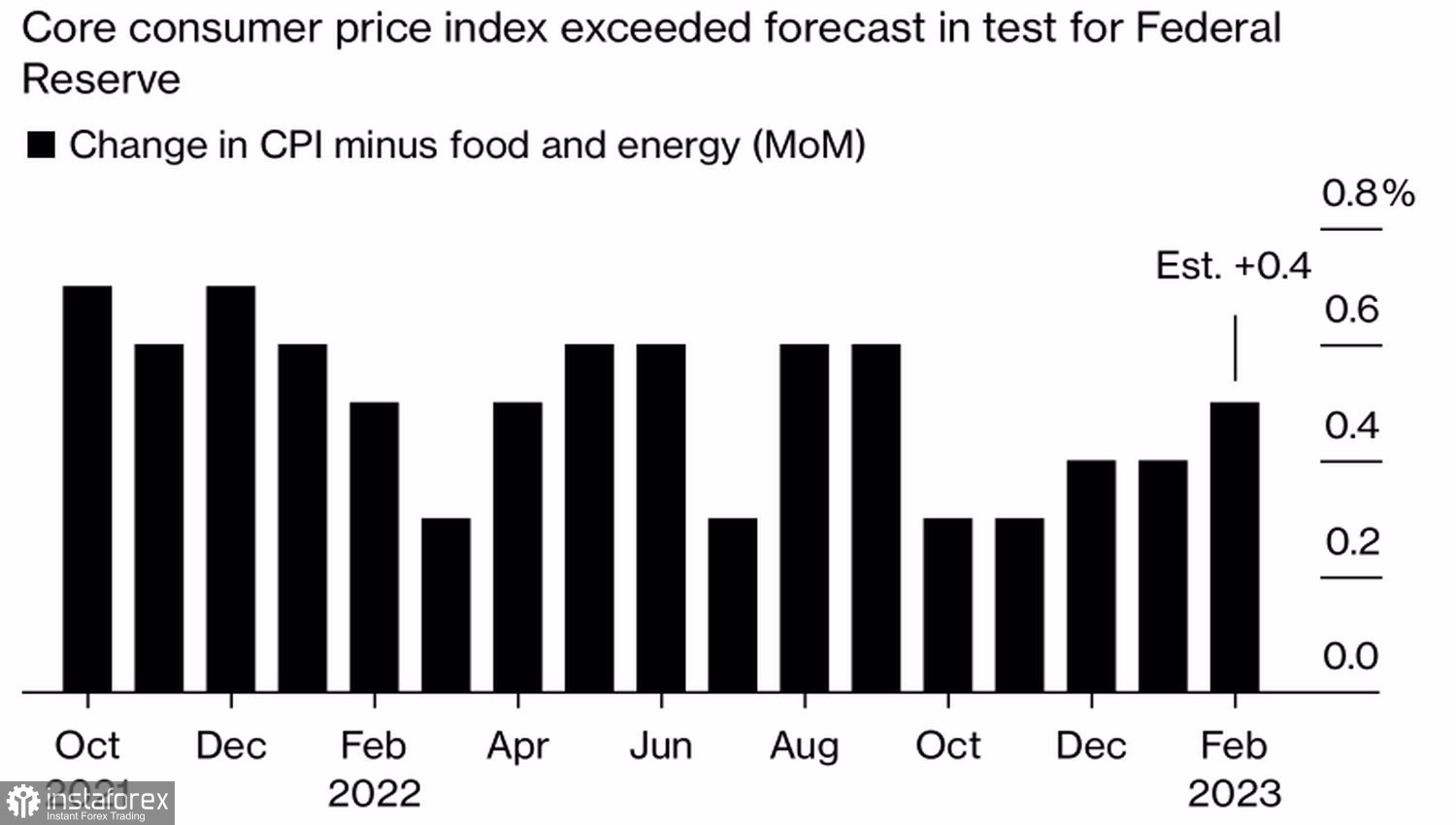

Such thoughts are prompted by the still hot February inflation data. Although consumer prices and the core indicator slowed year-on-year, they remain elevated on a monthly basis. This forces the Fed to continue to raise borrowing costs and increases the risks of a partial recovery of the significantly fallen U.S. Treasury yields. This is bad news for the precious metal.

Inflation dynamics in the USA

The stabilization of the situation in the banking sector after the support measures implemented by the Fed and other regulators will also contribute to the growth of U.S. debt market rates. As a result, after the turbulent beginning of spring, XAUUSD risks losing some of its gains and stabilizing. Unless the ECB gives a "dovish" surprise by suddenly deciding not to raise the deposit rate by 50 bps at the meeting on March 15 because of the Silicon Valley Bank (SVB) failure. If that happens, the euro will weaken, the dollar will appreciate, and gold quotes will fall.

Technically, gold's inability to cling to the $1,900 per ounce pivot point would be the first sign of bullish weakness. We partially take profits on the longs formed from $1,824 and look for opportunities to increase them on pullback.