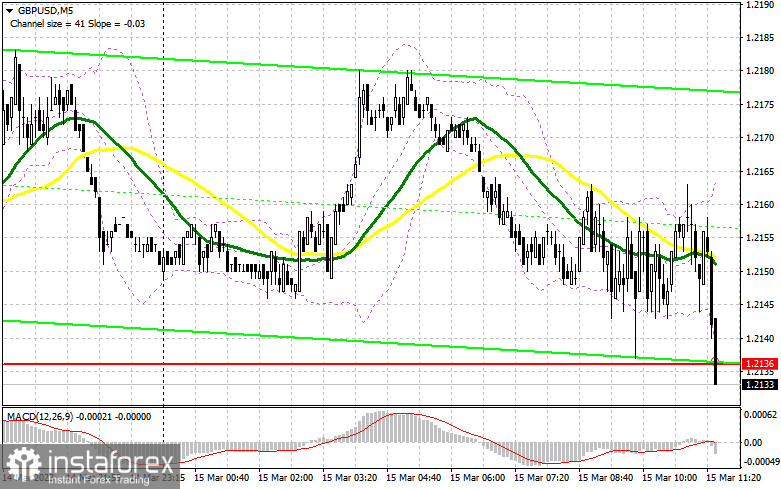

In my morning forecast, I focused on the level of 1.2136 and suggested that you base your trading decisions on it. Let's take a look at the 5-minute chart and see what happened. It was impossible to attain the levels I suggested because of the market's minimal volatility before the UK budget's publication. The technical situation has not changed recently.

To open long positions on the GBP/USD, you must:

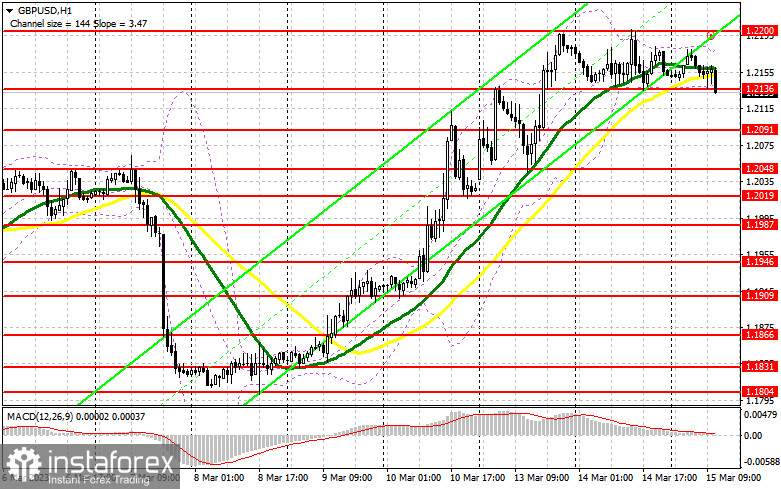

The release of the UK government's budget will have a significant impact on the British pound. However, it is important to keep in mind that strikes are currently being held throughout the UK to persuade Finance Minister Jeremy Hunt and Prime Minister Rishi Sunak to change their minds about raising wages, which the government opposes due to high inflation, which has a significant negative impact on the economy. I recommend that buyers focus on the nearest support level of 1.2136 if the pound continues to decline. Nevertheless, only the possibility of a false collapse will enable you to receive a buy signal to go back to the high of 1.2200 set by yesterday's outcomes. I bet on a more active increase of GBP/USD to 1.2265 when fixing and testing this range from top to bottom against the backdrop of traders' favorable reactions to the UK budget. Also, I only purchased there following a breakthrough with a potential for growth at 1.2221, where I set the profit. Nothing terrible will occur if the bulls fall short of their targets and miss 1.2136 in the afternoon, but the likelihood of a greater drop will rise. In this scenario, I suggest that you wait before making any purchases and only start long positions around the next support level of 1.2091 and only in the event of a false drop. To recover just from the minimum of 1.2048 and achieve a correction of 30-35 points within a day, I will buy GBP/USD right away.

If you want to trade short positions on GBP/USD, you will need:

Strong retail sales figures in the UK will be used by pound sellers to support their positions against the US currency. The formation of a false breakout in the area of the closest resistance of 1.200, which I was unable to get above yesterday, appears as the ideal opportunity for selling during the American session of today. Poor retail sales figures should help with this, which will be a great indication to start short positions to drive GBP/USD to 1.2136, the intermediate support created in response to yesterday's results. When the pair experiences a breakout and a reverse test from the bottom up of this range against the backdrop of UK budgetary issues or a rise in US retail sales, pressure will build on the pair, generating a sell signal with a decline to 1.2091. At least 1.2048 remains the most distant target, where I will fix the profit. Only a false breakout in the area of the next level of resistance around 1.2265 will provide an entry point for short positions given the possibility of GBP/USD growth and the absence of bears at 1.200 in the afternoon. In the absence of action, I will sell GBP/USD immediately from the high of 1.2221, but only if the pair falls by 30-35 points within the day.

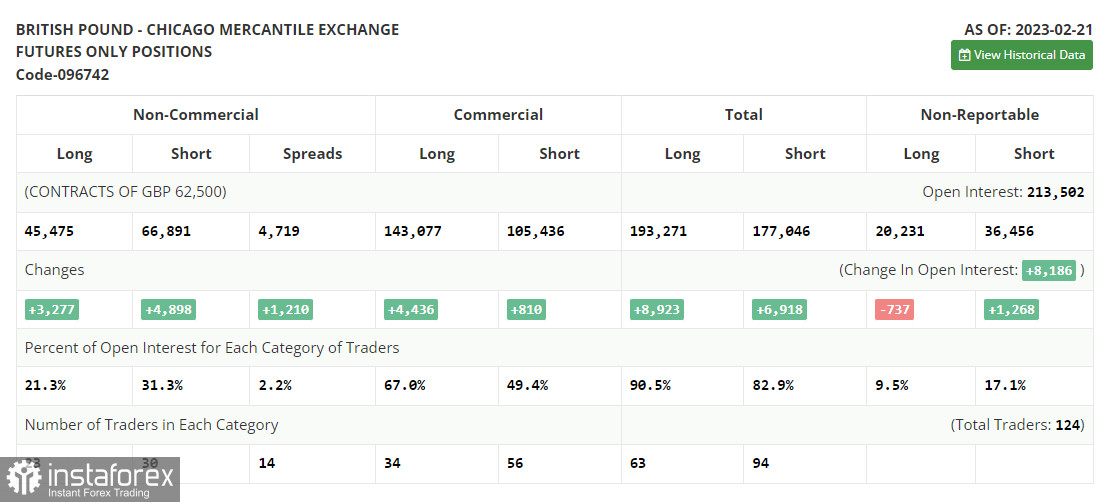

Both long and short positions rose in the COT report (Commitment of Traders) for February 21. The information from a month ago is not very pertinent at this time, thus it should be understood that these data are of little interest at this time. This is because statistics are only now starting to catch up following the cyberattack on the CFTC. I'll hold off till new reports are released and rely on more recent data. Important events this week are predicted to yield statistics on the UK labor market and the growth of average earnings, which will help the Bank of England in determining future interest rates against the backdrop of stable inflation. The increase in household income could maintain the high rate of inflation. We are also awaiting information on US inflation, which might help traders believe that the Fed and Jerome Powell won't resume their course of strict policy, as was suggested last week. The prospect of the US banking industry collapsing, which emerged during the BSV bankruptcy, would undoubtedly alter Fed policymakers' assessments of how much more they need to raise the rate to "finish off" the economy. According to the most recent COT data, long non-profit positions increased by 4,898 to 66,891 while short non-profit positions increased by 3,277 to 45,475. As a result, the non-profit net position's negative value increased to -21,416 from -19,795 a week earlier. The weekly ending price fell from 1.2181 to 1.2112 this week.

Signals from indicators

Moving Averages

Trade is taking place below the 30 and 50-day moving averages, which suggests that a downward correction is likely.

Note that the author's consideration of the period and costs of moving averages on the hourly chart H1 differs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's upper bound in the area of 1.2185 will serve as resistance in the event of growth.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.