The U.S. and global stock indices are falling again, while the U.S. dollar, on the contrary, is strengthening, including amid continued demand for defensive assets after the banking crisis in the U.S.

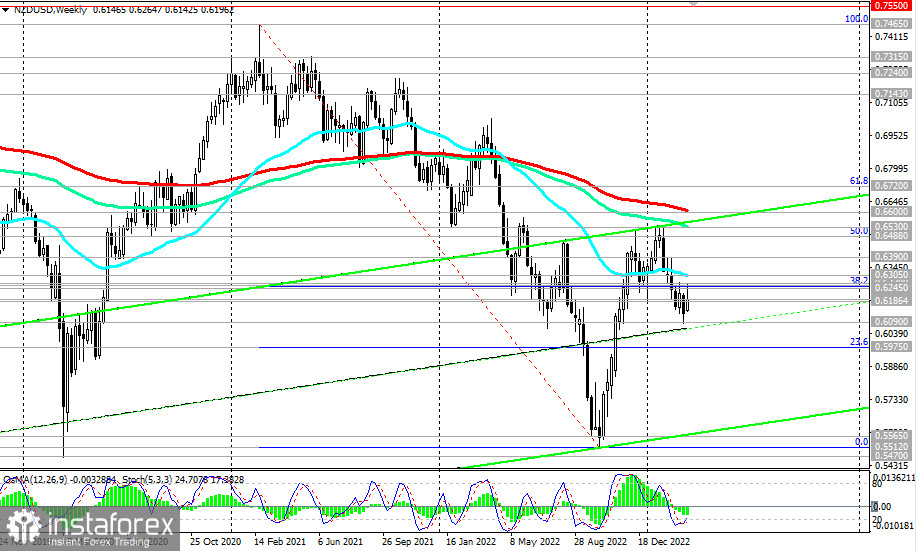

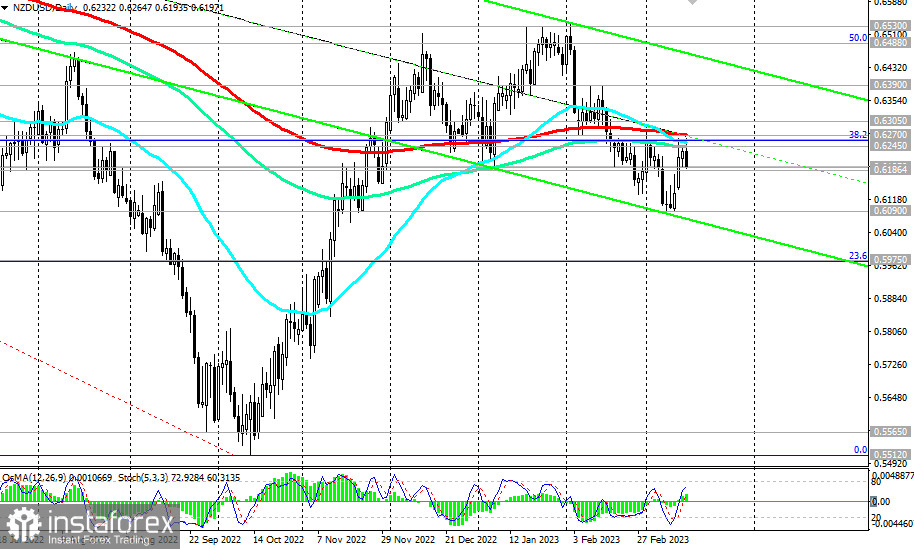

As of writing, NZD/USD was trading near the level of 0.6200, below the key medium-term resistance levels 0.6305 (50 EMA on the weekly chart), 0.6270 (200 EMA on the daily chart), while remaining in the global downward trend zone, below the key long-term resistance levels 0.6720 (200 EMA on the monthly chart), 0.6600 (200 EMA on the weekly chart), 0.6530 (144 EMA on the weekly chart).

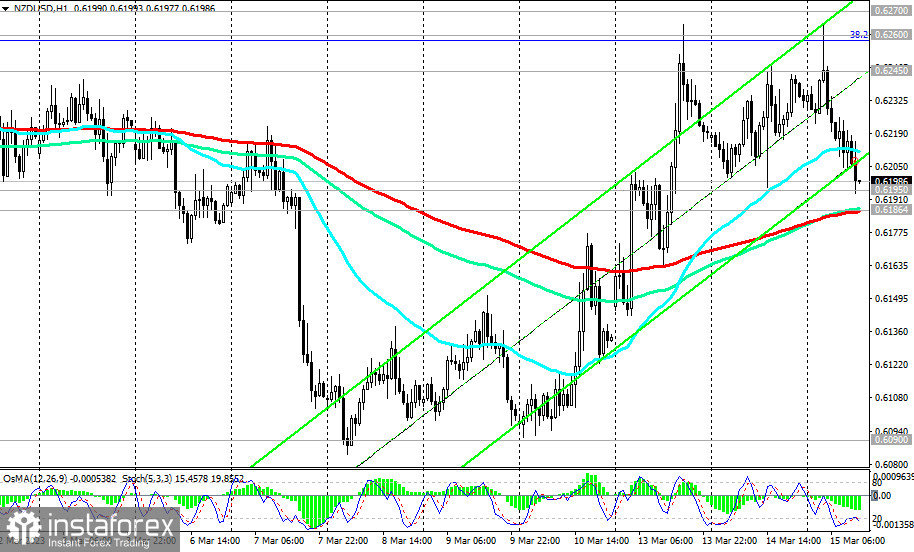

At the same time, the price is approaching the important short-term support level 0.6186 (200 EMA on the 1-hour chart), the breakdown of which will become an additional signal to increase short positions.

Alternatively, there will be a rebound near this support level, and NZD/USD will again rush towards the resistance levels 0.6305, 0.6270.

In turn, their breakdown will bring NZD/USD into the medium-term bull market zone with the possibility of further growth towards the resistance levels 0.6530, 0.6600.

A breakdown of the local and short-term resistance level at 0.6225 can also be a signal.

In the meantime, and today, short positions remain preferable.

Support levels: 0.6195, 0.6186, 0.6090, 0.6000, 0.5975, 0.5900

Resistance levels: 0.6225, 0.6245, 0.6260, 0.6270, 0.6305, 0.6390

Trading scenarios

Sell Stop 0.6180. Stop-Loss 0.6230. Take-Profit 0.6090, 0.6000, 0.5975, 0.5900

Buy Stop 0.6230. Stop-Loss 0.6180. Take-Profit 0.6245, 0.6260, 0.6270, 0.6305, 0.6390, 0.6400, 0.6500, 0.6538, 0.6600, 0.6625