Bitcoin and the entire cryptocurrency market are spending the current trading week on a bullish note. The main reason for this was the sudden crisis in the U.S. banking system. Investors turned their attention to decentralized assets, and therefore we should expect a positive trend in the flow of funds into crypto funds at the end of this week.

Bitcoin was the main beneficiary of investor panic and saw a 25% gain. As of March 16, the cryptocurrency is trading near the $25k level, and there is every reason to believe that the current macroeconomic situation will contribute to further growth in asset quotes.

Fed plans and harsh reality

Two weeks ago, the situation looked as pessimistic as possible. Inflation declined slowly, prompting the Fed to talk openly about extending its hawkish policy and raising rates more aggressively. At the same time, there was a peak in the withdrawal of liquidity from the American economy.

As a result, investors rushed to Treasuries, which provoked increased pressure on BTC and SPX from the U.S. dollar index. In addition, the labor market remained strong, and the number of applications for unemployment did not exceed 200,000.

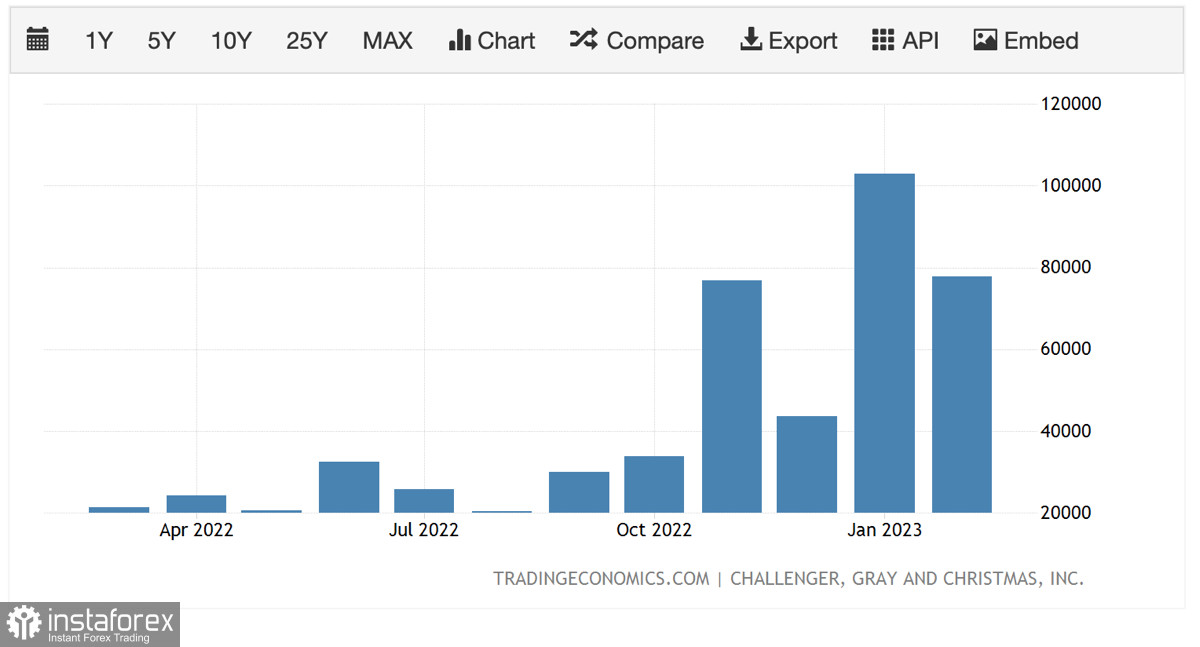

However, problems arose where they were least expected—in the banking sector, where there were unrealized losses of $650 billion. Securities purchased prior to the aggressive rate hike lost significant returns. These factors provoked panic in the financial markets and capital movements.

At the same time, the labor market gave the first crack, and the number of applications for unemployment exceeded 200,000. The combination of these factors put the Fed in a situation where the current policy could lead to massive liquidity problems in the banking system, and as a result, significant problems with unemployment and bankruptcies.

However, the fall in inflation to 6% softened the situation, both for the Fed and the markets, where the positive began to prevail. We saw the growth of precious metals and cryptocurrencies, as well as positive signals in the futures market, where a 0.25% rate hike competes with the end of an aggressive policy.

BTC/USD Analysis

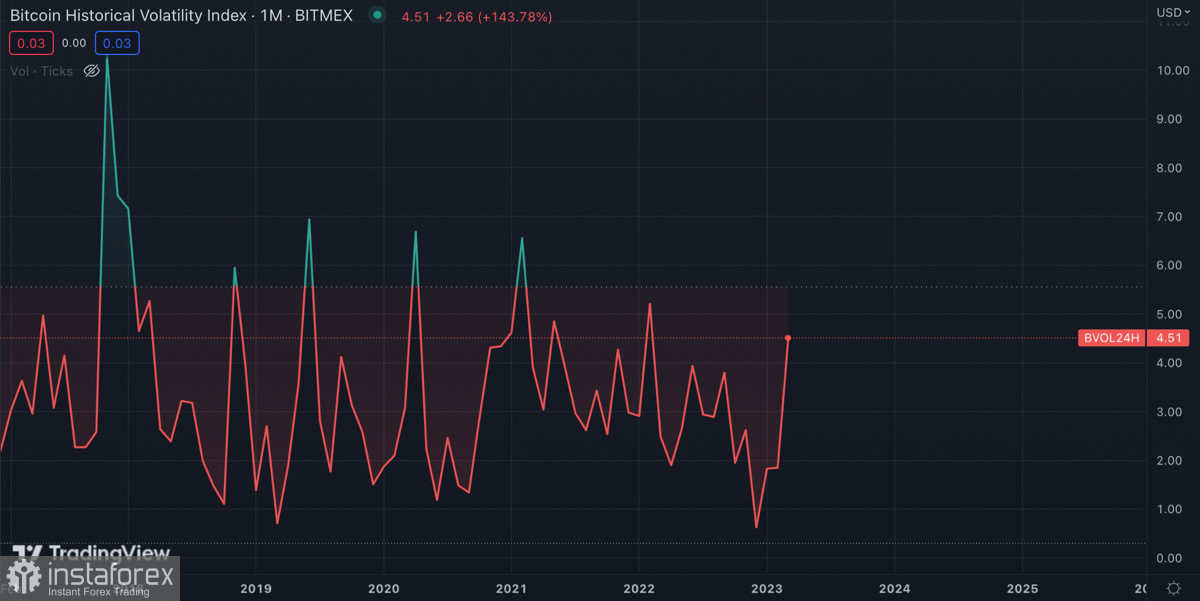

Bitcoin's powerful rise has once again confirmed the cryptocurrency's dependence on macro factors and Fed policy. According to BBG analysts, swap markets have begun to lay down monetary policy easing in 2023 at 1% of peak levels.

At the same time, the situation with the U.S. banking system remains tense, and it is likely that the situation with SVB may happen again with other companies. Given this, precious metals and Bitcoin can become a reliable savings tool.

It could also mean that in the medium term, the Fed's policy will turn 180 degrees, which will also have a positive effect on Bitcoin quotes. The first signals for this have triggered a significant surge in "whale" transactions in the $25k–$26k range, according to Santiment.

Results

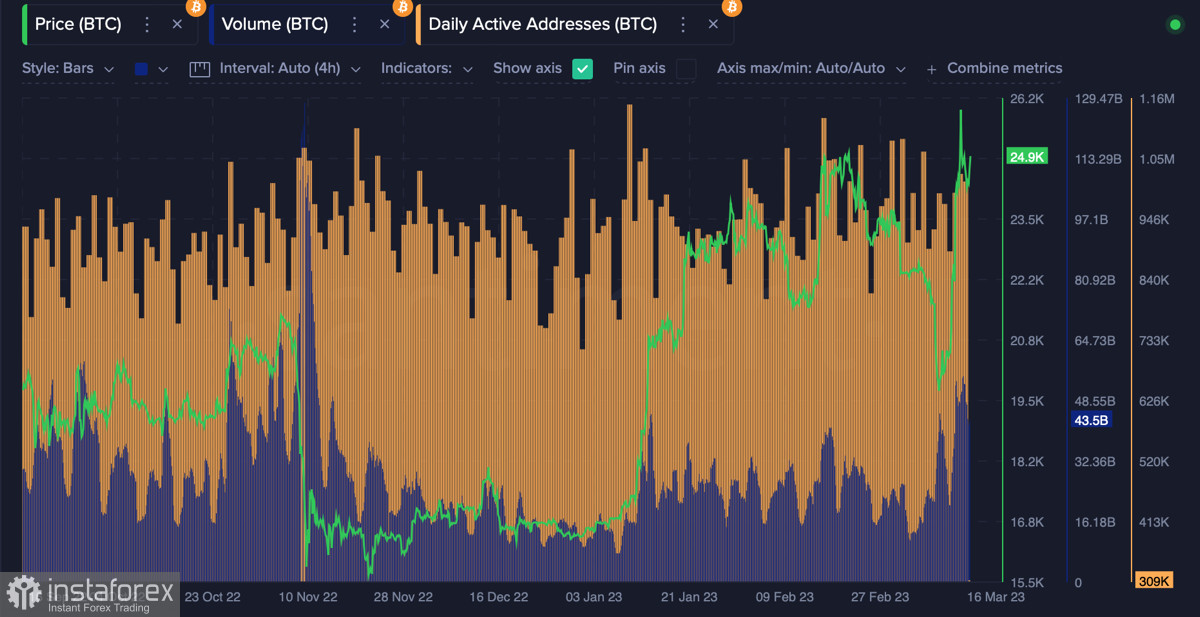

Given BTC's consolidation near $25k, we can expect the asset to move towards that mark again in the near future. On the daily chart, a bullish cross is already forming on the stochastic, and the RSI is gradually resuming the upward movement.

Trading volumes remain high around $45 billion, indicating strong interest in BTC. The activity of unique addresses in the Bitcoin network also remains at a high level, and therefore we can expect an assault on the $24.9k–$25.1k resistance area.