Pressure on euro returned after news emerged that inflation in the eurozone fell in February. However, the need for further aggressive policy from the European Central Bank remains, as underlying prices have continued to rise, which is not good. As such, the bank will carry on raising rates to actively fight rising prices and make euro more attractive to investors.

Important data from the US is expected in the afternoon, which could provide support to dollar. Good US industrial production figures, rising US consumer expectations and sentiment indices from the University of Michigan are likely to return demand for dollar, which will weaken euro and pound and lead to a correction in both of them later in the week.

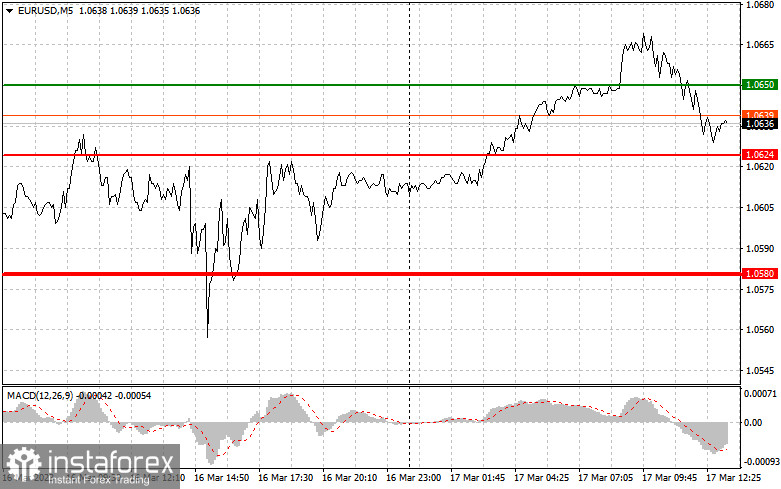

EUR/USD

For long positions:

Buy euro when the quote reaches 1.0650 (green line on the chart) and take profit at the price of 1.0696.

Euro can also be bought at 1.0624, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0650 and 1.0696.

For short positions:

Sell euro when the quote reaches 1.0624 (red line on the chart) and take profit at the price of 1.0580.

Euro can also be sold at 1.0650, but the MACD line should be in the overbought area as only by that will the market reverse to 1.0624 and 1.0580.

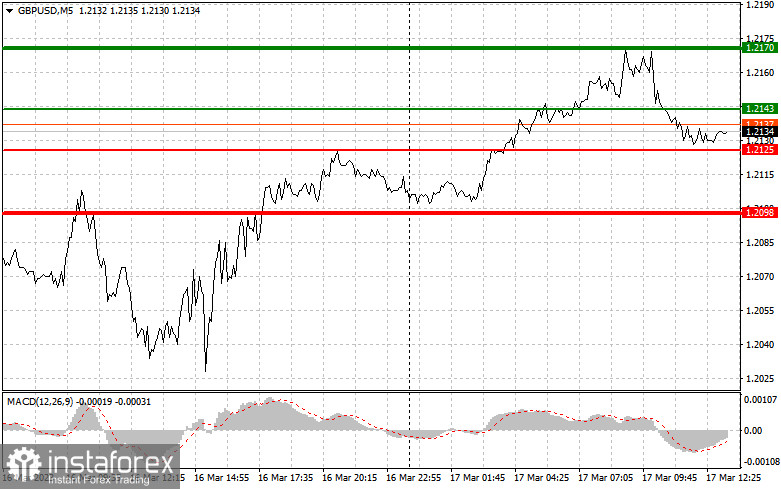

GBP/USD

For long positions:

Buy pound when the quote reaches 1.2143 (green line on the chart) and take profit at the price of 1.2170 (thicker green line on the chart).

Pound can also be bought at 1.2125, but the MACD line should be in the oversold area as only by that will the market reverse to 1.2143 and 1.2170.

For short positions:

Sell pound when the quote reaches 1.2125 (red line on the chart) and take profit at the price of 1.2098.

Pound can also be sold at 1.2143, but the MACD line should be in the overbought area as only by that will the market reverse to 1.2125 and 1.2098.