The US industrial production report turned out to be much worse than expected and the previous data was revised from 0.8% to 0.5%. And instead of slowing to 0.2%, the industrial production showed a decline of 0.2% year-on-year. These results made it possible for the pound to fully recover its losses, which the pound suffered right after the Credit Suisse announcement, which triggered the euro's fall and eventually pulled the pound down. The single currency has not returned to its previous values and it will probably do that during the day. Moreover, we found out that Credit Suisse has been purchased by another Swiss bank - UBS. So it looks like Europe managed to save the emerging bank crisis, which gives investors optimism of course. Anyway, the GBP has won back its losses, and now it will wait for the euro. So, a temporary stagnation is the most likely outcome. Moreover, the macroeconomic calendar is totally empty today.

Industrial Production (United States):

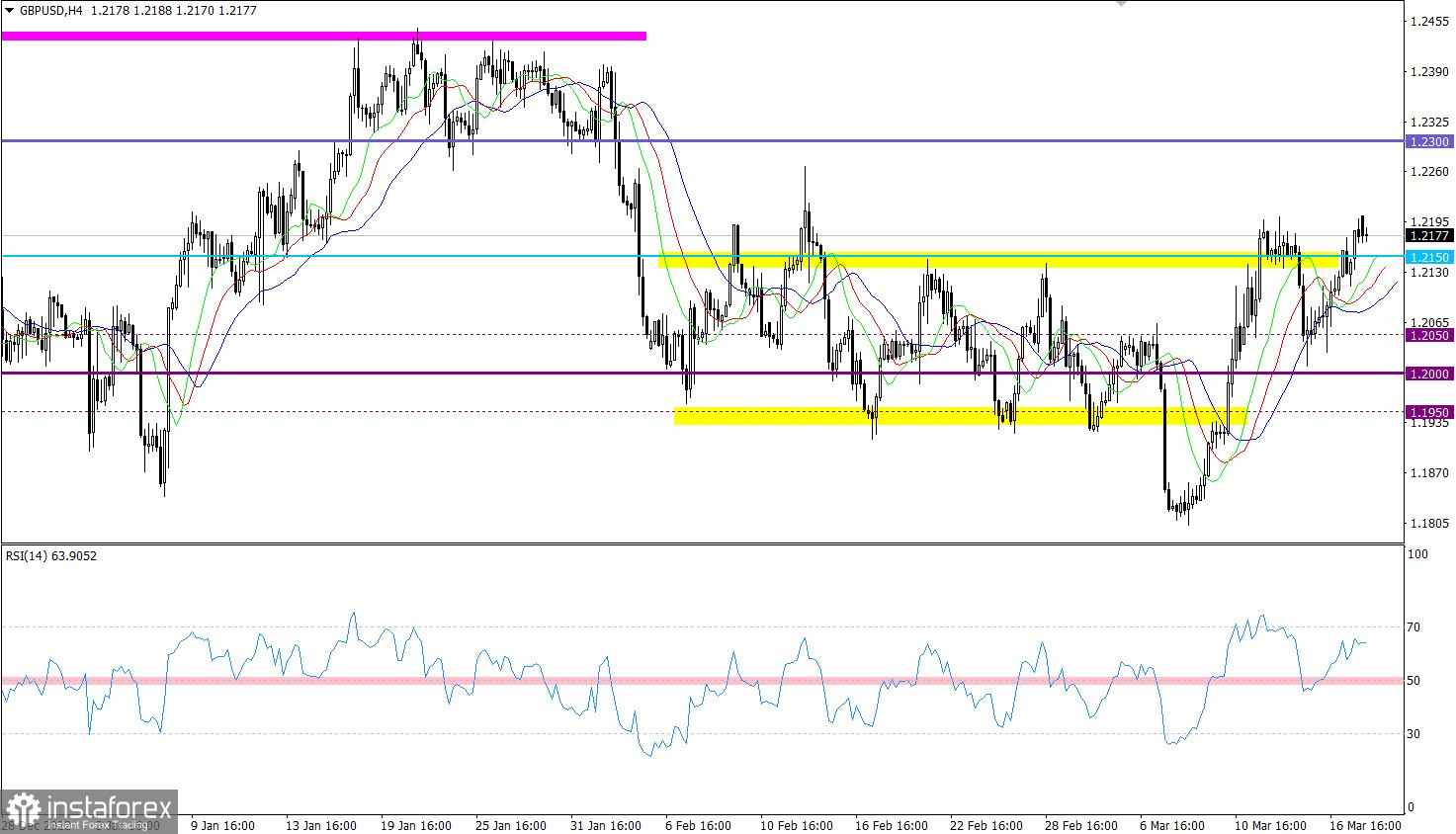

GBP/USD ended last week with growth. As a result, it came close to the local high of the uptrend, which indicates the bullish sentiment prevails.

On the four-hour, one-hour and one-day charts, the RSI technical indicator is moving in the upper area of the indicator, which confirms the signal of growth of the volume of long positions on the euro.

On the four-hour and one-day charts, the Alligator's MAs are headed upwards, which corresponds to the bullish momentum.

Outlook

We can assume that keeping the price stable above 1.2200 will strengthen long positions in the market, which in turn will open the way towards 1.2300. However, falling below 1.2100 may lead to another move towards the psychological level of 1.2000.

The complex indicator analysis unveiled that in the intraday, medium-term and short-term periods, technical indicators are pointing to bullish sentiment.