The visit of Chinese state leader Xi Jinping to Moscow, assurances from US Treasury Secretary Janet Yellen that the government is ready to help medium and small banks, and Russia reducing oil production by 500 million b/d by the end of June (according to Alexander Novak), have kept market players interested in risk; the S&P 500 1.30%, oil 4.02%, the yield on 5-year U.S. government bonds rose from 3.58% to 3.74%, gold fell 1.92%, and the euro gained 47 points (0.44%).

But there was a divergence in the currency market as other world currencies declined: the pound by -0.49%, aussie by -0.72%, yen by -0.87%, and the loonie by -0.32%. I think that the Federal Reserve's rate hike will put the euro back in a currency-wide downtrend.

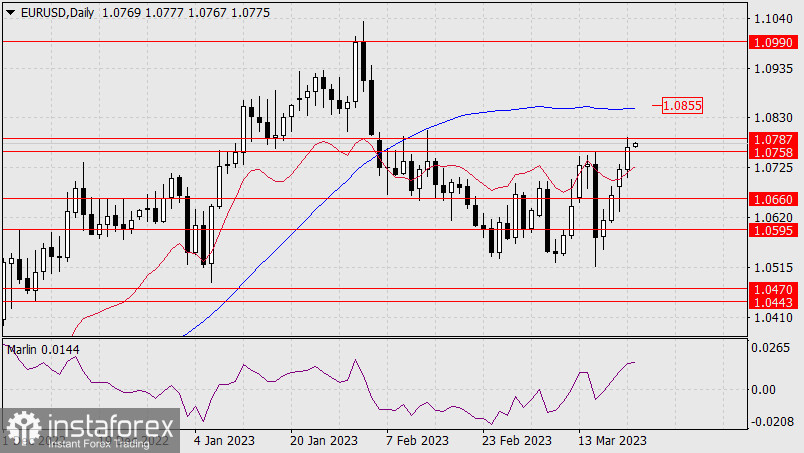

From a technical point of view, the price reached the target range of 1.0758/87, the Marlin oscillator is ready for a downward reversal on the daily chart.

The price and the oscillator form a divergence on the four-hour chart. We can confirm the reversal when the price overcomes the support of the MACD line near 1.0695, which coincides with the March 7 high.

If traders have a weak response towards the Fed rate hike, the euro will continue to rise to the MACD line (1.0855) on the daily chart.