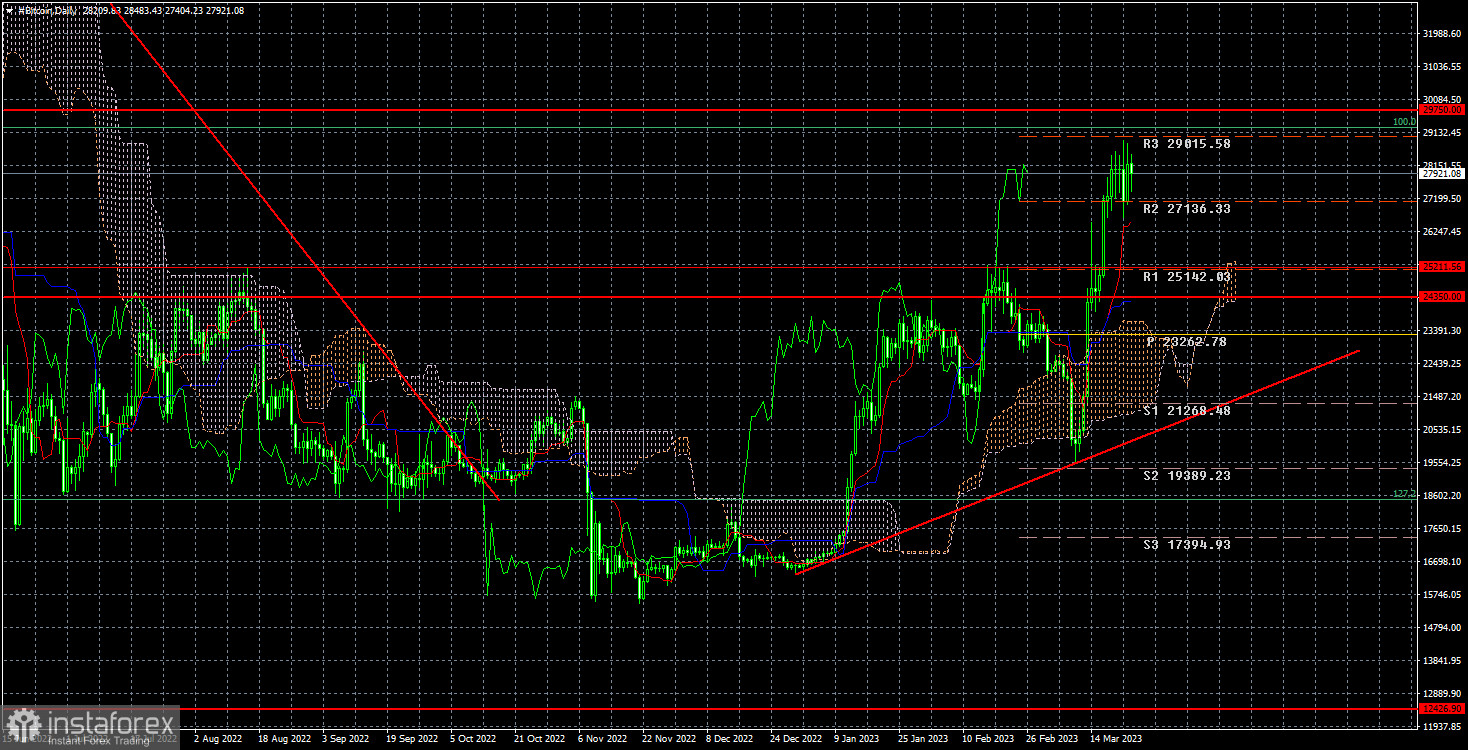

Bitcoin has managed to rise to $29,000 over the past several days. BTC continues to hover near that level at this point. The technical situation has not changed at all in the last few days, despite the crazy fundamental background of the past two weeks. It pushed Bitcoin up somewhat, even though it may not be obvious to many traders. However, first things first. The new ascending trend line currently favors bullish traders, but as we said before, BTC is approaching the level of $29,750, which acts as the nearest target level. Therefore, it needs to break above it in order to rise further.

This week, the Federal Reserve and the Bank of England conducted policy meetings. The cryptocurrency market has ignored the UK regulator, but the same cannot be said about the Fed. A few months ago, we said Bitcoin could rise in theory as the Fed approached the end of its monetary tightening cycle. In reality, Bitcoin started moving up even earlier. First of all, it was provoked by sharp drop of inflation in the US in January, and then - by banking crisis in the United States that forced the Fed to launch a new $300 billion stimulus program. This implies that this money will simply be printed, inflating the money supply yet again. Therefore, this money will have to be at least partially deposited in some market. Why not in the cryptocurrency market? As a result, traders rushed to buy Bitcoin, expecting it to rise again amid a declining US dollar.

Furthermore, Jerome Powell's statement that the Fed funds rate hikes could be over in the near future have played their role. Solid reasons to buy BTC appeared only two weeks ago, but these factors are likely no longer affecting the market. Now, the interest rate will remain high for a long time, and there are still no factors that could lead to a BTC uptrend. Whatever upside potential it had has already been used up. However, fundamental factors are quite unpredictable. Few people could have foreseen the collapse of three banks in the US, and more could follow. Bitcoin could take advantage of the turmoil in the global financial system. Because of that, traders should be ready for any scenario and should not forget about technical analysis, the best way to visualize what is going on in the market.

According to the D1 chart, BTC broke through the key level of $25,211. Traders might have opened long positions at that moment. These positions can be kept open targeting $29,750. If Bitcoin bounces off these level, a sell-off may begin as the instrument need to retrace after another 30% jump. If BTC breaks above $29,720, long positions can be opened or old ones can be kept open targeting $34,267