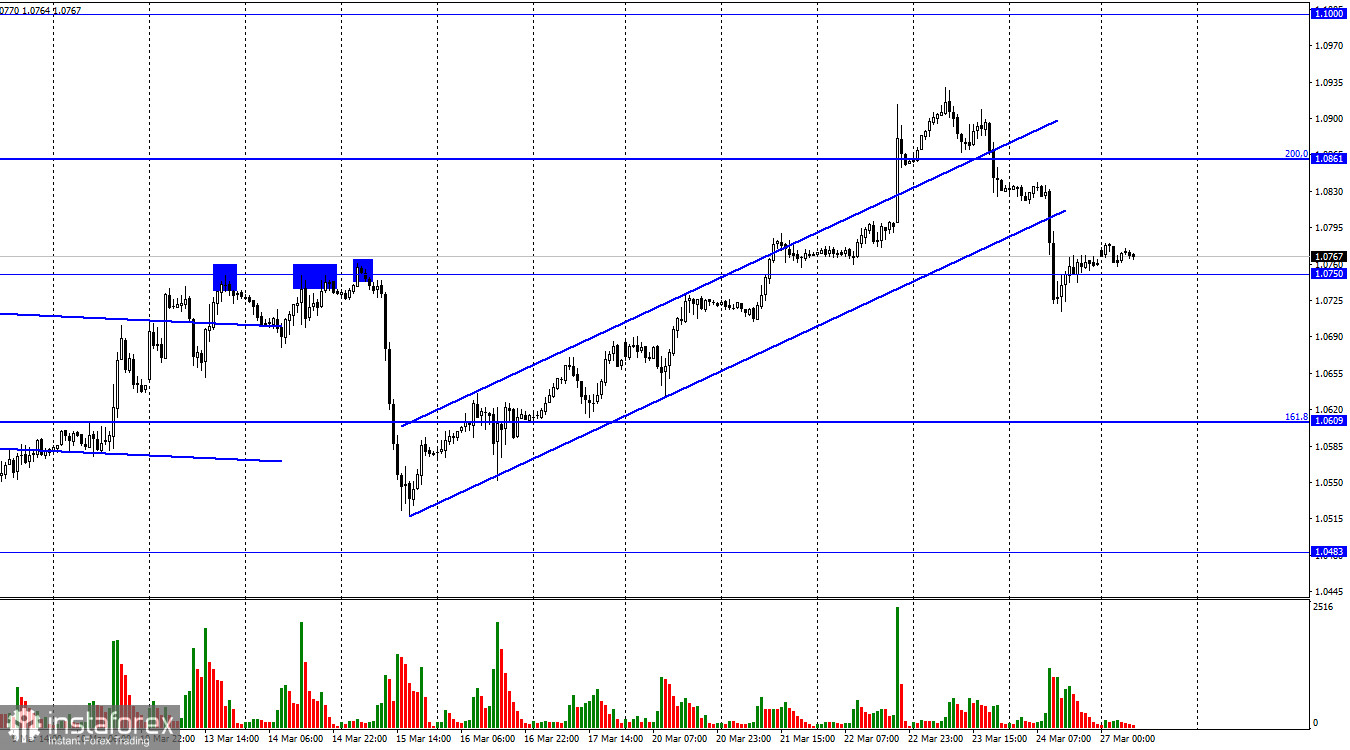

Hello, dear traders! On Friday, EUR/USD extended the downtrend toward 1.0750. On Monday, after consolidation below the level, the price may fall to the 161.8% Fibonacci level of 1.0609. Sentiment became bearish after the close below the ascending trend corridor.

On Friday, data on business activity in the eurozone and Germany was released. In recent months, the manufacturing PMI has been below 50, indicating a contraction. In March, the situation did not change. Business activity in the manufacturing sector decreased to 44.4 in Germany and to 47.1 in the eurozone and came below market expectations. Meanwhile, the services PMI grew to 53.9 in Germany and to 55.6 in the eurozone. The euro was bearish against the greenback in the European session.

The current decline in price can be seen as a correction. However, this does not mean that the euro has lost growth potential. Last week Christine Lagarde said core inflation in the eurozone remained at a high level, without any signs of a slowdown. In other words, the EBC may keep raising interest rates. In February, inflation surged, and the regulator lifted rates. Some analysts expect a 0.25% rate hike in May. In my view, we may see one more 0.50% rate hike. This factor is likely to drive the euro higher against the greenback in the coming months.

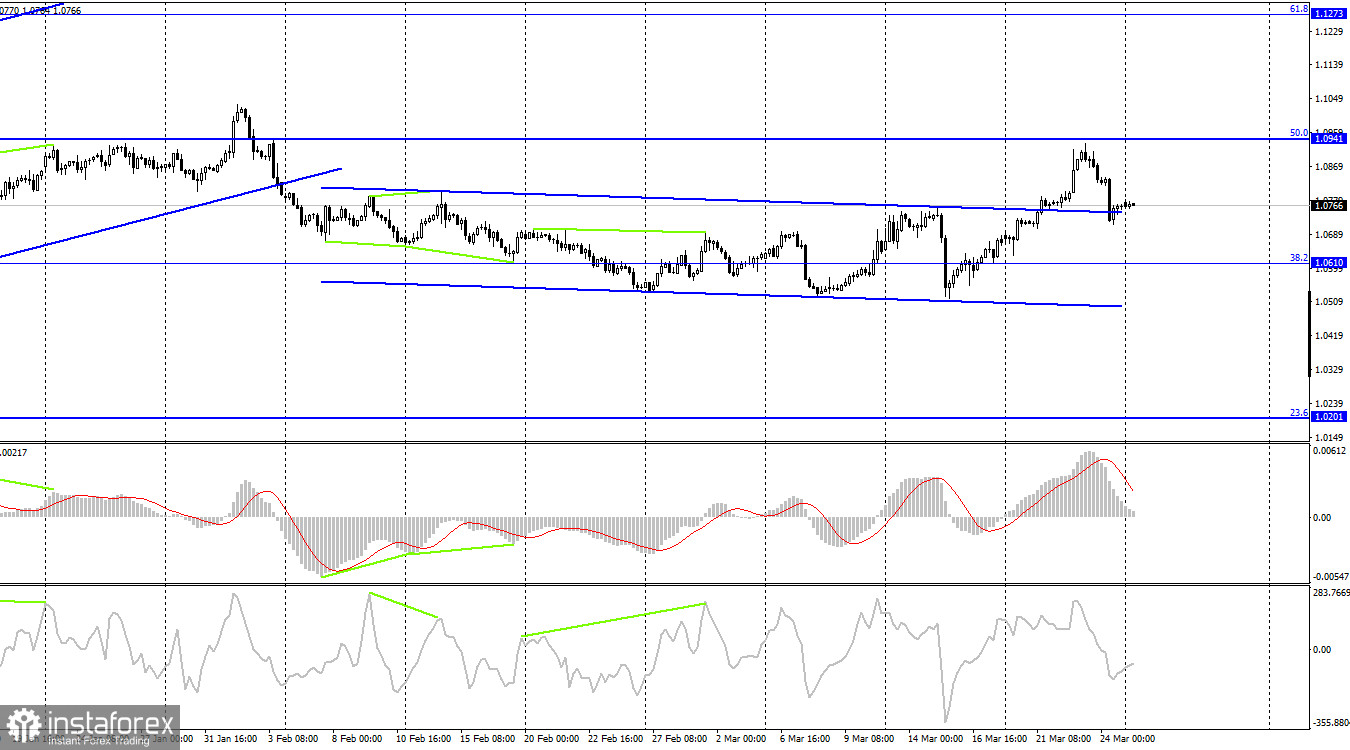

In the 4-hour chart, the pair closed above the sideways corridor, which means growth may extend. However, the pair failed to consolidate above the 50.0% retracement level of 1.0941, and no bounce also took place. Therefore, the price may go down to the 38.2% retracement level of 1.0610. Neither of the indicators shows divergence today.

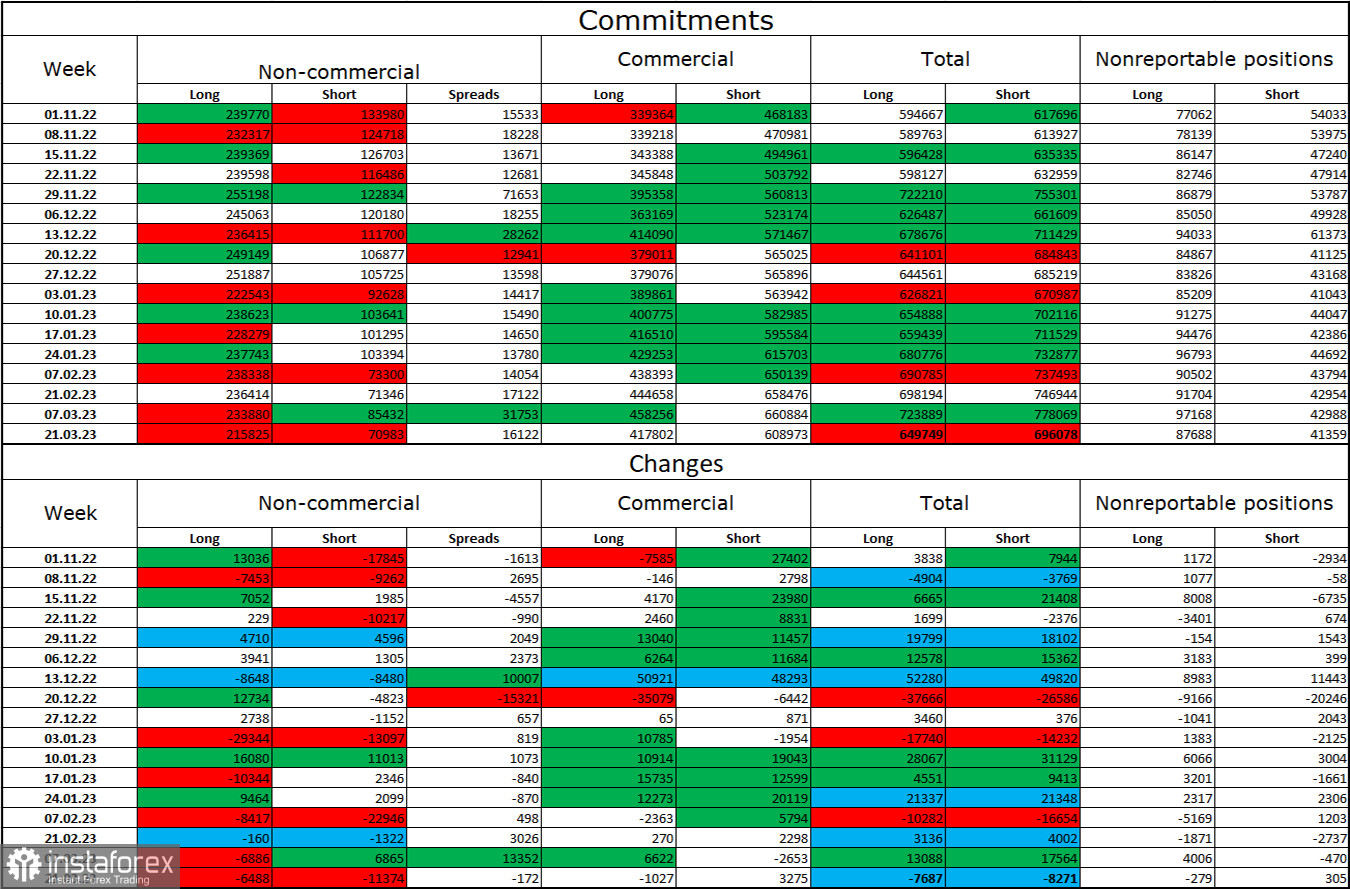

Commitments of Traders (COT):

Over the reporting week, speculators closed 6,488 longs and 11,374 shorts. Sentiment remains bullish and keeps getting stronger. Speculators currently hold 215K long positions and 71K short ones. The euro has been bullish for several weeks now, but buying volumes have not changed. The outlook for EUR/USD is going to be positive for as long as the ECB raises rates by 0.50%. However, sentiment may become bearish once ECB stops raising doing so.

Macroeconomic calendar:

On March 27, the macroeconomic calendar is empty. Fundamental factors will not have any influence on trader sentiment today.

Outlook for EUR/USD:

The trading plan was to sell after consolidation below 1.0861 on the 1-hour chart, with the target at 1.0750. Because the target was reached, we may now sell after the close below 1.0750, targeting 1.0609, and buy after a bounce off 1.0610, targeting 1.0750 and 1.0861, on the 1-hour chart.