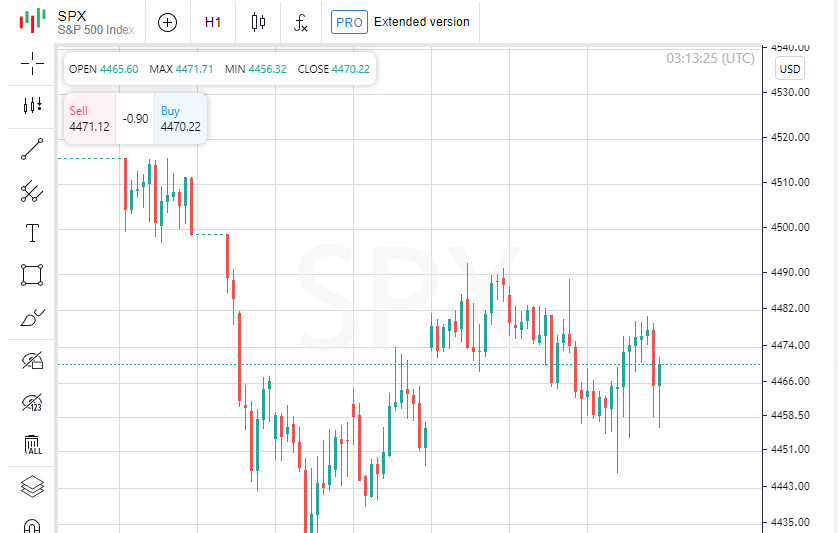

The S&P 500 showed modest growth, with market giants like Amazon and Microsoft driving the rise of the high-tech Nasdaq index. Meanwhile, the Dow Jones industrial average ended the trading session with a slight decrease.

Consumer price data for August revealed a rapid increase due to rising energy costs. However, the core measure, which excludes volatile food and energy prices, continued on a moderate path, aiming for the Fed's 2% annual inflation target.

Peter Tuz from Chase Investment Counsel emphasized that recent market trends could have sparked concerns among investors about inflation. However, the current report affirmed many expectations that the Fed will wait for more data before making rate decisions.

Tuz also noted the impact of rising fuel prices on the consumer market, suggesting that extra spending on gasoline reduces spending on other goods.

Analysts estimate a 97% chance that the Fed will not change rates at the next meeting, assuming the key rate will remain in the range of 5.25%-5.50%.

As for the indices, the Dow Jones fell by 0.2%, reaching 34,575.89, the S&P 500 increased by 0.13% to 4,467.49, and the Nasdaq grew by 0.29%, closing at 13,813.59.

European Shares Decline Awaiting European Central Bank Decision

Amid the release of the consumer price index report and a drop in the eurozone's industrial production, investors closely monitored the upcoming European Central Bank meeting. As a result, European stocks ended the trading day lower.

Pan-European STOXX 600 Index Falls, while MSCI Global Equity Index Barely Rises

The Pan-European STOXX 600 index decreased by 0.32%, while the global MSCI equity index edged up by 0.01%. Emerging market stocks lost 0.09%. In the Asia-Pacific region, the main MSCI index fell by 0.19%, with Japan's Nikkei also declining by 0.21%.

Following the release of the CPI report, which confirmed expectations of the Fed maintaining its rates, the yield on the 10-year U.S. Treasury bond fell to 4.2544%. Meanwhile, the yield on the 30-year bond stood at 4.3463%.

Inflation data didn't particularly impact the U.S. dollar, which stabilized in the global market. The dollar index showed a slight growth of 0.05%, while the euro lost 0.2%, standing at $1.0731. The Japanese yen weakened by 0.26% against the dollar, reaching 147.47 yen per dollar. At the same time, the British pound strengthened its position, increasing by 0.05% and trading at $1.249.

Oil and Gold Prices Drop amid Dollar Strengthening

Oil prices fell due to an unexpected increase in U.S. stockpiles, overshadowing expectations of limited global supply. WTI crude oil fell by 0.36%, reaching $88.52 per barrel. Meanwhile, Brent decreased by 0.2%, trading at $91.88 per barrel.

Following oil, gold also saw a drop in price. Spot gold fell by 0.3% and traded at $1908.39 per ounce, close to a two-week low. The CPI report contributed to a slight strengthening of the dollar, which likely affected gold dynamics.

Stock market volatility is decreasing: the CBOE Volatility Index fell by 5.27% to 13.48.

Regarding futures, December gold futures fell by 0.20% to $1,900 per troy ounce. WTI futures for October delivery decreased by 0.07% to $88.78 per barrel, while Brent oil futures for November delivery increased by 0.07%, reaching $92.12 per barrel.

In the currency market, the EUR/USD pair remained almost unchanged, dropping by 0.19% to 1.07, while USD/JPY increased by 0.24%, standing at 147.44.

The USD index futures strengthened its position, rising by 0.04% to reach 104.38.