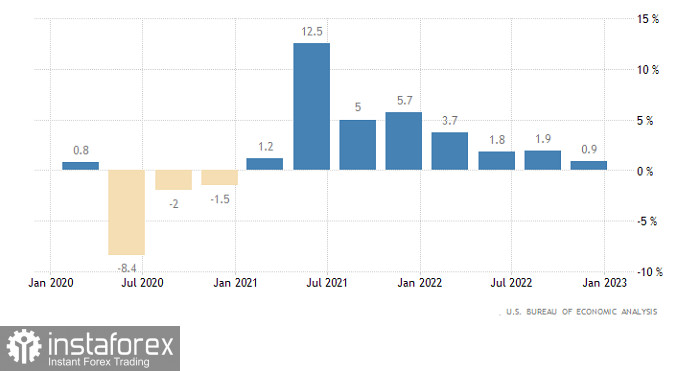

The macroeconomic calendar was completely empty yesterday, pretty much the same as today. Sure, jobless claims data in the US is scheduled, but the changes should not be large as both initial and repeated claims are expected to increase by only 3,000. The same applies to GDP data, which should confirm earlier estimations that economic growth had slowed down from 1.9% to 0.9%. This fact has long been taken into account by the market, thus, there may be consolidation ahead of tomorrow's inflation data from the eurozone.

GDP (United States):

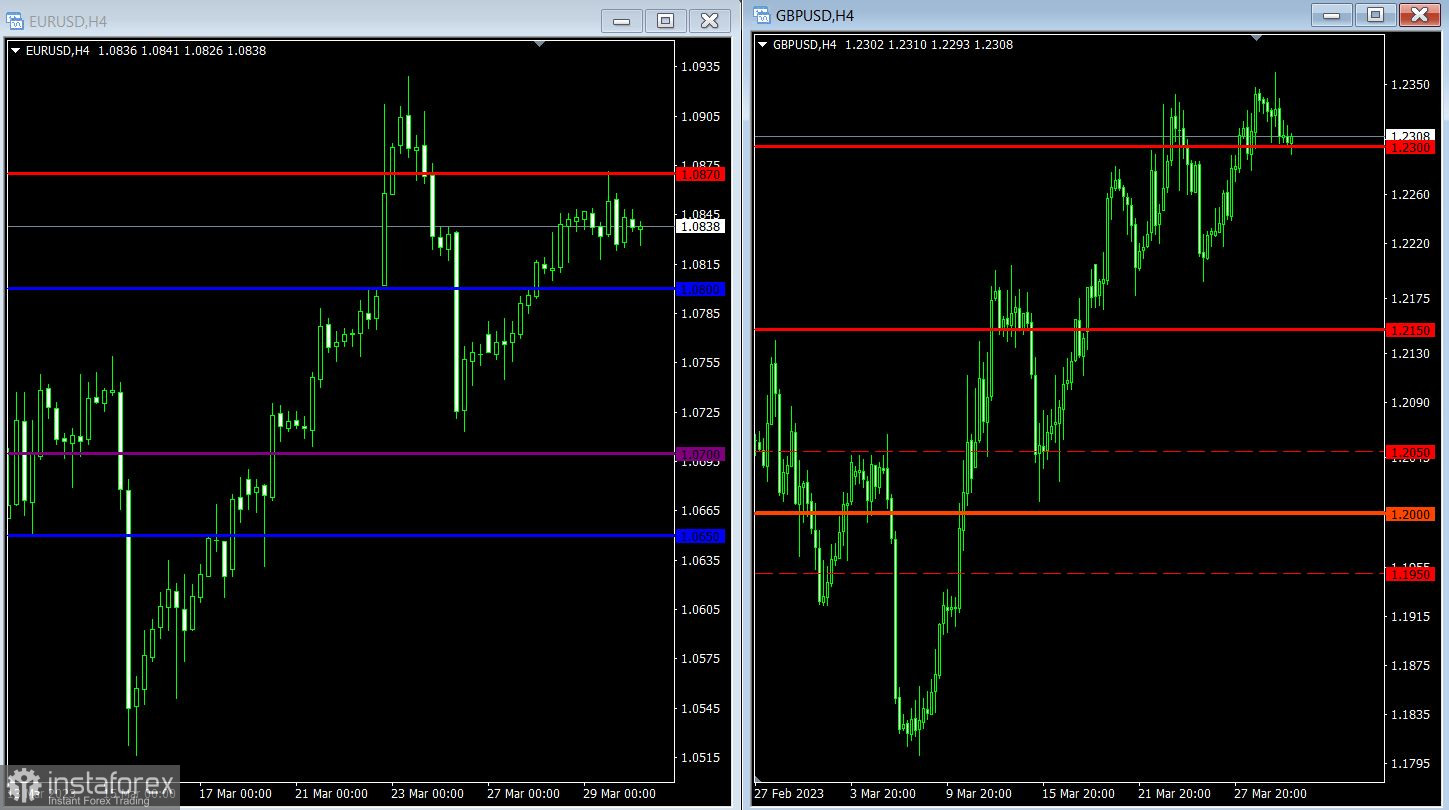

EUR/USD stopped moving after rallying for the past three days. The consolidation limits are 1.0820/1.0870. The current halt could be viewed as a sign of accumulation, which means that there could be a surge in volatility, especially when there is an exit beyond one or the other limits.

Although GBP/USD returned to 1.2300, the trend remains bullish. Thus, staying above 1.2350 will continue the upward spiral, in which the target level could be the high of the medium-term trend. In the case of a prolonged decline below 1.2300, the pair will see a complete correction.