Risk appetite is increasing as authorities are trying their best to cushion the crisis that is happening to the US banking system. This led to the decrease of dollar demand in the market.

Many seem to believe that another collapse should not be expected from the US banking system in the near future, and that the end of Q1 2023 will gives some optimism to investor sentiment. This is because fund managers usually take advantage of the situation, buying company shares which, in turn, leads to further growth.

There is also a chance that the rally will continue in April if the reading of the US GDP for 4Q is not worse than expected. Inflation data due out on Friday may also not show any increase.

The PCE index is forecast to show a slowdown in growth from 0.6% to 0.4% m/m and remain at 4.7% y/y. The overall value also assumes a deceleration from 0.6% to 0.5% m/m and a fall to 5.1% y/y. Reports on income and expenses are also scheduled, with the former falling to 0.2% and the latter slipping to 0.3%.

Of course, the upcoming inflation data may give a boost if it is not higher than the forecasts. It may also encourage the Fed to raise interest rates by 0.25%, instead of taking a pause in May.

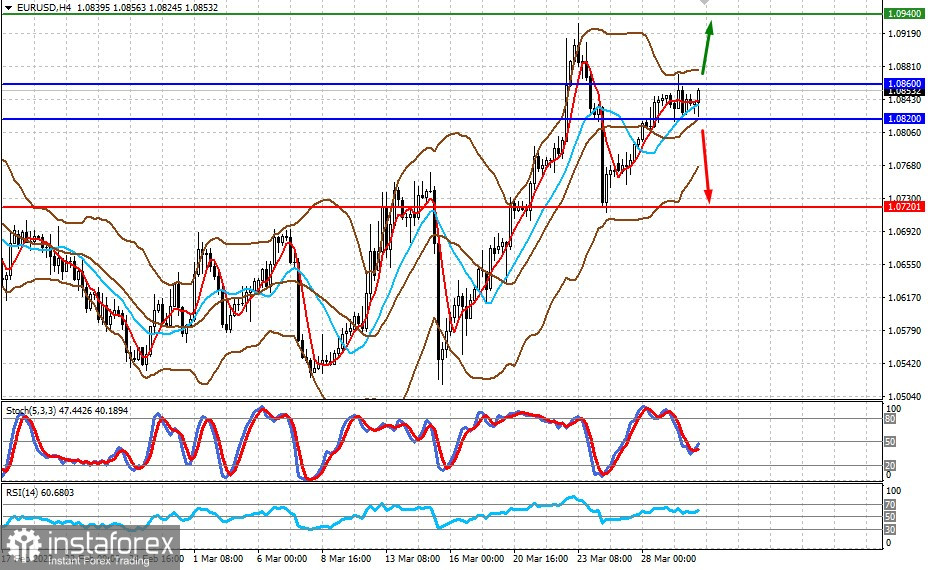

Forecasts for today:

EUR/USD

The pair is consolidating in a very narrow range, at 1.0820-1.0860, in anticipation of consumer inflation figures from Germany and the eurozone. If the former shows a marked slowdown, he price will decline to 1.0720. If it is higher, the pair will continue rising towards 1.0940, which will give the ECB a stronger opportunity to raise interest rates.

XAU/USD

Gold is trading below 1975.00. If inflation data from the US shows a slowdown in growth, the quote will continue rising towards 2015.00.