The local consolidation of the main cryptocurrency in the $26.6k–$29k range continues. Over the past day, Bitcoin made a bullish spurt and stabbed the $29.1k level. At the same time, the cryptocurrency failed to gain a foothold inside the resistance zone.

The coming days may become decisive for the further movement of the price. On the one hand, Bitcoin retested the upper border of the area, and failed to gain a foothold inside it, which indicates further movement of the asset to the lower border of the channel.

On the other hand, the events on Friday may have a favorable impact on the short-term fate of Bitcoin. In any case, there are enough fundamental factors in the market that can lead to the growth of cryptocurrency.

Banking Crisis = Crypto Rally?

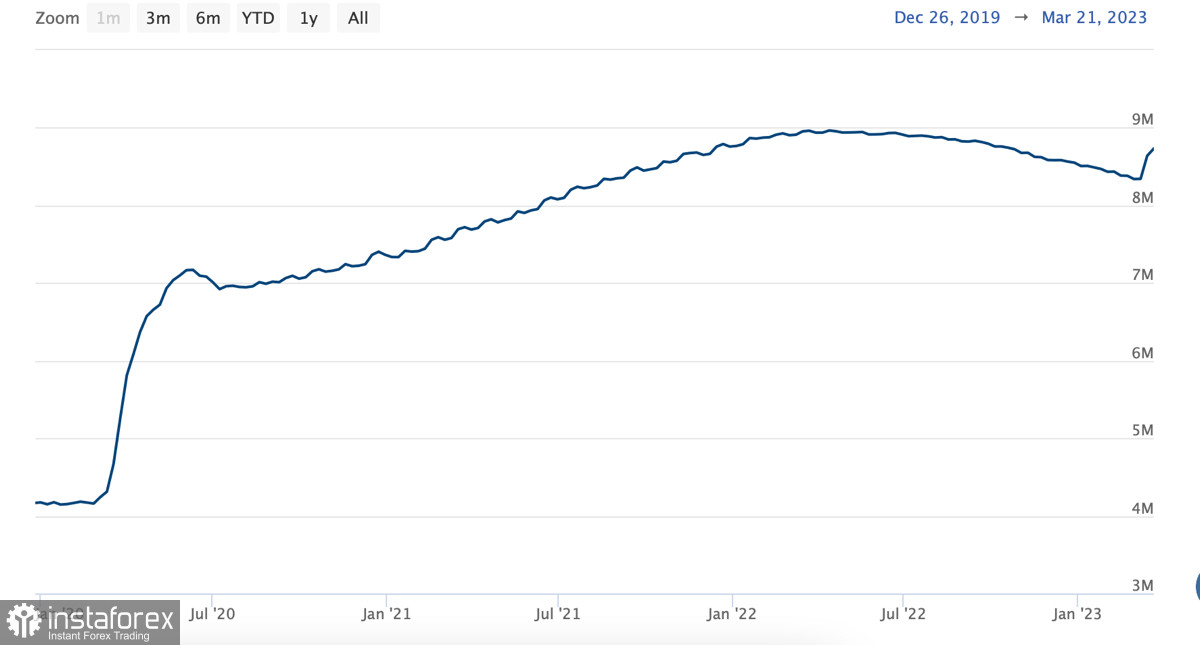

The Fed's balance sheets have grown by $400 billion over the past week and continue to grow as part of the emergency lending program. According to data from various sources, the regulator plans to inject $2 trillion into the economy.

The chief strategist at Bloomberg Intelligence believes the banking crisis will trigger a bullish rally in cryptocurrencies by over-saturating the economy with money. We are already seeing a massive outflow of funds from banks and a gradual rise in Bitcoin capitalization.

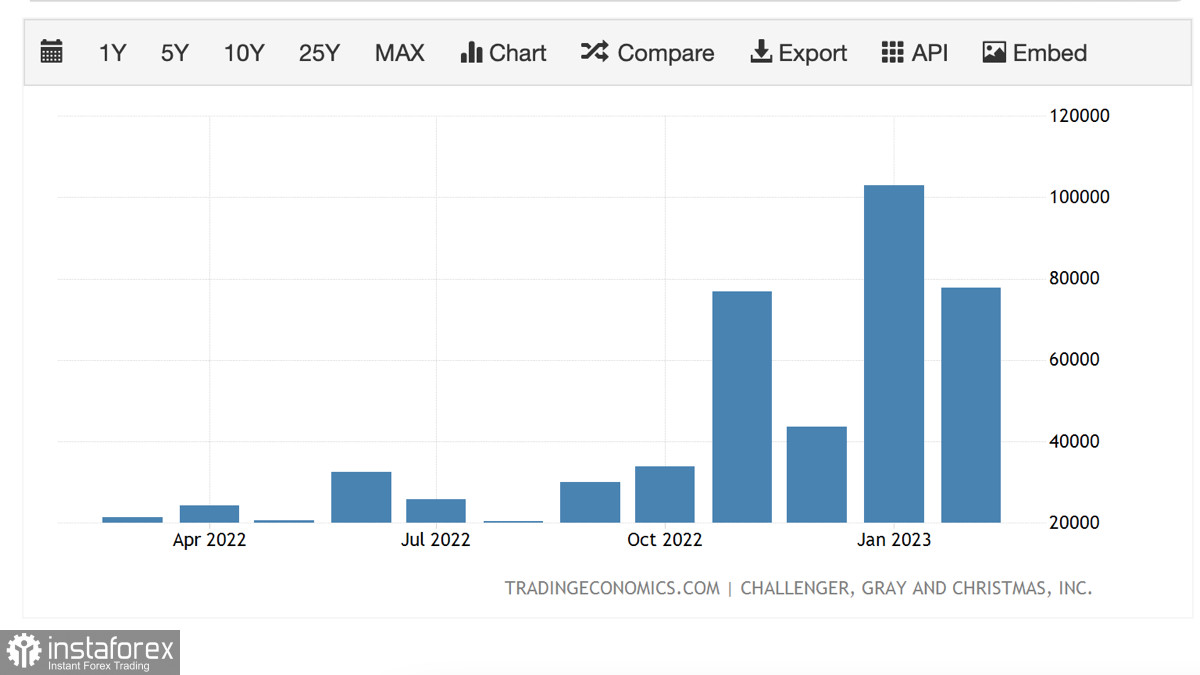

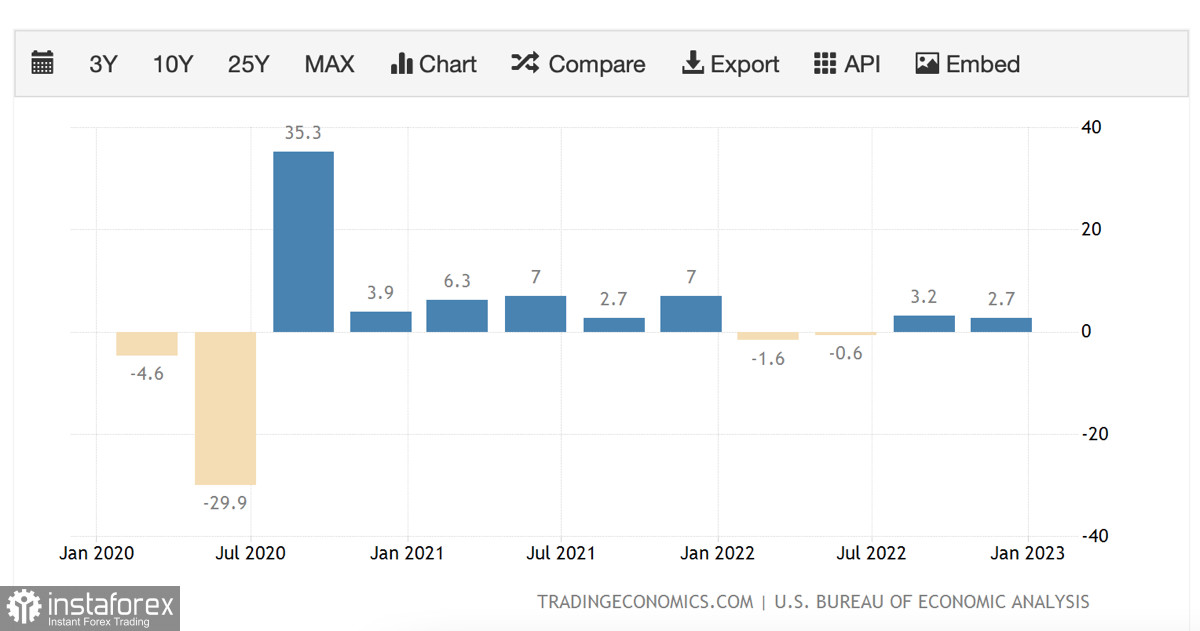

At the same time, the Fed is not going to end its quantitative easing program, nor is it abandoning further rate hikes, according to BlackRock. However, as of the end of March, for the first time since 2021, U.S. companies began to mention layoffs rather than shortages of employees more frequently.

This is an indirect signal of a cooling labor market, which has remained strong throughout the months of hawkish Fed policy. Tomorrow's events, namely the release of labor market and GDP reports, could significantly affect the regulator's decision to raise rates in the medium term.

Is Bitcoin preparing to sink to the bottom?

After a brief consolidation triggered by Bitcoin's rebound from the bottom, the cryptocurrency resumed its upward movement and reached the upper boundary of the $26.6k–$29.1k channel. The asset failed to make a bullish breakout of this boundary, and it is very likely that BTC will go for a retest of the lower boundary of the range.

Note that over the past few weeks, a trend has formed in which the downward movement of the BTC price is enhanced by rising volumes. It is likely that we will see a similar trend when the price of the cryptocurrency moves to the lower boundary of the range.

That said, tomorrow's U.S. labor market and GDP statistics will be decisive in determining the future dynamics of Bitcoin's price movement. As of March 30, the cryptocurrency is showing more downside signals next week.

On the daily chart, we see a weakening of the bullish trend, which allowed BTC to touch the $29.1k level. Stochastic and the RSI index acquired a flat direction after a local upward momentum. The MACD indicator completes the formation of a bearish intersection, which indicates a growing bearish sentiment.

Results

Tomorrow's macroeconomic statistics will set the final point in the short-term prospects of Bitcoin. Bearish and profit-taking sentiments begin to prevail in the BTC market. The $29.1k–$31.5k resistance zone remains unassailable with current bullish volumes.