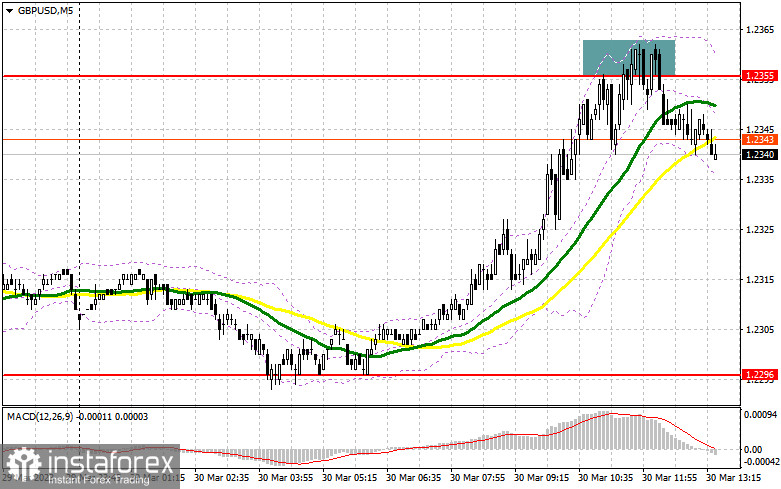

I focused on the level of 1.2355 when I made my morning forecast and suggested trading decisions based on it. Let's take a look at the 5-minute chart to see what happened. Growth and the formation of a false collapse there closer to the middle of the day provided an excellent entry point into short positions, but it never reached a significant sell-off. The decline amounted to about 15 points before coming to a complete stop. Both the technical picture and the plan itself were left unchanged for the second half of the day.

You require the following to open long positions on the GBP/USD:

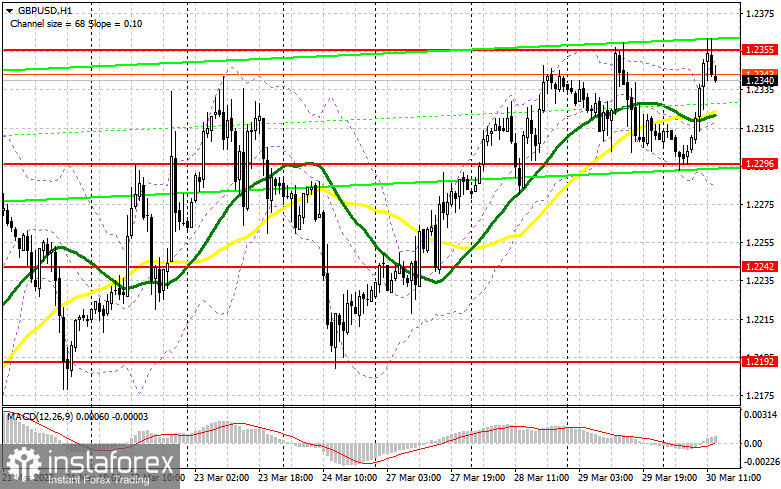

Even at the end of this month, buyers of the pound do not give up hope for the upward trend to continue, but they lack an essential factor in the form of reliable data or speeches by British lawmakers on the subject of interest rates. I suggest you pay close attention to the reports on the number of initial unemployment benefit applications in the United States and the change in GDP for the final quarter of last year in the afternoon. These indicators are unlikely to surprise us, so the focus will shift to Finance Minister Janet Yellen's comments, which may touch on the banking problem, suggesting new methods to solve it, further weakening the dollar's position. Naturally, I would like to get a market entry position near 1.2296 if the pair declines in the afternoon. A breakout and a test from top to bottom of this range will form an additional buy signal, which will return the bullish trend and push GBP/USD to 1.2395. If false breakout forms at this level, just above the moving averages playing on the side of the bull's pass, the pair will return to 1.2355. We can discuss growth to 1.2443, where I will set profits, in the event of a retreat above this range, against the backdrop of very weak fundamental data on the American labor market. The area of 1.2505, which is unlikely to be updated today, will be the target at a distance. The pound could return to being under the control of sellers if GBP/USD declines and there are no buyers at 1.2296, which is also not ruled out. If this occurs, I advise delaying long options until 1.2242. I suggest only making purchases based on a false breakout. To correct 30-35 points within a day, it is possible to initiate long positions on the GBP/USD immediately for a rebound from 1.2192.

For opening short positions on the GBP/USD, you will need:

Sellers did everything possible the day before, but it did not work out to achieve an excellent downward correction. We must now consider how to better protect the monthly maximum because, if we fail to do so, we risk losing the chance to trade the pair in the side channel. The Federal Reserve System representative Neil Kashkari's hawkish remarks will aid the bears in creating a false breakout in the area of 1.2355, as I described above, which will trigger a sell signal and cause a decline to 1.2296. After yesterday's growth, a breakout and a reverse test from the bottom up of this range will provide an appropriate level at which to begin selling with an update to the minimum of 1.2242. The area around 1.2192, which serves as the bottom boundary of the side channel, will serve as a further target. The pound will come under pressure again if this level is updated, and a new bearish trend may develop as a result. The bull market will reappear with the possibility of GBP/USD growth and the absence of bears at 1.2355 in the afternoon, which is more probable. This will cause a move of GBP/USD to the area of a new maximum of 1.2395. An entry point into short positions based on the decline of the pound is created by a false breakout at this level. If there is no action there, I recommend selling GBP/USD from 1.2443, expecting the pair to rebound by 30-35 points within the day.

Signals from indicators

Moving Averages

Trading is taking place above the 30 and 50-day moving averages, which suggests that the pound will continue to rise.

Notably, the author considers the time and prices of moving averages on the hourly chart H1 and departs from the standard definition of the traditional daily moving averages on the daily chart D1.

Bands by Bollinger

The indicator's lower limit, which is located around 1.2290, will serve as support in the event of a decline.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

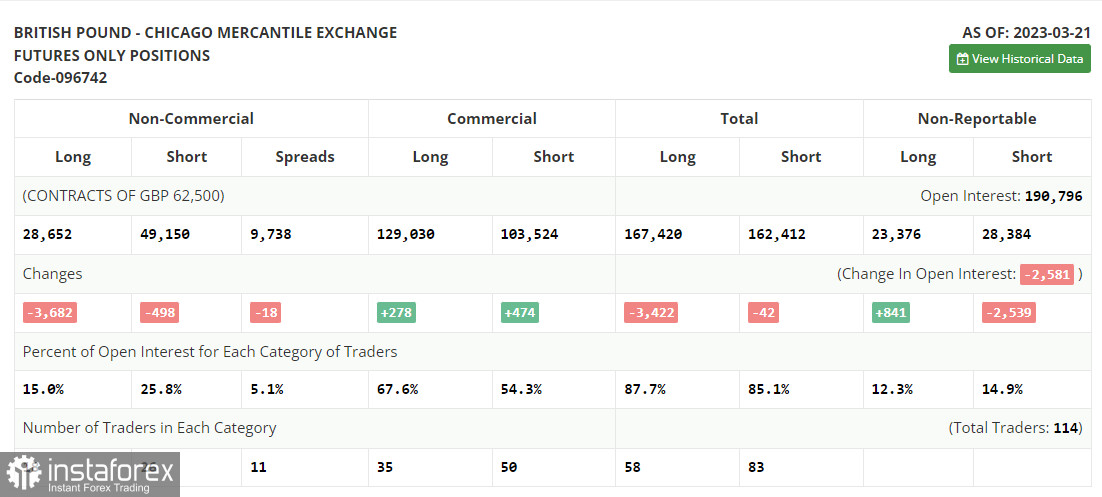

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.