As I have had the opportunity to state more than once, a lot now depends on inflation and the monetary policy of central banks for both pairs. These are the indicators that market participants are observing. The European Central Bank (ECB) released an economic report today with a variety of data on important subjects. It predicted that the rate of inflation would remain unacceptably high for a long time. In 2025, the regulator projects that the consumer price index will have averaged 2.1%, 2.9%, and 5.3% in the previous three years. As a result, it will be at least three years before inflation reaches its desired amount. Let me tell you that the ECB and other central banks were actively promoting inflation for many years following the 2008 crisis. They failed to meet their target of 2% for ten years. Although it's difficult to comprehend now, that is not the sacramental significance. What is the likelihood that the ECB will handle inflation of about 10% in 3–4 years if it can't spread inflation from 0% or even from 1% to 2% within 10 years? In my opinion, one of the potential outcomes should be considered along with the ECB's forecasts.

I also want to point out that other institutions besides the Central Bank have the power to affect the economy's various sectors and metrics. According to the same ECB report, wage pressure has increased as a result of a strong labor market and workers' wishes to recover some of the wages lost due to inflation. In other words, as European employees became aware of the decline in their wages, they started to put in a little bit more effort to make up for their losses. Let me remind you that, according to the guiding principle "less money, less spending, less demand, less price growth," central banks view low wage growth as one of the methods for lowering inflation. From the perspective of the global economy, this might be a very clever strategy, but from the perspective of regular employees, it is not a useful way to accomplish the task.

The report also stated that although market tensions are still elevated and may result in tighter credit conditions and a decline in confidence, risks to the economy's prospects are gradually declining. Because of the decline in energy costs and the strong economic stability, GDP projections for 2023 have been updated. With the help of all this data, I can only come to one conclusion: the ECB won't increase interest rates significantly. They predict that it will take about three years for inflation to reach 2%, which indicates that the rate will cease increasing soon. So, three more raises of 25 basis points, plus or minus one increase, are what we can anticipate. Since this is a little higher than the Fed rate, the euro should not experience significant market support.

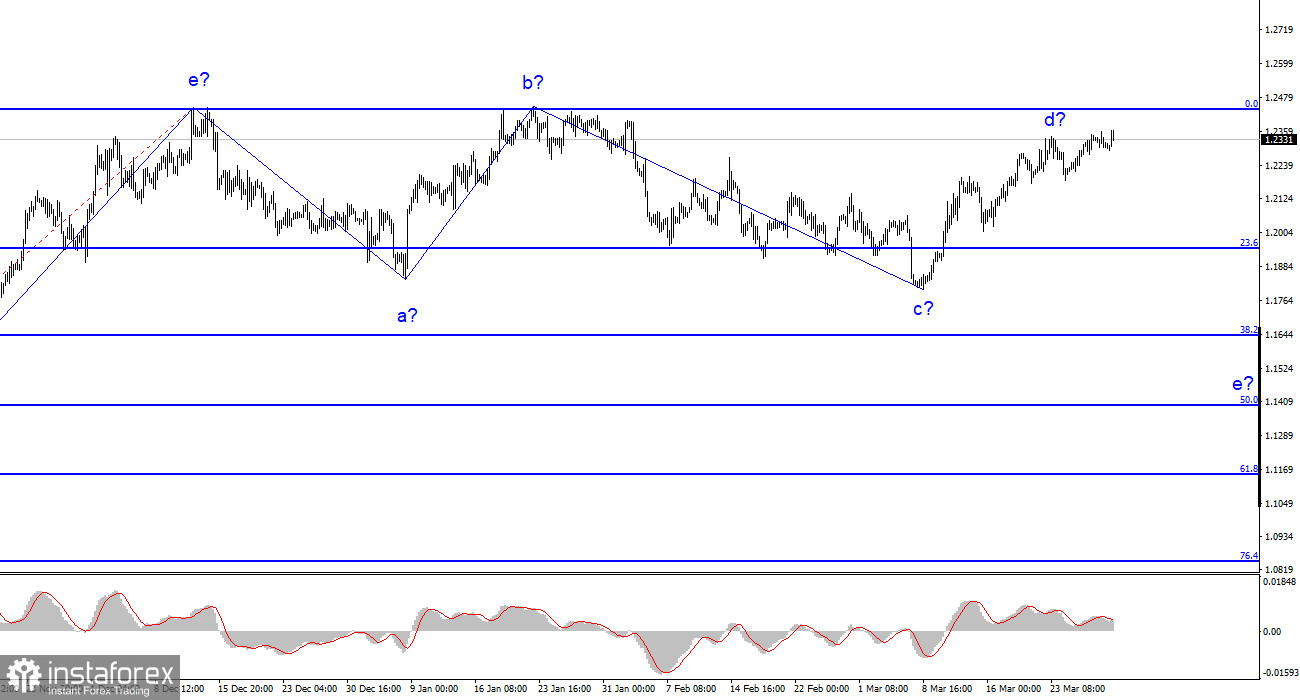

I draw the conclusion that the downward trend section's development is finished based on the analysis. However, the wave analysis for the euro is confused right now, making it challenging to determine where the pair is in the trend. Even after one wave up, which may be a complicated wave b, a new three-wave pattern of waves down can start to form. Therefore, based on the MACD reversals "up," I suggest cautious purchases with targets close to the 10th figure.

The wave pattern of the pound/dollar pair presumably represents the end of a segment of a downward trend (due solely to the correlation of the euro and the pound). According to the "up" reversals of the MACD indicator, it is possible to take into account purchases with targets higher than the 25-figure range at this moment. The possibility of developing a downward wave e, the targets of which are situated 500–600 points below the current price, is something I do not entirely rule out, though.