Investors switched from policy expectations from the Federal Reserve to the European Central Bank. Yesterday's German inflation report gave them reason to believe that the ECB will continue to tighten. Germany's overall CPI fell in March, and badly, to 7.4% y/y from the previous 8.7% y/y. It turns out that it was just a little bit higher than the forecasted 7.3% y/y. Such an approach could backfire on investors when the US inflation report turns out to be weaker than expected. However, the US data is still a long way off - it will be out on April 12. U.S. personal income and consumer spending for February will be released today - the forecast is good: income 0.2% m/m, spending 0.3%.

On the daily chart, the price exceeded the upper limit of the descending green channel, it is being removed. Now, to continue rising to the target level of 1.0990, the price should overcome the March 23 high of 1.0930. The Marlin oscillator still has room for growth.

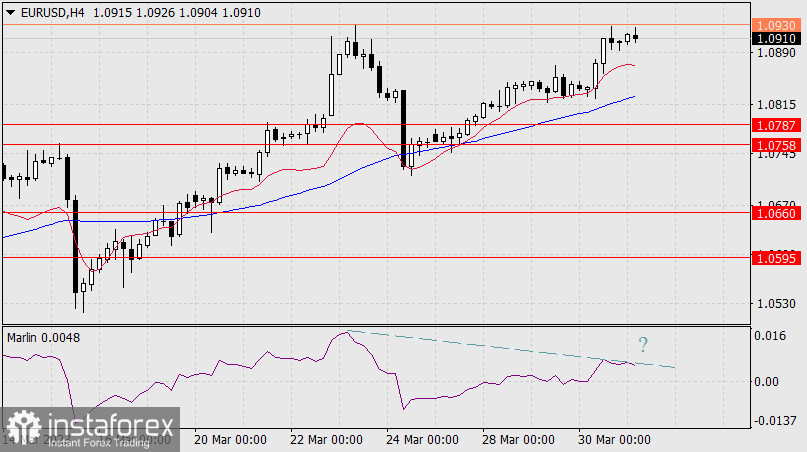

On the four-hour chart, the bears may form a divergence (weak) with the Marlin oscillator. If it does, its potential is just enough to try to overcome the support of the MACD line at the 4H and daily charts (1.0835 and 1.0865 respectively). However, the attempt will probably fail, since the market needs certain forces to return the euro to the range of 1.0758/87, and so far there are none of those.