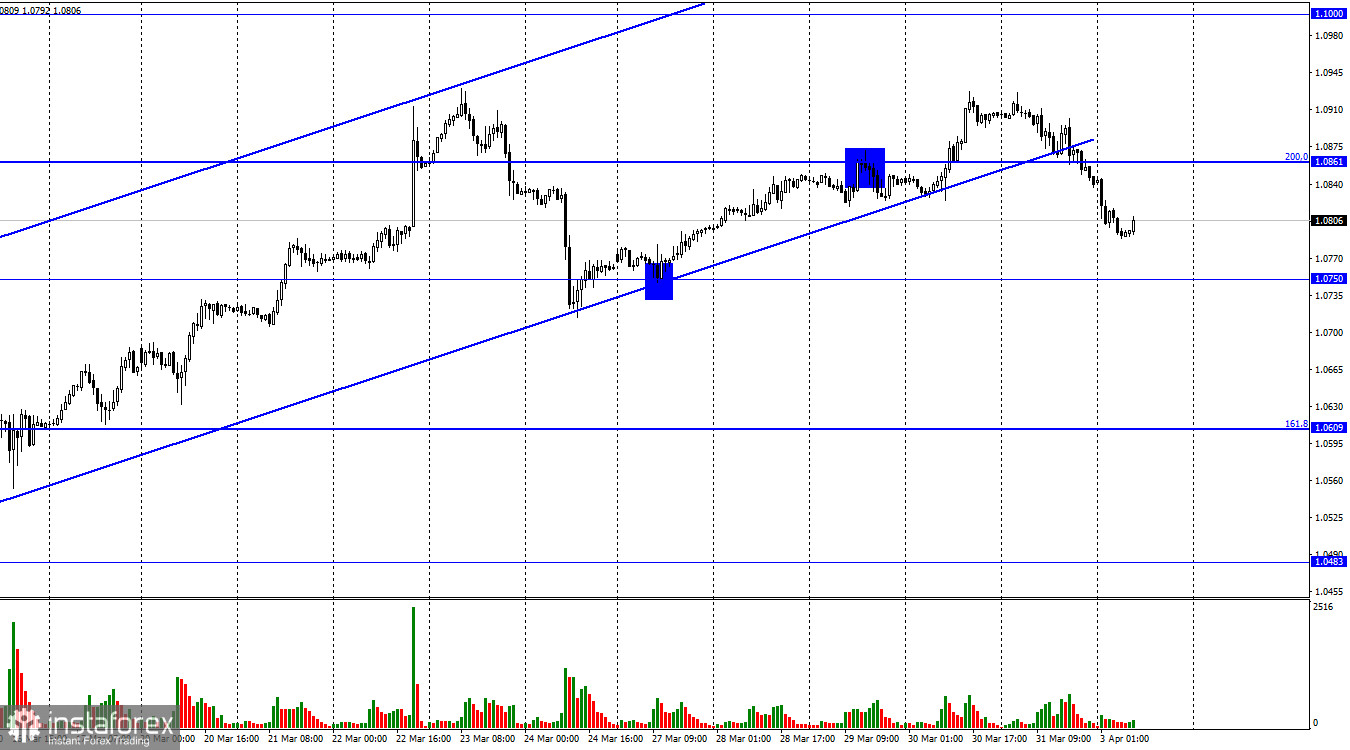

The EUR/USD pair reversed once more in favor of the US dollar on Friday and then held steady under the upward trend corridor and the corrective level of 1.0861. As a result, quotes can now continue to drop in the direction of the 1.0750 level, and traders' attitudes have switched to "bearish." I support the option of further decline, but I draw attention to the fact that the bulls have lately dominated the market. Since the value of the euro increased significantly, there were very particular causes for this. And nothing changed dramatically last week that would suggest a sharp retreat of bulls from the market. The pair's rate could resume growing if it is fixed above the level of 1.0861.

The most significant report of the previous week (on European inflation) was published on Friday. Let me tell you that the same report (which demonstrated a sharp decline in the consumer price index) was published in Germany on Thursday. The following day, it became clear that March's rate of inflation in the European Union was even lower. Moreover, if there hadn't been a "but," traders could have begun offering the euro in large quantities. The baseline indicator is now 5.7%, having increased once more. The primary inflation rate may soon surpass core inflation in importance. Core inflation is expected to keep increasing and won't surge until the summer, according to analysts. Therefore, there will be ongoing pressure on the European Central Bank to increase interest rates. The most important indicator for the ECB is core inflation, which is simply not going down. The results are as follows: both declining and rising inflation. Since it is hard to ignore the decline in the primary indicator, it is very challenging for traders to predict how the ECB will respond at this point. The scenario is still quite confusing.

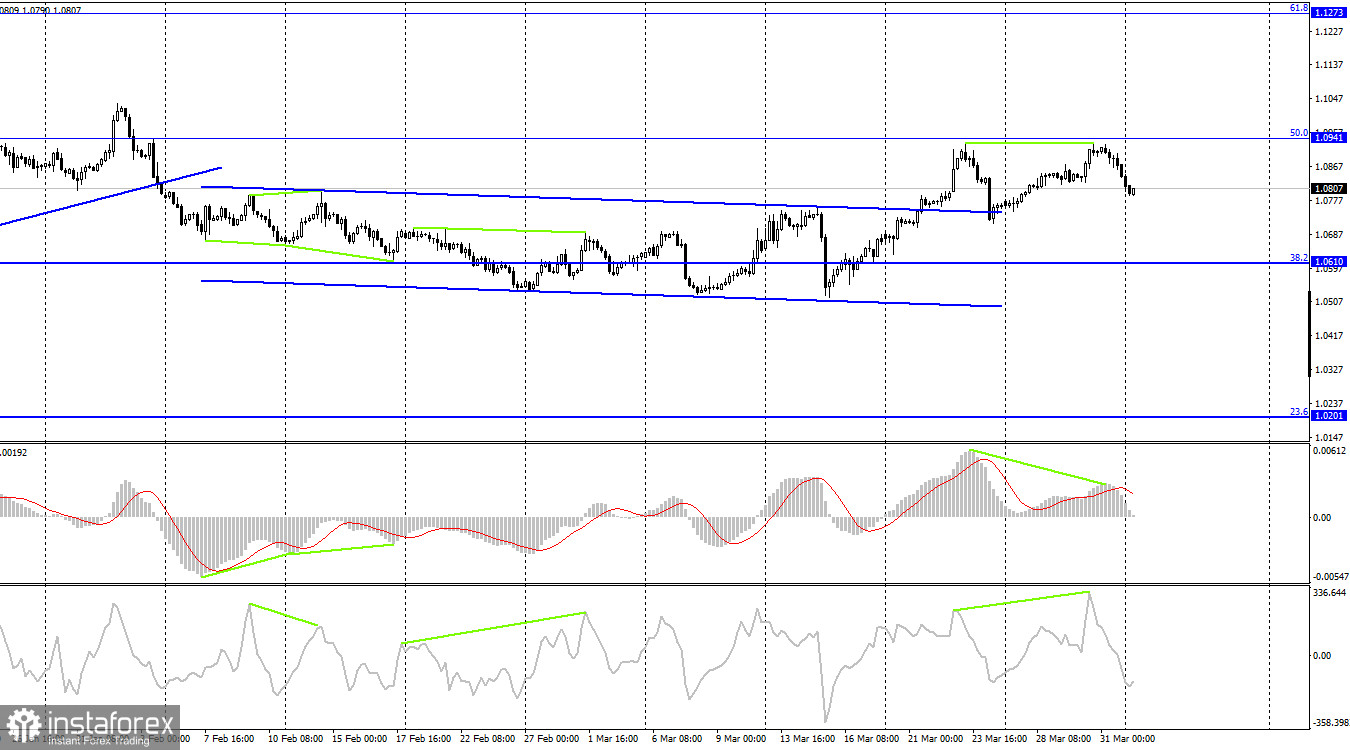

The 4-hour chart shows that the pair has stabilized above the side corridor, allowing us to predict further growth. However, consolidation was not possible above the corrective level of 50.0% (1.0941), and two "bearish" divergences simultaneously formed at this point. As a result, the pair's decline is "emerging" and has already started on both charts. There is a greater possibility of continued growth in the direction of the corrective level of 61.8% (1.1273) if quotes close above the level of 1.0941.

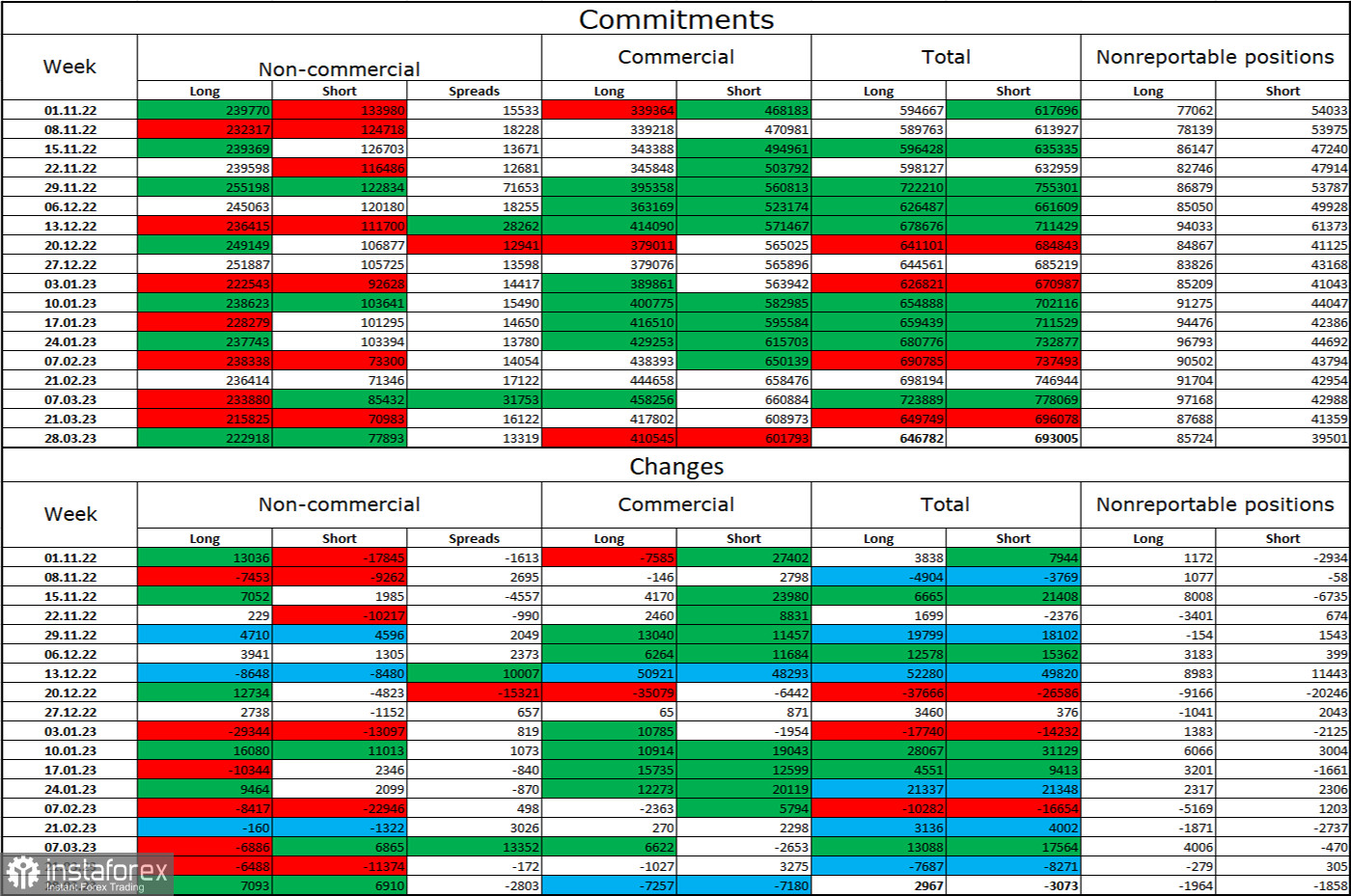

Report on Commitments of Traders (COT):

Speculators initiated 7,093 long contracts and 6,910 short contracts during the most recent reporting week. Major traders' overall attitude is still "bullish" and getting better. Currently, 223 thousand long contracts and 78 thousand short contracts are all centralized in the hands of traders. Although the value of the euro has been rising for more than six months, professional traders haven't increased their use of long contracts in recent weeks. After a protracted "black period," the situation is still in favor of the euro, and its prospects are strong. Until the ECB gradually raises the interest rate by increments of 0.50%, at least. I would like to point out that the market could become "bearish" in the near future since the ECB won't be able to keep raising interest rates by half a percent. On both charts, sell signs are present.

Calendar of events for the United States and the European Union:

EU – index of business activity in the manufacturing sector (PMI) (08:00 UTC).

US – index of business activity in the manufacturing sector (PMI) from ISM (14:00 UTC).

The economic event calendars for the USA and the European Union both have one intriguing item for April 3. The information backdrop may not have much of an impact on the traders' attitudes today.

Forecast for EUR/USD and trading advice:

On the hourly chart, the pair's sales could be initiated when closing under the corridor with a target of 1.0750. These deals can now be maintained. On the hourly chart, the pair may be bought if it rebounds from the 1.0750 level with a target price of 1.0861.