The US stock market surged significantly in March, kickstarting the second quarter of 2023. Today's reports on oil production cuts by OPEC+ have boosted the price of crude, leading to renewed fears of an inflation upsurge. This indicates that the Fed would have to avoid dovish rhetoric, as the fight against inflation is far from over. US Treasuries have changed their yield curve, with the yield on the 2-year note, which is vulnerable to Fed policy, jumping by 7 basis points.

Overall, the sentiment in the stock market outside the energy sector remains muted. In Europe, the Stoxx 600 index was virtually unchanged as 14 of its 20 indexes suffered losses. S&P 500 futures went down by 0.1% and Nasdaq 100 futures fell by 0.7%. The S&P 500 index jumped by 3.5% last week in the best performance since November, while the high-tech Nasdaq index recorded its biggest quarterly gain since June 2020.

Crude oil futures rose by 6%, the biggest upward move in almost a year. The OPEC+ has announced it would cut production by more than 1 million barrels per day. Energy stocks rose in Europe as a result, along with energy stocks in the US pre-market.

The Federal Reserve's recent plans to pause interest rate hikes this year are now once again in serious question. Money markets have already raised the probability of a quarter point interest rate hike in May to 65% from the 55% seen last week.

As noted above, the impact of high oil prices is certain to have an impact on inflation, pushing it up around the world. This means that it might take more time and effort for central banks to regain their target levels. It also means that when interest rates peak, they will stay higher for longer than previously expected. At this point, there should be much less speculation about the Fed lowering rates in December.

The earnings season is coming up, and I'm sure the market may enter a short-term recession very soon until investors are finally convinced that things have not changed much in Q1 compared to Q4 2022.

Gold has barely moved, while the Swiss franc has weakened against the US dollar. Bitcoin has already recouped all of its losses and is holding steady at $28,000.

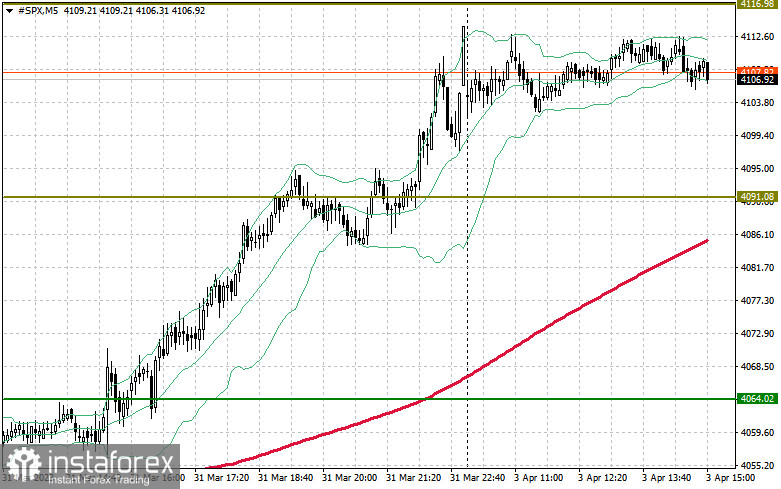

On the technical side, demand for risky assets persists. The S&P 500 index can increase only if the bulls manage to push the index above $4,116, opening the way to $4,150. Another key goal for bulls is holding on to $4,184, which will make the new bull market stronger. If the index slides down amid low demand and the lack of positive factors, bulls will have to keep the index above $4,090. Otherwise, it would quickly drop to $4,060, opening the way towards $4,038.