Monday was a hard day. The third Monday in March started with turmoil. First the SVB bankruptcy, then the forced takeover by Credit Suisse and finally the OPEC+ decision to cut oil production by 1 million bpd. A surprise that came out of nowhere and added uncertainties to the inflation equation. Instead of slowing under the influence of the banking crisis, consumer prices risked drawing a new peak. EURUSD initially reacted with a drop, but the bulls quickly regained the initiative.

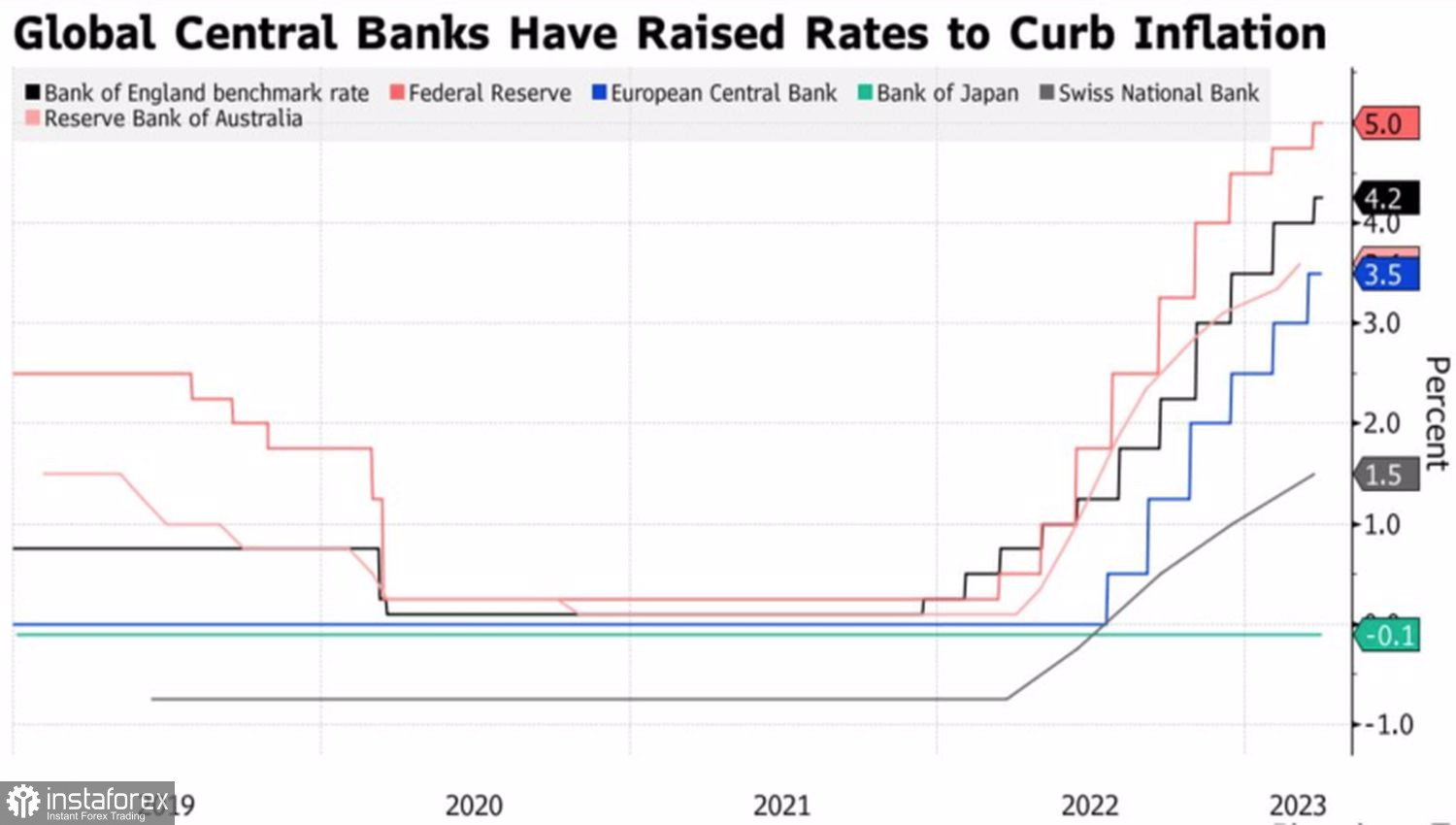

As soon as central banks assessed the effect of credit institutions' bankruptcies on the economy and how they could slow inflation, everything was turned upside down. Derivatives raised the implied borrowing cost ceilings around the world, including Frankfurt and Washington, and the likelihood of a 25 bps hike in the federal funds rate at the May FOMC meeting jumped above 50%. A week ago it was less than 20%.

Central bank rate trends

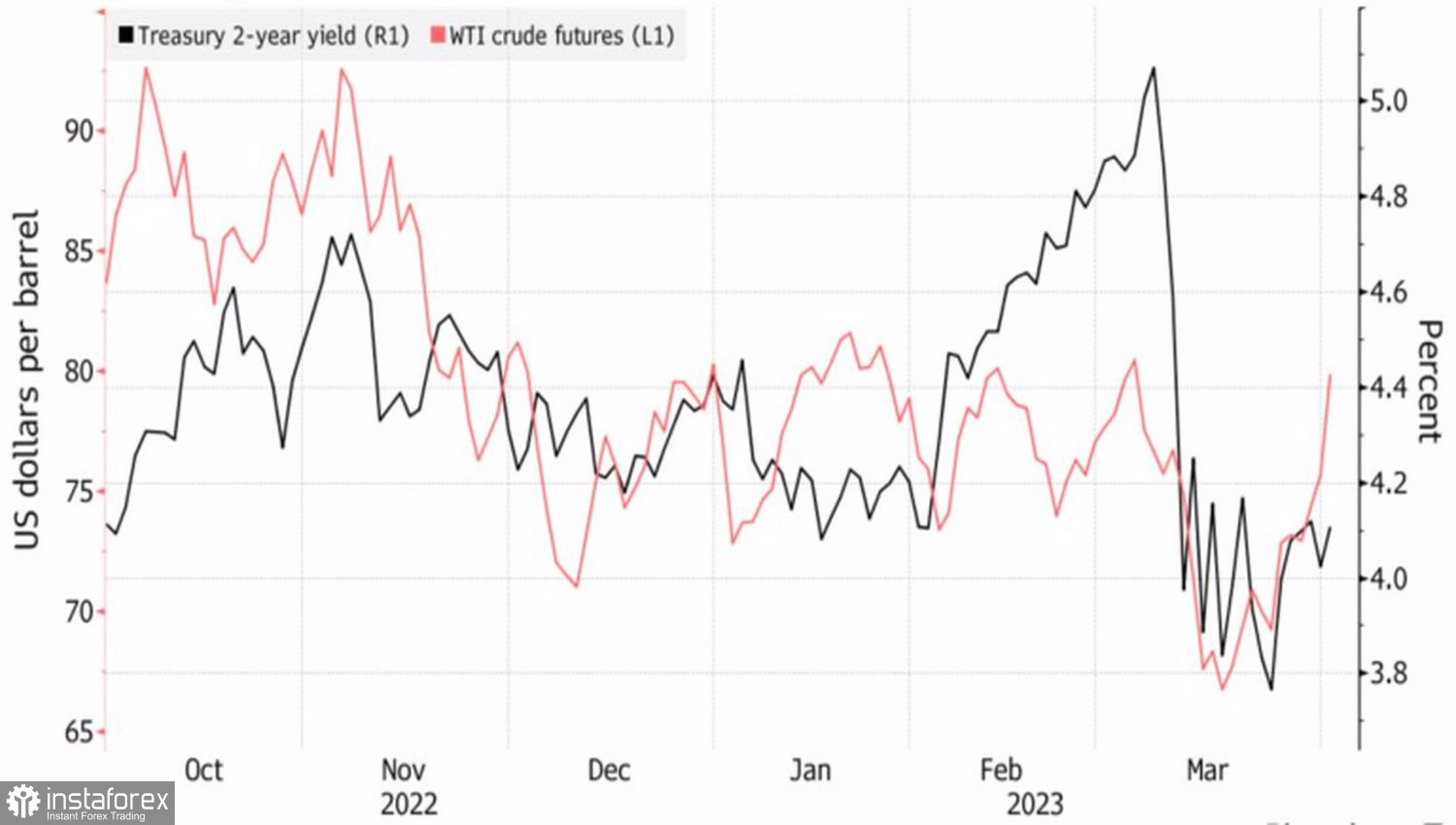

According to one of the Federal Reserve's top hawks, James Bullard, it is still unclear what effect rising oil prices will have on monetary policy, but the OPEC+ decision is unexpected. The president of the St. Louis Fed believes that rising oil prices could accelerate CPI and complicate the central bank's job.

Markets see this as an increase in perceived borrowing cost ceilings. Thus, for the Bank of England repo rate, the peak rose to 4.69%, for the European Central Bank deposit rate to 3.63%. Simultaneously, the odds of a recession in the U.S. economy over the next 12 months rose from 55% to 60%. Credit Agricole's analysis of the six previous recessions since 1980 shows that the dollar typically strengthens at the start of a recession against risky currencies and then falls over the next 6 months. The main beneficiaries were the yen, the franc, and the euro. How will it be this time?

Either way, the recession has yet to come to fruition. Will the OPEC+ decision be a harbinger of its beginning? Judging by rising U.S. Treasury bond yields, yes.

Oil prices and U.S. bond yields

However, in fact, it may turn out to be just an ordinary shock. Which are very quick to pass. This was the case with the bankruptcy of SVB, the sale of Credit Suisse. Will this happen to oil? And how quickly? Judging by the quick bounce of the EURUSD, it has already happened.

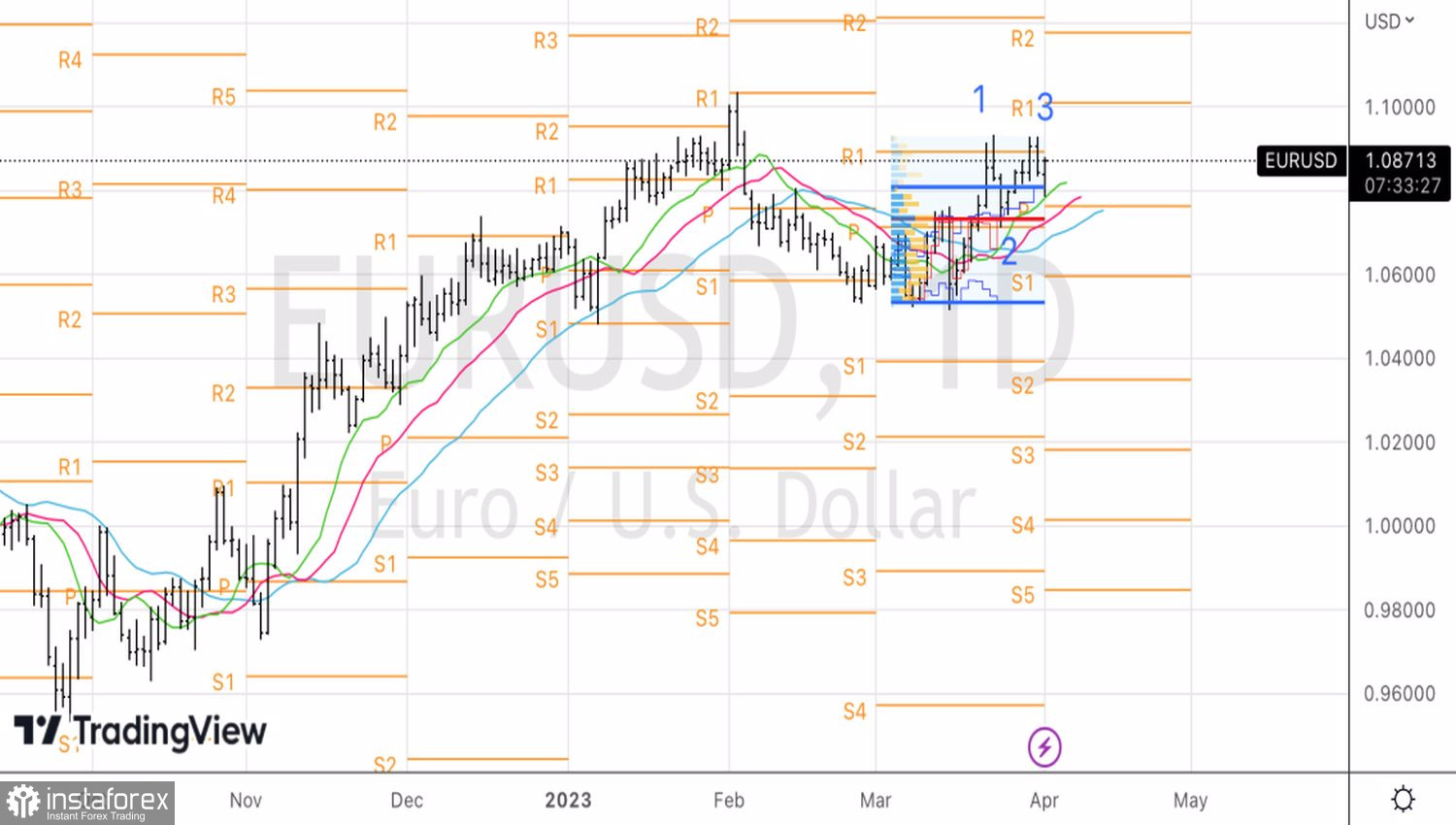

Traders rushed to seize the opportunity to buy the euro cheaper. The prospects for the single currency remain bullish. The trump cards of EURUSD are the hawkish ECB, the improvement of the eurozone economy's outlook amid falling energy prices and the proximity of the end of the Fed monetary tightening cycle.

Technically, the bears' incapacity to conduct a successful counterattack and implement a 1-2-3 pattern is a sign of their weakness. Let's use a break through resistance at 1.09 and an update of the local peak at 1.0925 as a reason to buy.