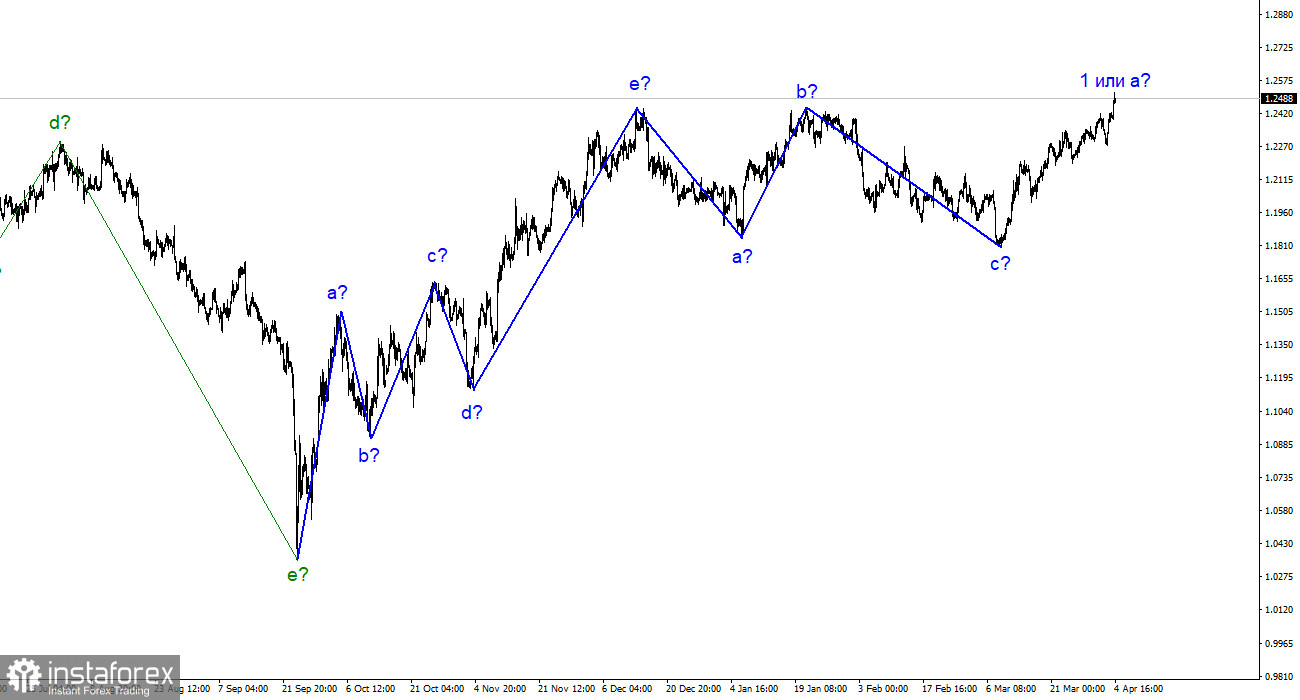

The wave analysis for the pound/dollar pair appears challenging and has undergone minor adjustments. As the current upward wave's peak has surpassed the previous downward wave b, the entire segment of the downward trend consisting of waves a-b-c can be deemed complete. Although there is a modest resemblance to the trend area for the same period in the performance of the euro currency, it should be noted that both pairs have developed three-wave downward wave sets. If this assumption is accurate, a new upward trend for the pound has begun. So, beginning on March 8, I can only identify one wave, and there's every reason to believe that the British pound's rise will be long and strong. It is pretty difficult to predict how the euro will perform simultaneously. I continue to believe that both pairs should generate identical wave patterns. However, there have recently been issues with this. According to the pound, wave b might begin soon, following which the growth in quotes should resume with targets situated up to thirty figures. Unless wave c turns out to be identical to a series of lowering waves. The current news context is confusing, and I would not bet solely on the strong growth of the British economy.

On Tuesday, the pound and dollar exchange rate increased by another 90 basis points. There was no background news anywhere during the day. But, this did not cause the market to wait patiently and silently for its chance. The British pound increased by 180 points in the first two days of the week. And it's hard to say what caused such a big change since yesterday's wave analysis didn't show such a rise. Thus, we can say that the market is concerned about the American economy and does not anticipate a significant interest rate increase from the Fed. This is what Commerzbank economists believe. Yet, this is only the perspective of a few people from hundreds or even thousands of people worldwide. And the British pound has a reasonable reason for declining.

Today, a member of the Bank of England's PEPP Committee, Silvana Tenreyro, delivered a speech. She says that the regulator may decide to cut the interest rate much sooner than is thought now to prevent a huge drop in inflation. According to the phrase, "to avoid a major reduction in inflation," caution is required. The United Kingdom is virtually the only developed nation with inflation exceeding 10%. Despite eleven increases in interest rates, inflation is almost unchanged. The most recent inflation report revealed its increasing pace. In this situation, monetary policy should be tightened even more, but Tenreyro said it should be loosened. She says a more permissive strategy is necessary to reach the inflation target. These words cannot be considered anything other than "dovish" rhetoric, yet the British pound is unconcerned. It keeps growing consistently.

Conclusions in general.

The wave pattern of the pound/dollar pair assumes the conclusion of a section of declining price movement (due solely to the correlation of the euro and the pound). Currently, the wave markup could be clearer. Therefore, I suggest you acquire cautiously if your targets exceed 25 figures. No news context would support the pound. Yet, the rising demand for it is an issue. The development of a corrective wave b may begin soon.

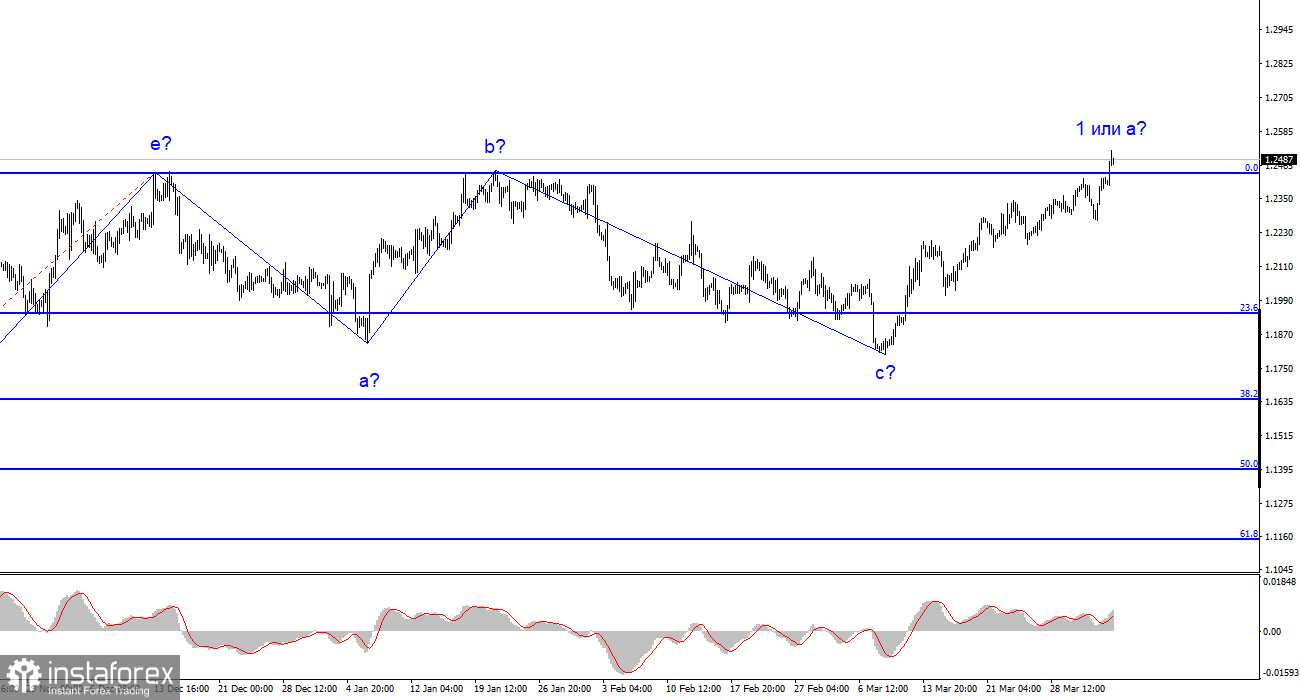

The image resembles the euro/dollar pair on a higher wave scale, although there are still differences. Currently, the upward correction part of the trend is complete. If this assumption is accurate, we are still awaiting the continuation of the development of a five-wave downward section with the possibility of a decrease between 14 and 16 figures.