On Tuesday, the GBP/USD currency pair resumed its upward trend. Can this pair's actions surprise someone else? If the EUR/USD pair at least tried to roll back down a little during the day and only the weak JOLTs report in the US again pushed it into growth, then the British pound began to advance from the start of the day and disregarded the report. This again demonstrates that the euro and the pound would have gained in price even if there had been no data on job openings on Tuesday. So, we've already discussed the causes of this movement. In reality, they either do not exist or are so weak and unconvincing that, under normal circumstances, they could barely generate such a growth in the pair. But currently, situations are unique. For weeks, the market has been biased toward purchasing the pound and the euro. After the strongest growth occurred in the second half of 2022, neither currency significantly declined. No fundamental elements would cause both currencies to gain 500-700 points in a couple of weeks. No significant events occurred yesterday. The market perceives nearly all reports and news positively for the euro and pound. Thus, it makes no sense to discuss the basis or macroeconomics now. Moreover, let's see what happens on Friday when a package of significant figures is released in the United States. We are confident that even the market will interpret it against the dollar.

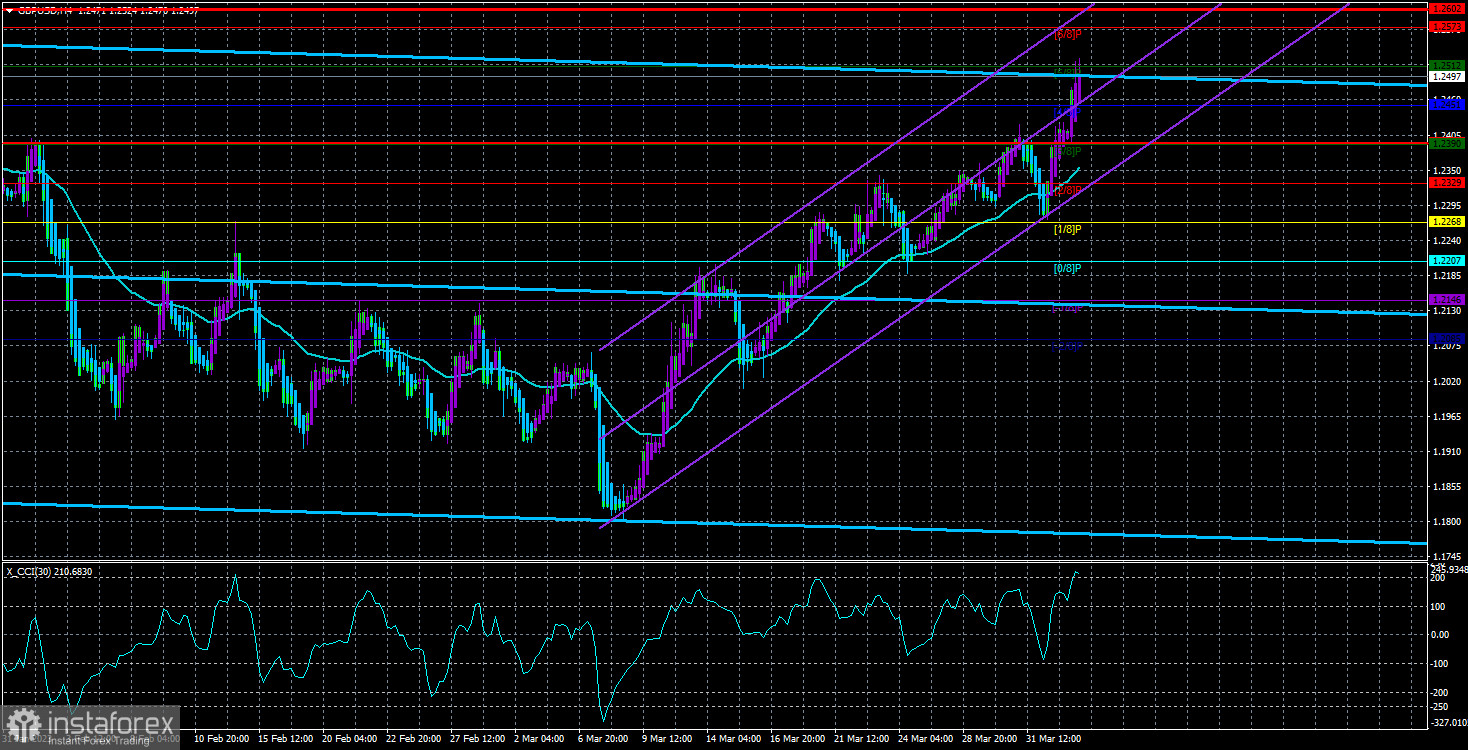

On the 24-hour TF, the pair surpassed and broke past the 1.2440 level. Technically, it may still have time to recover and stay in the side channel, but the way the pair has moved over the past few weeks shows that people will continue to buy without reason. In addition, it is evident on the 24-hour TF that the corrective against growth in September-December of last year was very mild. In recent weeks, it has been clear that the pair has been unable to establish a foothold even below the 4-hour moving average. The quotes have a strong angle of increase, which shows how emotional the movement is. Normally, the pair is adjusted lower because not all incoming statistics and news support a single currency at any given time. However, it is irrelevant because news is considered an excuse to purchase more pounds.

Silvana Tenreyro, a member of the monetary committee of the British regulator, delivered a speech yesterday, mostly disregarded by the market. This is the most intriguing event. She wasn't talking about the need to keep tightening monetary policy. Instead, she was talking about a quick return to lower interest rates. Ms. Tenreyro's remark that a high rate level could result in a sharper decline in inflation below the target level caused us to think. First, we needed to learn how to respond to these words. Despite eleven monetary policy tightenings, inflation in the United Kingdom does not decline "at all." If the present CPI level reaches 10%, what type of decline in inflation below the target level can be anticipated? When inflation reaches at least 2 to 3 percent in a few years, a cut in the key rate will be necessary, but not in the near future.

Now that inflation has risen again, we are discussing raising the interest rate further. The increase in the value of the pound sterling can be attributed to the fact that the BA rate will surpass the Fed rate in 2023. And what reaction does the pound have to such words by Silvana Tenreyro? Indeed, nothing. After already gaining 600 points without adjustment, it continues to increase calmly. This is all that traders need to know about the current movement of the second-most-important currency pair. Before fixing the price below the moving average, we do not advise considering the sale of a pair. Even above the moving average does not provide a likelihood of greater than 50 percent that the fall will continue.

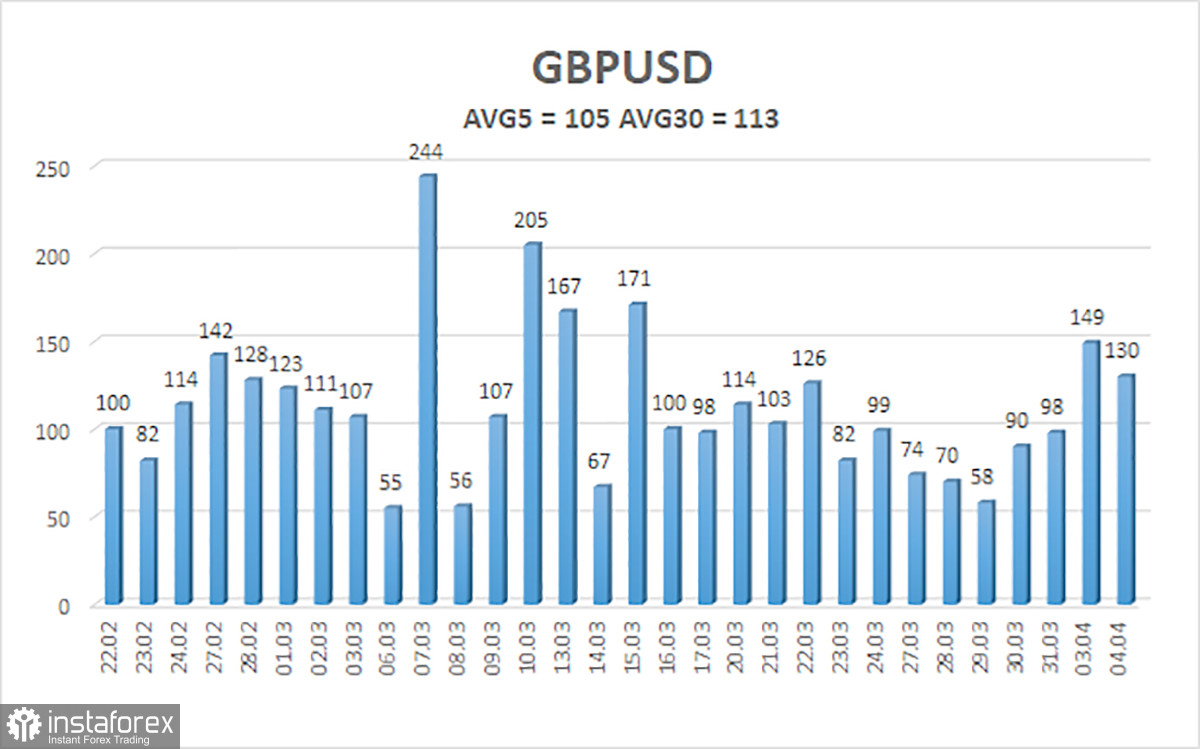

The average five-day volatility of the GBP/USD pair is 105 points. This value for the pound/dollar pair is "average." So, on April 5, we expect the price to move within the channel, with support and resistance at 1.2392 and 1.2602, respectively. The Heiken Ashi indicator's downward reversal signifies a new round of downward correction.

Nearest support levels:

S1 – 12451

S2 – 1.2390

S3 – 1.2329

Nearest resistance levels:

R1 – 1.2512

R2 – 1.2573

R3 – 1.2634

Trading Recommendations:

In the 4-hour time frame, the GBP/USD continues to trend north. Unless the Heiken Ashi indicator turns down, you can maintain long positions with targets at 1.2573 and 1.2602 for the time being. If the price settles below the moving average, short positions can be considered with targets of 1.2329 and 1.2268.

Explanations for the illustrations:

Channels of linear regression – aid in determining the present trend. If both move in the same direction, the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel the pair will trade within over the next trading day based on the current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.