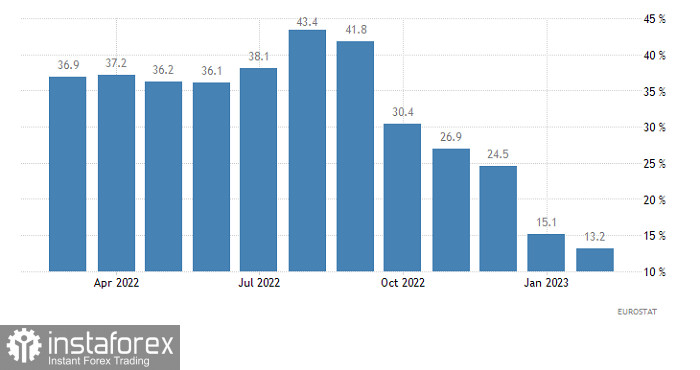

As expected, producer price growth in the euro area slowed more than expected, from 15.1% to 13.2%. Meanwhile, economists had expected a 13.8% slowdown. Although these figures indicate possible rate cuts by the ECB in the near future, the market still paid little attention to the results.

Eurozone PPI:

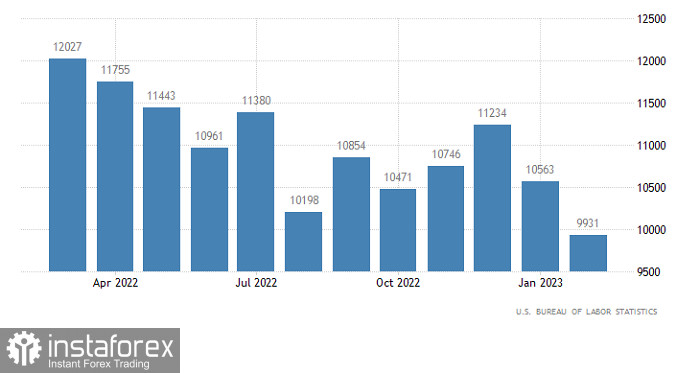

In fact, the euro extended gains against the US dollar amid a decrease in US job openings. The reading dropped to 9,931,000 from 10,563,000 and came below market expectations of 10,800,000. With the US Department of Labor report due on Friday, these figures suggest that its results may disappoint traders. Apparently, the US labor market is slowing down.

United States Job Openings:

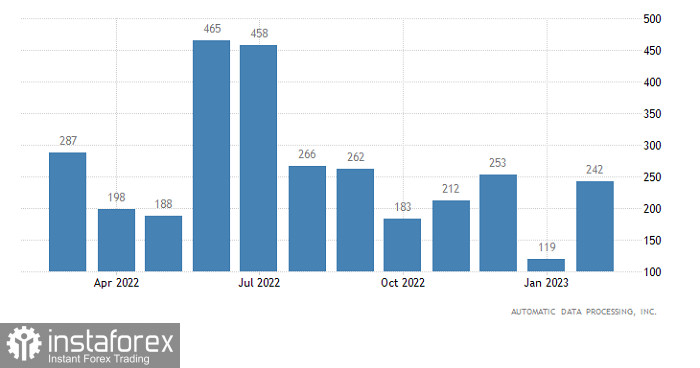

Therefore, today's employment data in the United States will be more important to traders. We may see figures increase by less than 200,000. So, the greenback is likely to show further weakness.

United States Employment Change:

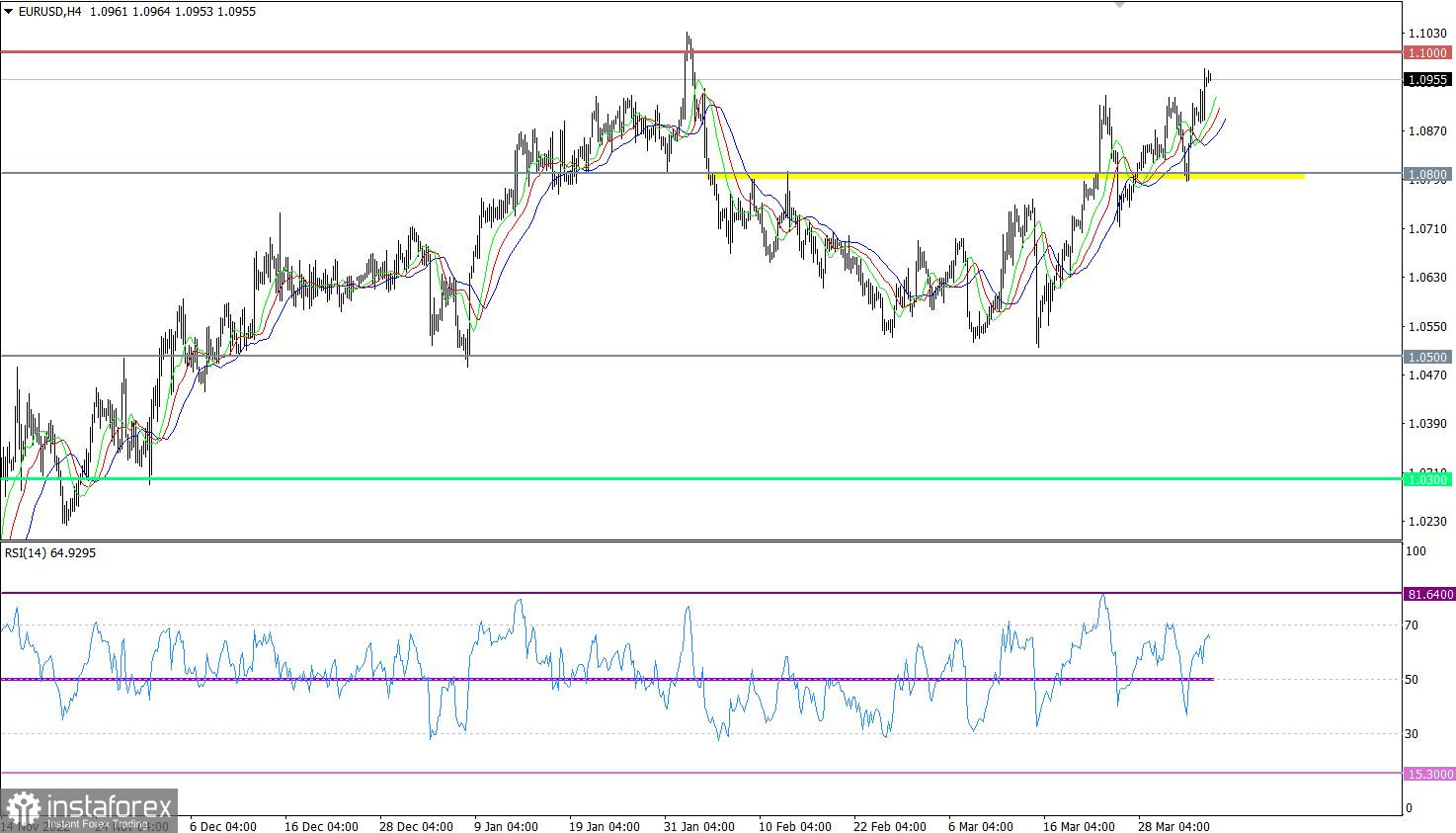

EUR/UUSD tested weekly highs. Buying volumes increased. The pair has almost recovered completely from the February decline. In less than 70 pips, the price will reach the high of the medium-term uptrend.

In the H4 and D1 time frames, the RSI is moving up between lines 50 and 70, which indicates a strong bullish bias.

The Alligator's MAs are headed upward ligator in the H4 and D1 time frames, which is in line with the current price movement.

Outlook

Resistance is seen near the psychological level of 1.1000. In February, a correction occurred from the mark. Currently, the price is retracing up. If the story repeats, buying volumes may decrease, and the price may retreat. However, consolidation above 1.1050 in the D1 time frame will indicate a continuation of the medium-term uptrend.

In terns of complex indicator analysis, there is a bullish bias in the short-term, intraday, and medium-term intervals.