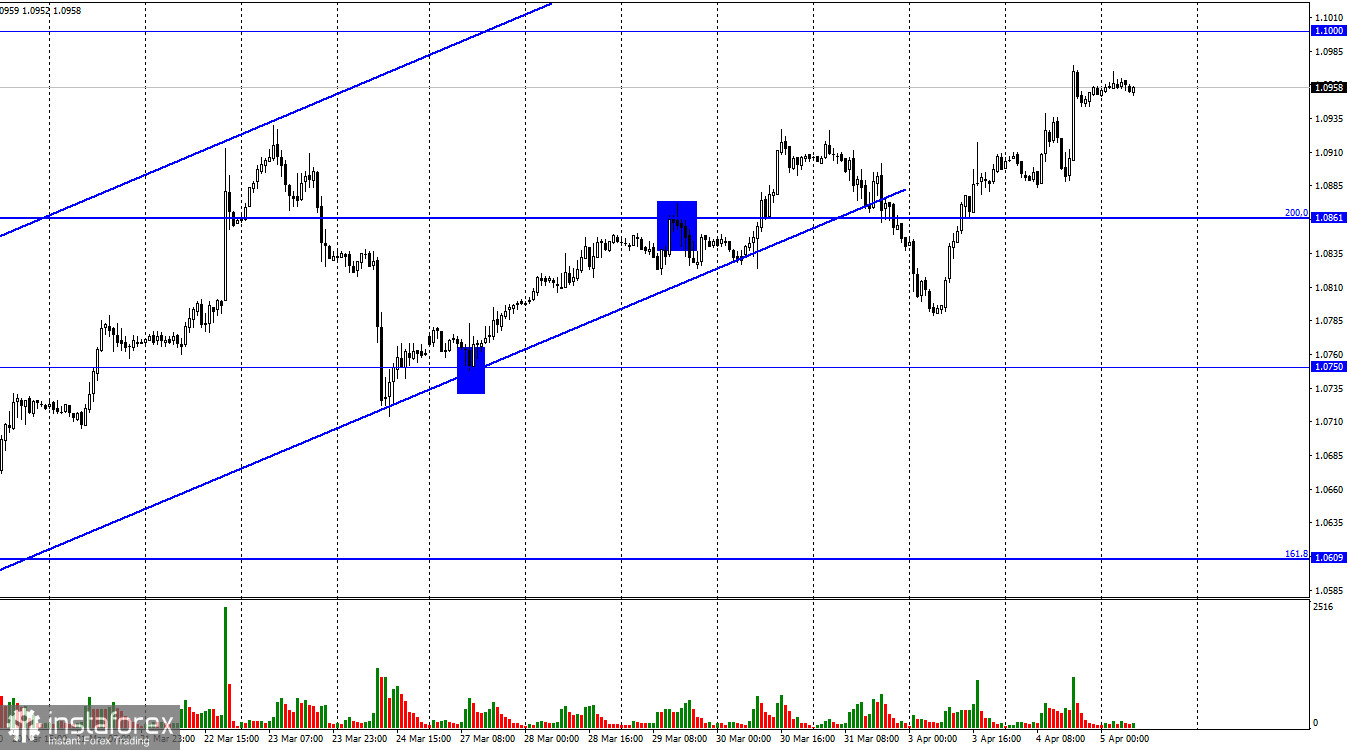

On Tuesday, the EUR/USD pair climbed toward the 1.1000 level. The rebound of quotes from this level may favor the U.S. dollar, with some movement toward the Fibonacci level of 200.0% (1.0861). Fixing the pair's exchange rate over 1.1000 will raise the likelihood of future growth reaching 1.1100.

On Tuesday, the background information could have been stronger. Just like on Monday. But, this did not stop bull traders. Many reports on the labor market are published simultaneously in the United States at the beginning of each new month, which always intrigues me at the beginning of each new month. And the labor market is one of the Fed's major sectors. Therefore, the influence of the situation of the labor market on the PEPP decreases over time. Traders are convinced that the FOMC rate will increase by 0.25 percentage points and that the tightening process will be complete. I hold a less extreme position and feel inflation may surprise many nations this year. And an unwelcome surprise. As a result, traders may underestimate how much the rates of all central banks will increase. Yet, the labor market does not impact the Fed as much as it did a few months ago. But the significance of the reports themselves remained the same.

One of the first reports in this series was provided yesterday, detailing the number of open JOLT positions. It revealed a much weaker value than anticipated, causing a new wave of U.S. dollar sales. The largest candle on the hourly chart represents the impact of this report. Today, ADP will release its report on changes in the number of people working in the non-agricultural sector. On Friday, payrolls and unemployment data will be released. The dollar is currently under pressure from itself, and bears are absent from the market. Such a scenario may remain till the end of the week if the numbers from the United States could be stronger.

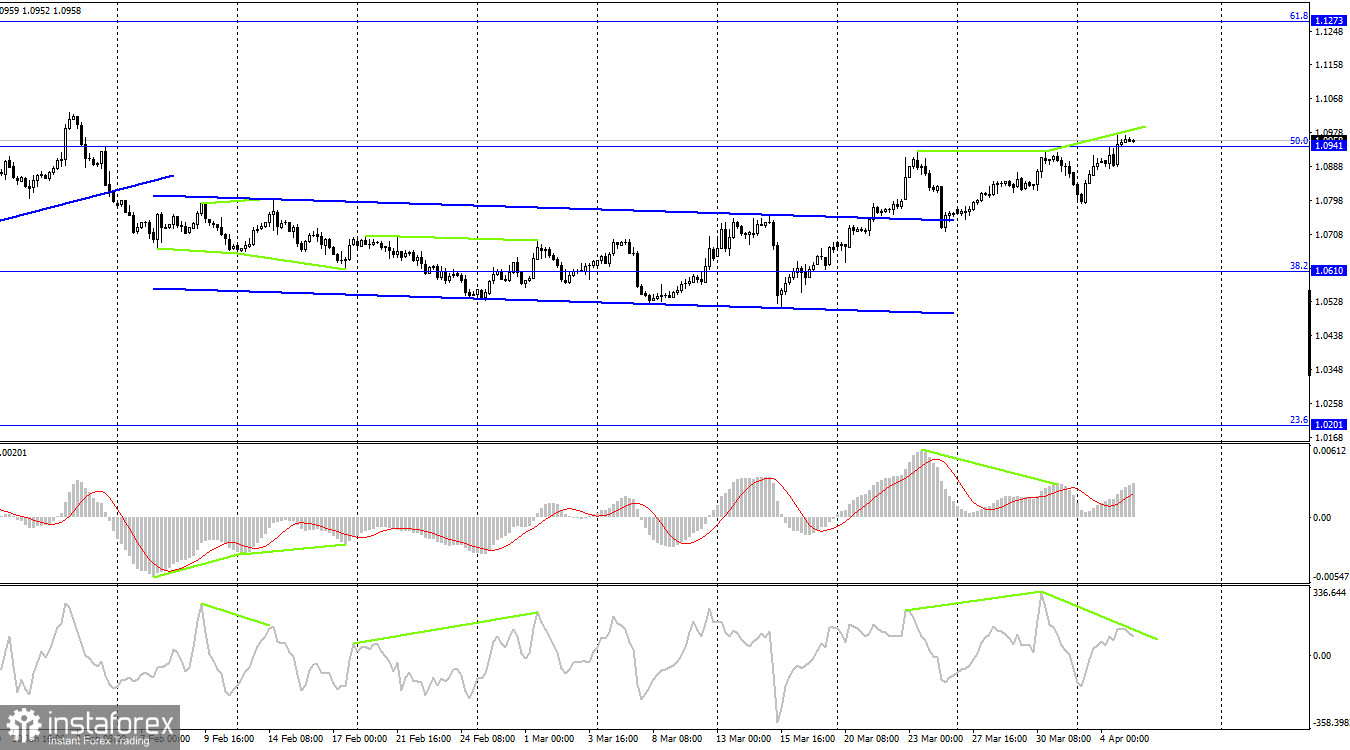

In the 4-hour chart, the pair has established itself above the side corridor, allowing us to anticipate further gains. But, it has not managed to consolidate above the corrective level of 50.0% (1.0941), and there are currently two "bearish" divergences with a third "brewing." Hence, the pair's drop persists on both charts. But, closing quotes above 1.0941 will lead traders to anticipate further gains in the direction of the corrective level of 61.8% (1.1273).

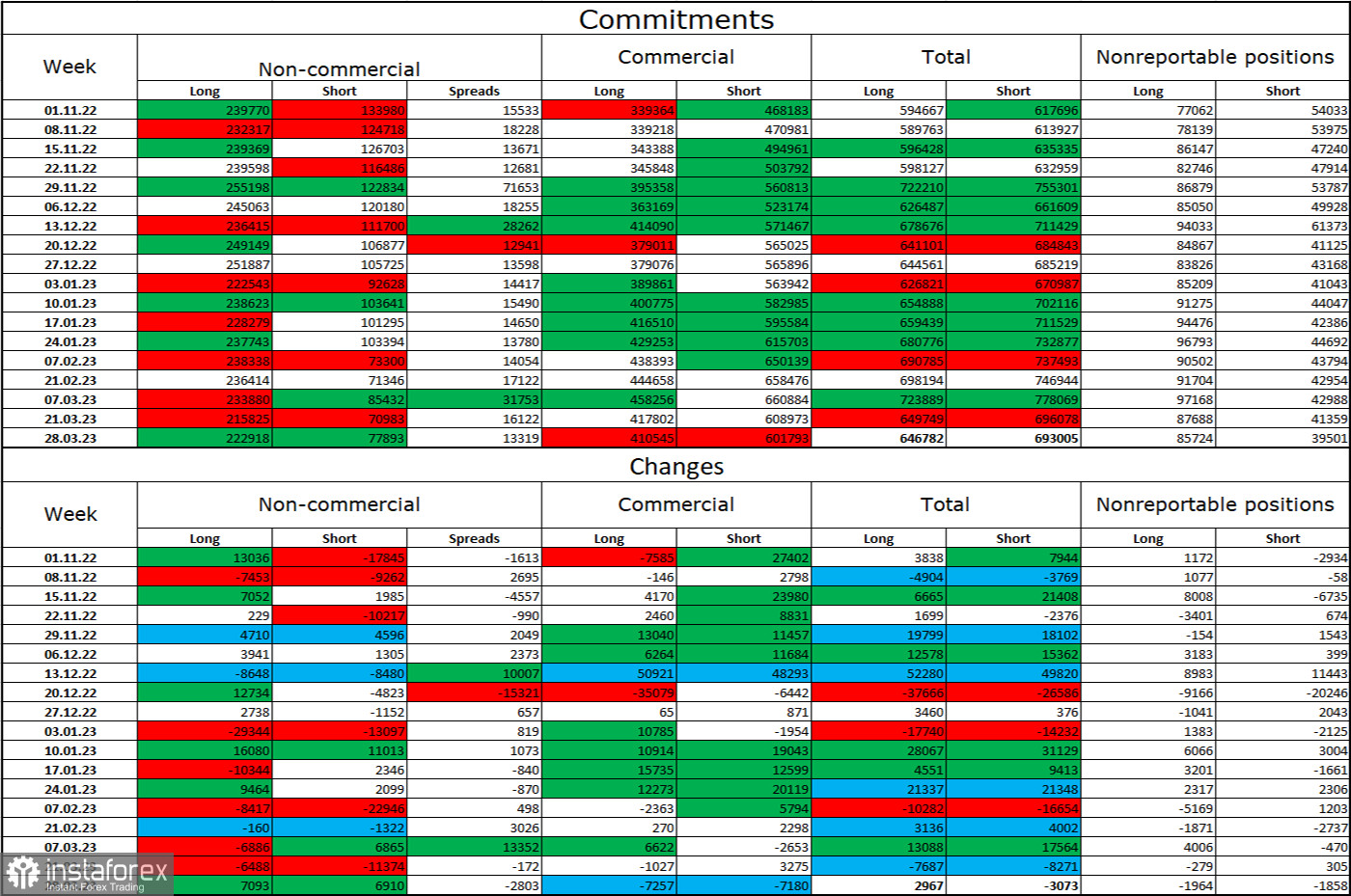

Report on Commitments of Traders (COT):

During the previous reporting week, 709 long contracts and 6,920 short contracts were opened by speculators. Overall, the sentiment of large traders remains "bullish" and continues to improve. The overall number of long contracts held by speculators is now 223 thousand, and the number of short contracts is 78 thousand. The European currency has been rising for almost six months, but the number of long contracts among professional traders has stayed the same during the past few weeks. After a long "dark period," the euro's status remains favorable. Thus, its prospects remain positive. At least until the ECB gradually increases the interest rate by 0.50%. I want to note, however, that the market sentiment may soon become "bearish" since the ECB will no longer be able to raise rates by a half percentage point on an ongoing basis. There are sell indicators on both charts.

News schedule for the United States and Europe:

E.U. – index of business activity in the service sector (08:00 UTC).

U.S. – change in the number of people employed in the non-agricultural sector from ADP (12:15 UTC).

U.S. – business activity index (PMI) in the services sector (13:45 UTC).

U.S. – ISM purchasing managers' index for the non-manufacturing sector of the U.S. (14:00 UTC).

There are some very interesting events on the economic calendars for April 5 for both the European Union and the United States. Today, the impact of the information context on the sentiment of traders may be of average strength.

EUR/USD forecast and trading suggestions:

On a 4-hour chart, sales can be initiated when the pair rebounds from 1.0941, with targets at 1.0861 and 1.0750. In a 4-hour chart, purchases are possible when the price closes over 1.0941 with targets at 1.0000 and 1.1100.