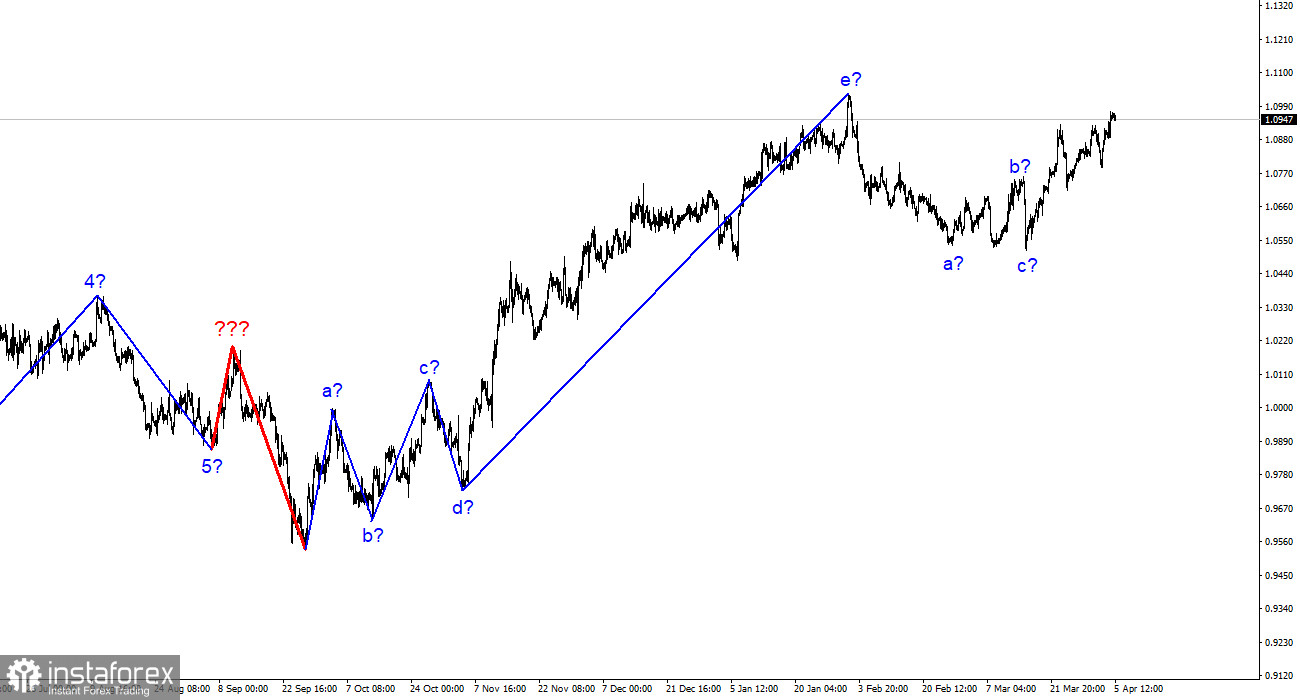

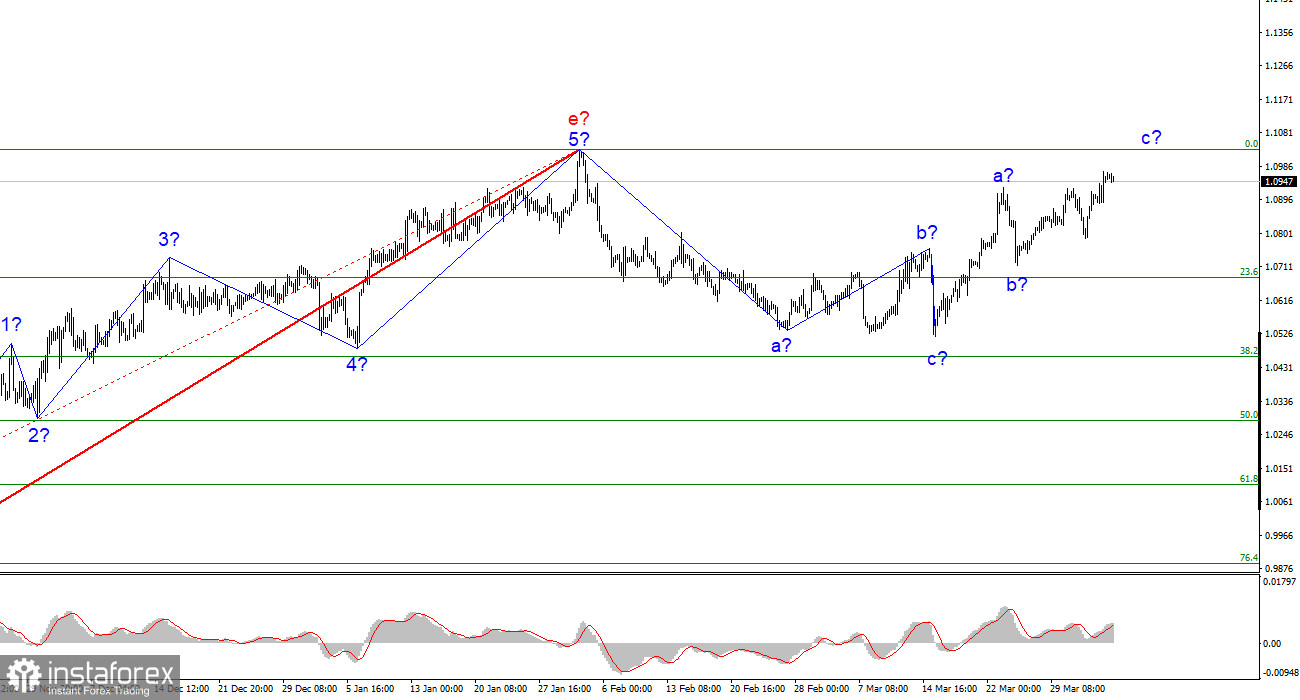

The most recent rising waves confuse the wave pattern on the 4-hour chart for the euro/dollar pair. These waves may represent the beginning of a new upward trend segment (as the most recent downward trend segment may be viewed as a three-wave pattern that has concluded), but this trend segment may finish soon if it also adopts a three-wave pattern. Hence, the wave pattern for the euro currency might become quite challenging, which is already exceedingly challenging to work with. When the third wave's peak has surpassed the first's peak, the formation of an upward series of waves may have ended. A similar thing was observed in the previous downward formation. Moreover, there are additional possibilities for wave analysis. When the projected wave c (a series of descending waves) turned out to be quite weak, I feel it is now appropriate to begin from the scenario, including an increase in the pair. Thus, buyers are more powerful than sellers, and the upward wave c may get longer. I suggest focusing on the wave e peak, which is 1.1033.

On Wednesday, the euro/dollar pair was rather calm for the early half of the day. Someone may believe that the most recent increase in the pair's quotes is illogical, but if we begin with the fact that the pair generates alternating waves of three, everything makes perfect sense. We should now develop three waves up, just as there have been three waves down. As previously stated, the issue is that the pair can only move in three waves. Hence, once such a pattern is found, it can end automatically at any time. The current news background does not help to comprehend what to expect in the coming weeks. The only important things that came out this week were the manufacturing sector activity indices for the US and EU. The release of data on job openings in the United States yesterday did not affect the dollar's demand. Assuming that the pair moves according to the news context, its prospects are quite uncertain.

The European currency has experienced a slight decline today. In March, the indicator of business activity in the services sector of the European Union went up to 55, which was below what the market was expecting. In the afternoon, figures on the US services sector's trade balance and business activity will be issued. I will also highlight the ISM index, which has historically been more significant than the S&P. The market anticipates it to exceed 54 points. If the ISM number exceeds this level, I shall wait until the pair declines. Moreover, the ADP data on the number of new non-agricultural jobs in the United States will be announced today. A similar idea to nonfarm payrolls. It can also significantly alter market sentiment.

Conclusions in general.

Based on the analysis, the development of the section with the downward trend is complete. Yet, the upward part of the trend can also be completed in the same manner, which consists of three waves. Hence, it can now provide advice on sales and purchases. The news context does not answer the question of the pair's most probable direction of movement. Also, wave analysis. I recommend cautious buying with targets near 1.1033 in the current market environment.

On the older wave scale, the ascending trend section's wave pattern has taken on an extended form but is likely complete. We saw five upward waves, which most likely followed the a-b-c-d-e pattern. Forming a downward section of the trend may not be finished yet, and it could take any shape or size.