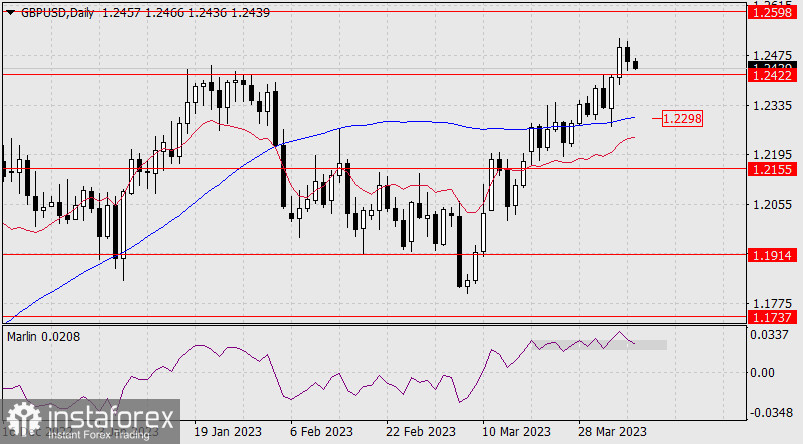

Yesterday, the British pound fell by 36 points. This was enough for the signal line of the Marlin oscillator to return to the range of the last week of March. This creates a standard technical dilemma: there was a consolidation and false breakout above the target level of 1.2422, or the price retests the level with the subsequent growth towards 1.2598.

If the price shows a reverse consolidation below 1.2422, it can fall to the MACD line near 1.2298. Crossing the support will extend the decline to the target level of 1.2155.

On the four-hour chart, the MACD line is approaching the test support at 1.2422, strengthening it and increasing its value. The Marlin oscillator is trying to move into the decline zone. Staying below 1.2422 will create the conditions for a breakout to 1.2298.