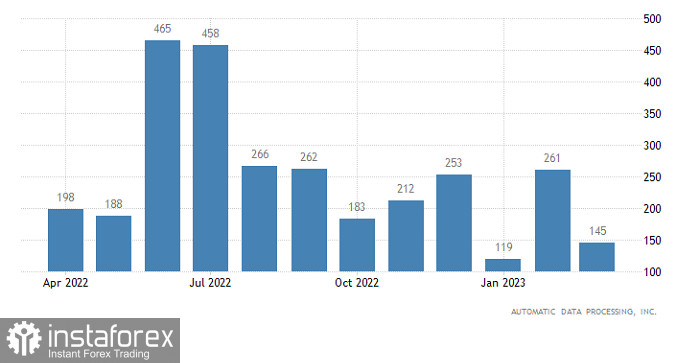

The only explanation for what is happening right now would be confusion and complete misunderstanding of what is happening. In fact, in spite of growth in US employment by 145,000, which is not enough to support the stability of the labor market, the dollar still traded higher when it should have declined. Of course, we can assume that the market is preparing for the report of the United States Department of Labor, which will be much worse than expected. Even the growth of unemployment rate is probable. And quite often, on the threshold of a significant event, the market moves in the opposite direction from expectations. This is nothing but speculation that adds to the subsequent surge, which can be a good profit. The problem is that the upcoming Friday will be a holiday. This means that the market will only be able to work out the contents of the US labor report by Monday. In other words, the dollar's movement from yesterday was too premature. So yes, investors are obviously confused and don't understand what is going on. Or more precisely, what to expect in the near future. And uncertainty scares the markets the most. And fear prevents rational comprehension of reality. Proceeding from this, there is a high chance that the market will behave a little bit inadequately today too. An upsurge of activity is likely to take place when jobless claims data is released in the United States. Both initial and continued claims are expected to increase. Even if it only edges up. That is, like yesterday, signs of a worsening labor market. And the market may well react with another wave of dollar growth. Although, the logical movement would be weakening.

Employment Change (United States):

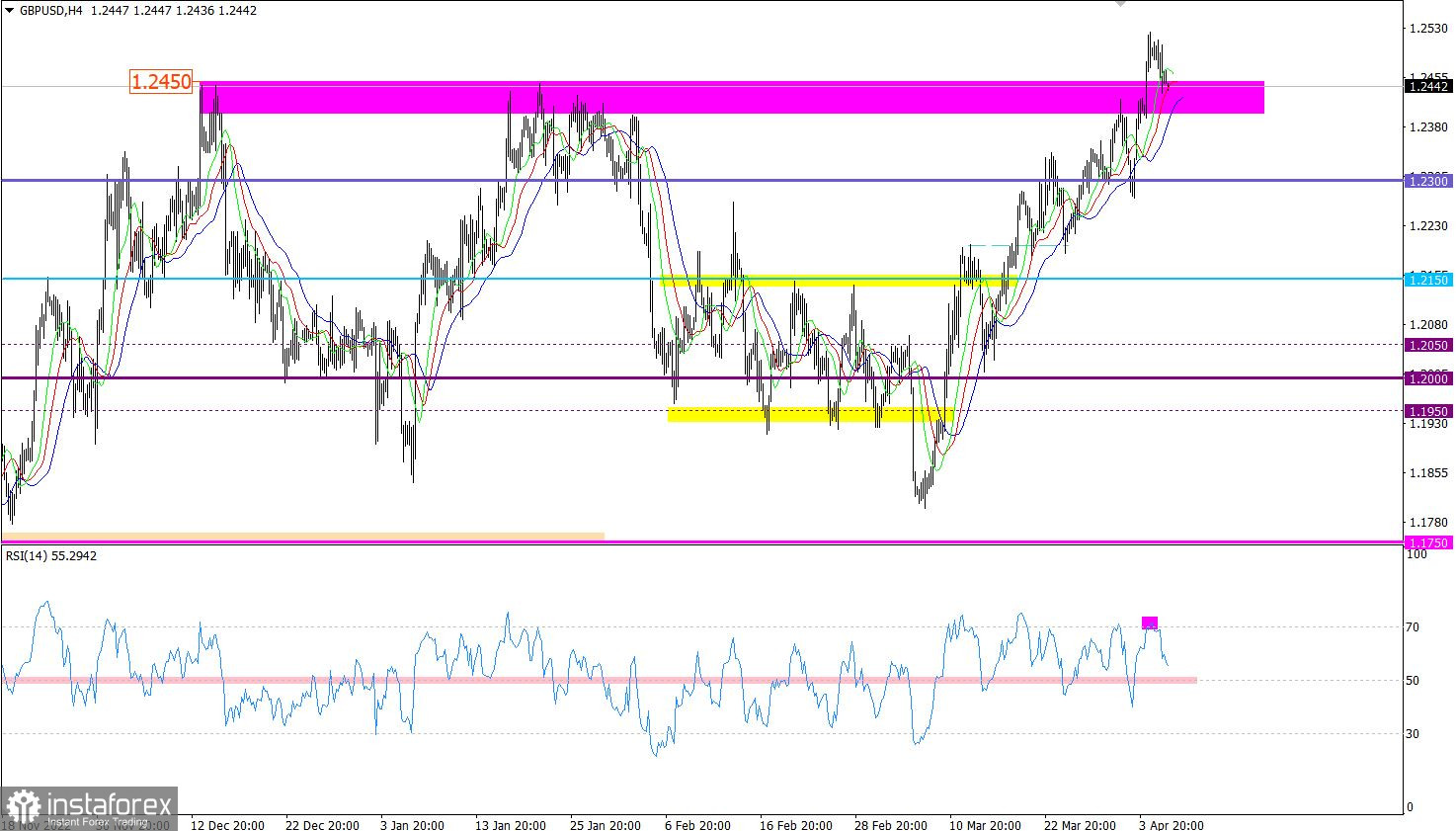

GBP/USD recently updated the local high of the medium-term uptrend. As a result, the quote temporarily stayed above 1.2500, where due to the signal of the pound's overbought conditions, it moved into the rollback phase.

On the four-hour chart, the RSI pointed to a rollback when it crossed the 70 line upwards. At the moment, the RSI is at the level of 55.80.

On the four-hour and daily charts, the Alligator's MAs are headed upwards, which reflects the quote's movement.

Outlook

The 1.2500 level, which the pound has already passed, serves as a resistance level. There was a pullback, which may serve as a process of regrouping of trading forces. So, in case the price climbs above 1.2500, it is possible to revive long positions in GBP. However, till then, the quote will be in the pullback phase.

The complex indicator analysis is focused on the pullback stage in the short-term and intraday periods. While the medium-term cycle still points to an uptrend.