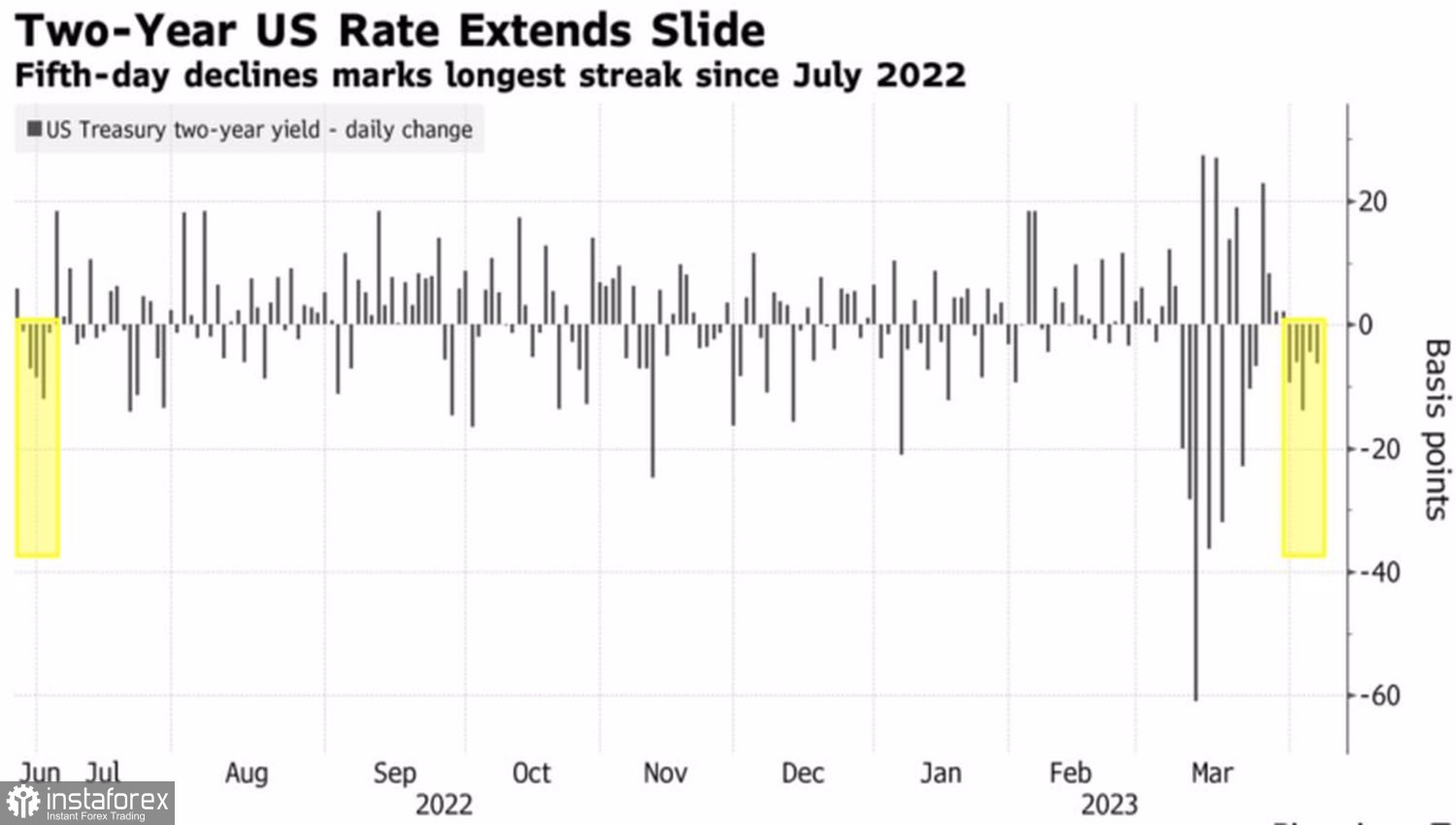

A recession in the U.S. economy is just around the corner. This news has spooked financial markets so much that Treasury yields have fallen for the fifth straight day. We are talking about the longest series since July 2022. According to MUFG, the main beneficiaries of the U.S. debt market rate cuts are the yen, the franc, the pound and the euro. MUFG expects EURUSD to return to the middle of the 1.1-1.15 trading range in the near future. However, for the time being, the single currency is taking a step back and preparing for the release of important US employment data.

U.S. Treasury bond yields dynamics

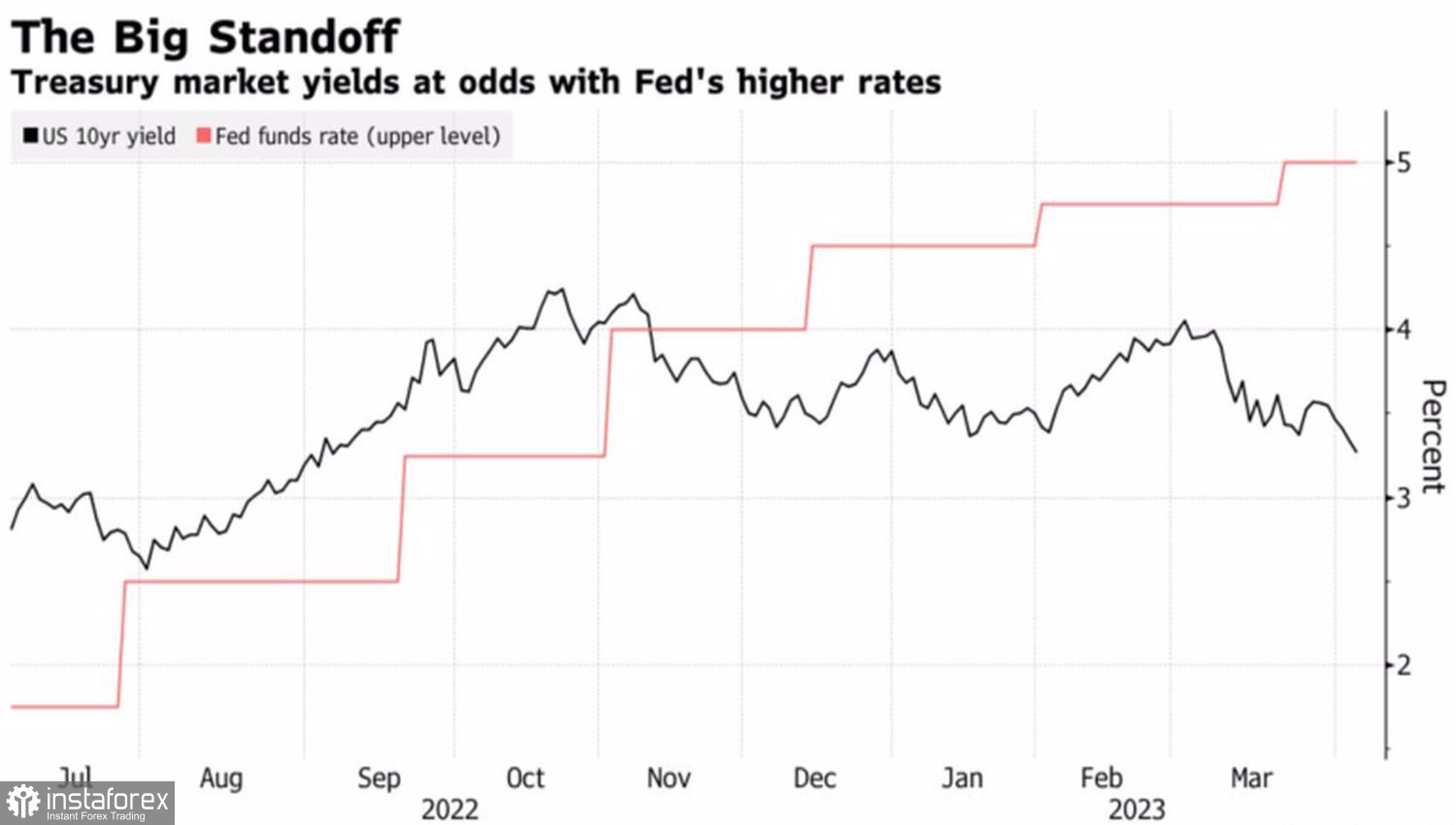

The market narrative in April has significantly changed from the February one. At that time, after an unexpectedly strong non-farm payrolls and inflation data, derivatives were forecasting a 5.75% increase in the federal funds rate and a complete abandonment of the idea that the Federal Reserve would take a dovish pivot. Fed Chairman Jerome Powell's hawkish rhetoric before Congress brought the U.S. dollar back to life. Alas, further events showed that the February surge was a final gesture.

The banking crisis and a series of disappointing data in the US have returned the beautiful swan to the image of the ugly duckling. Job losses to a two-year low, weak private sector employment numbers from ADP and business activity numbers from ISM caused the futures market to reduce the likelihood of a 25 bps federal funds rate hike at the May FOMC meeting from 70% to 40%. Derivatives see it falling as early as June. And no amount of hawkish rhetoric from Fed officials is convincing them otherwise.

The drop in Treasury bond yields unambiguously hints at a dovish pivot as early as this year. If the central bank really does go for monetary policy easing, it will be a verdict for the U.S. dollar. Now the U.S. currency is sold on rumors.

However, not everybody is confident with the bullish rally. Credit Agricole predicts that the pair will soon fall into consolidation, as the market's idea of the rate cut is fundamentally wrong. Inflation will remain at elevated levels for a long time, and the Fed will be forced to do what it is now saying - keep borrowing costs at their peak for an extended period of time.

Dynamics of the Fed rate and U.S. Treasury yields

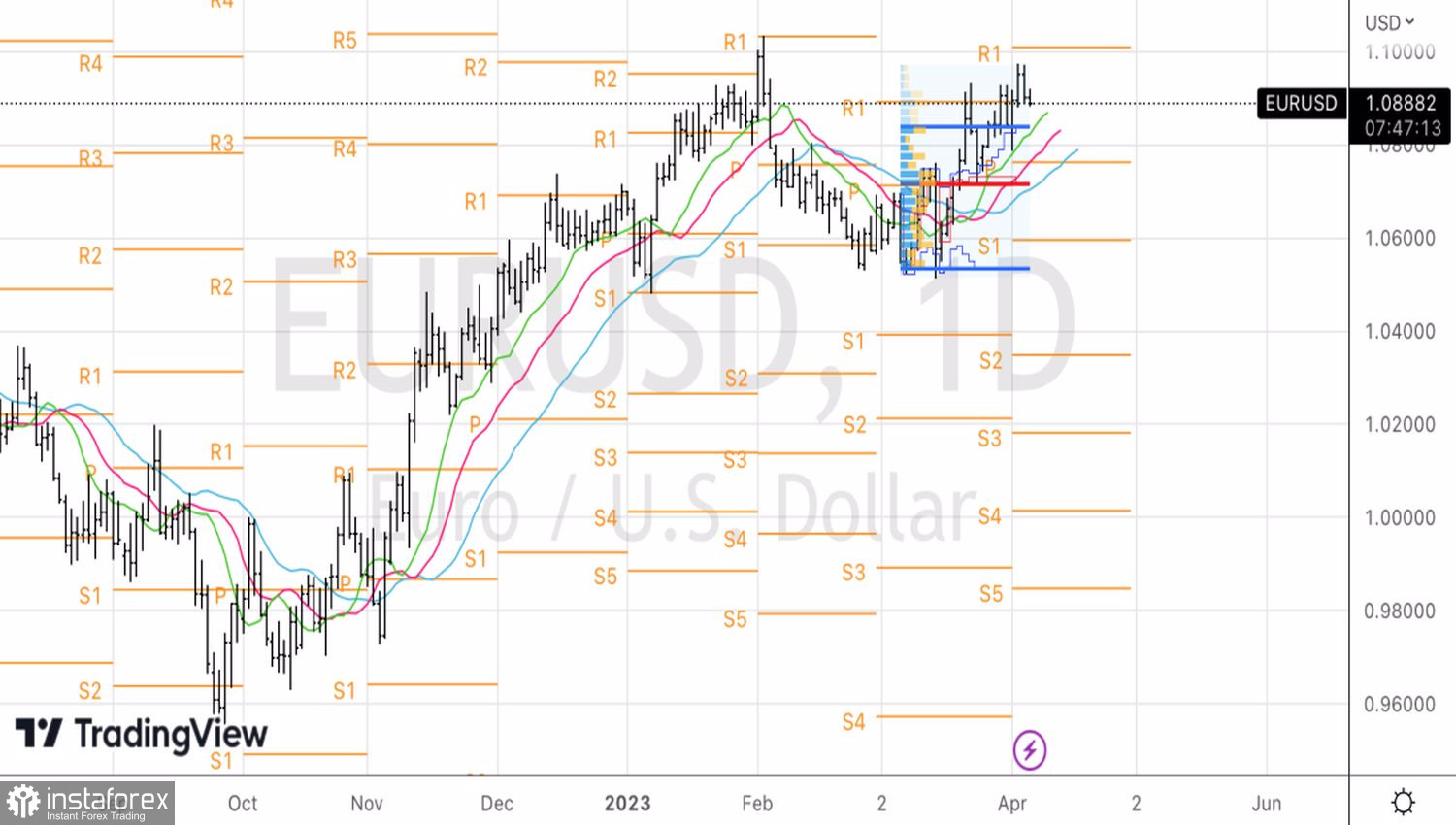

Falling bond yields and the resilience of the stock market that do not yet believe in the recession creates a headwind for the U.S. dollar. Nevertheless, EURUSD is going down, and the speculative factor is to blame. Hedge funds prefer to stay out of the deep end and close long positions before the release of the March US labor market report.

Technically, in order to activate the Anti-Turtles reversal pattern, EURUSD must fall below support at 1.084, where the upper limit of the 1.052-1.084 fair value range is located. As long as the pair stays above this level, we'll focus on longs.