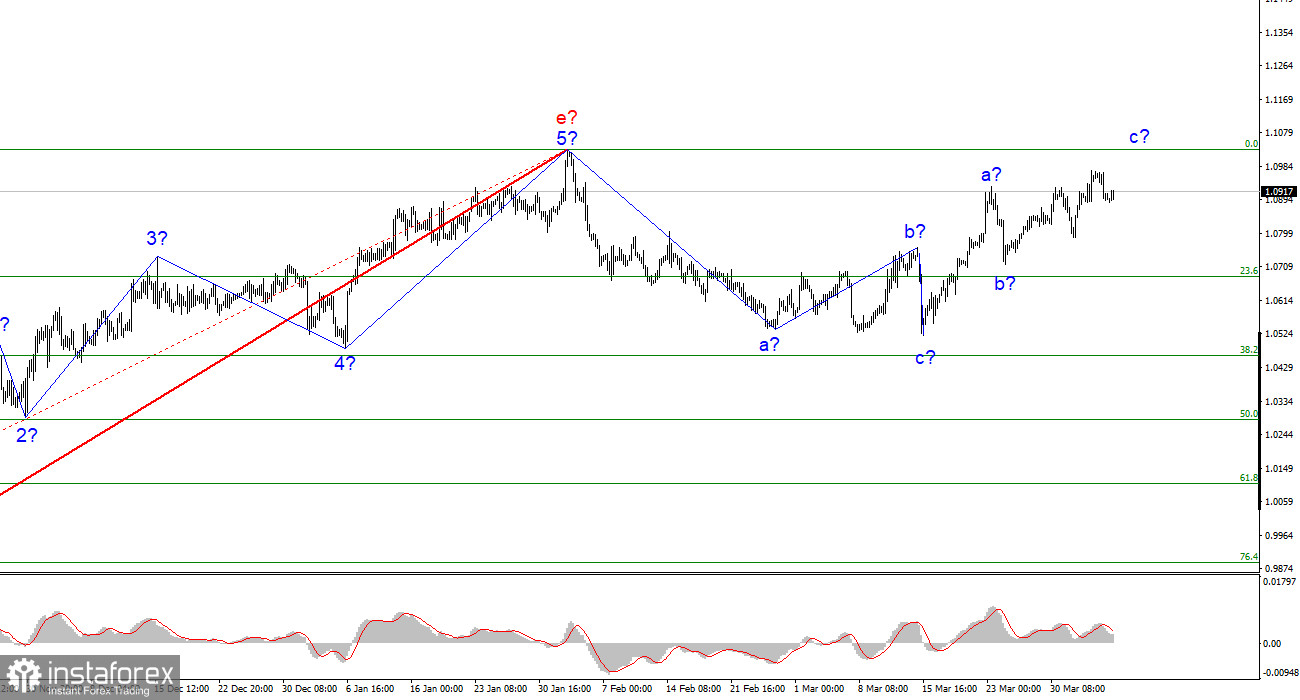

The recent ascending waves confuse the euro/dollar pair's 4-hour chart wave analysis. These waves may represent the beginning of a new upward trend segment (since the most recent downward trend segment can be viewed as a three-wave pattern that has concluded), but this trend segment may end soon if it also assumes a three-wave form. Consequently, the wave pattern for the euro has the potential to be extremely complex, and it is already exceedingly challenging to analyze. Since the peak of the third wave has surpassed the peak of the first, the formation of an upward series of waves may have ended. The same thing happened in the previous downward formation. Additionally, there are additional alternatives for wave analysis. As the expected wave c (a series of descending waves) turned out to be very weak, it is prudent to begin from the scenario involving an increase in the pair. Consequently, buyers are more powerful than sellers, and upward wave c may become longer. The target I propose for the near future is the peak of wave e, which corresponds to 1.1033.

The reports create additional dollar pressure.

On Thursday, the euro/dollar pair rose only about ten basis points against an almost empty economic calendar. A new report on the labor market in the United States was released the day before, revealing that the number of new jobs in March was just 145 thousand, much lower than market estimates. Yesterday, the dollar could withstand this news and even improved its position slightly throughout the day; however, this report and the JOLT report released at the start of the week indicate that Nonfarm Payrolls should not be anticipated to have a strong value by the end of March. ADP and Nonfarm payroll reports rarely correlate, so this might be false. In other words, a weak ADP report does not necessarily indicate a weak Nonfarm Payrolls report. Thus, destroying the U.S. dollar in advance is unnecessary, but several factors are currently working against it.

Analysts worldwide continue to conclude that the U.S. economy is declining but slowing at a very advantageous time. In fact, what should we anticipate if the Fed has already increased the interest rate to 5 percent? In contrast, it is decelerating against the backdrop of falling inflation, which was the primary target of the American regulator. If the 5% rate is sufficient to meet the Fed's targets (3.5% inflation by the end of the year), then the task can be considered complete, and the Fed can begin decreasing interest rates to stimulate the economy. In the context of policy easing, the economy, but not the U.S. dollar, may decline even further.

Conclusions in general.

Based on the analysis, the formation of the section with the downward trend is complete. Nonetheless, the upward section of the trend can also be concluded in the same manner, which consists of three waves. Therefore, providing advice on sales and purchases is now possible. The news context does not answer the query of the pair's most probable direction of movement. Also, wave analysis. I recommend cautious purchases with targets near 1.1033 in the current market environment.

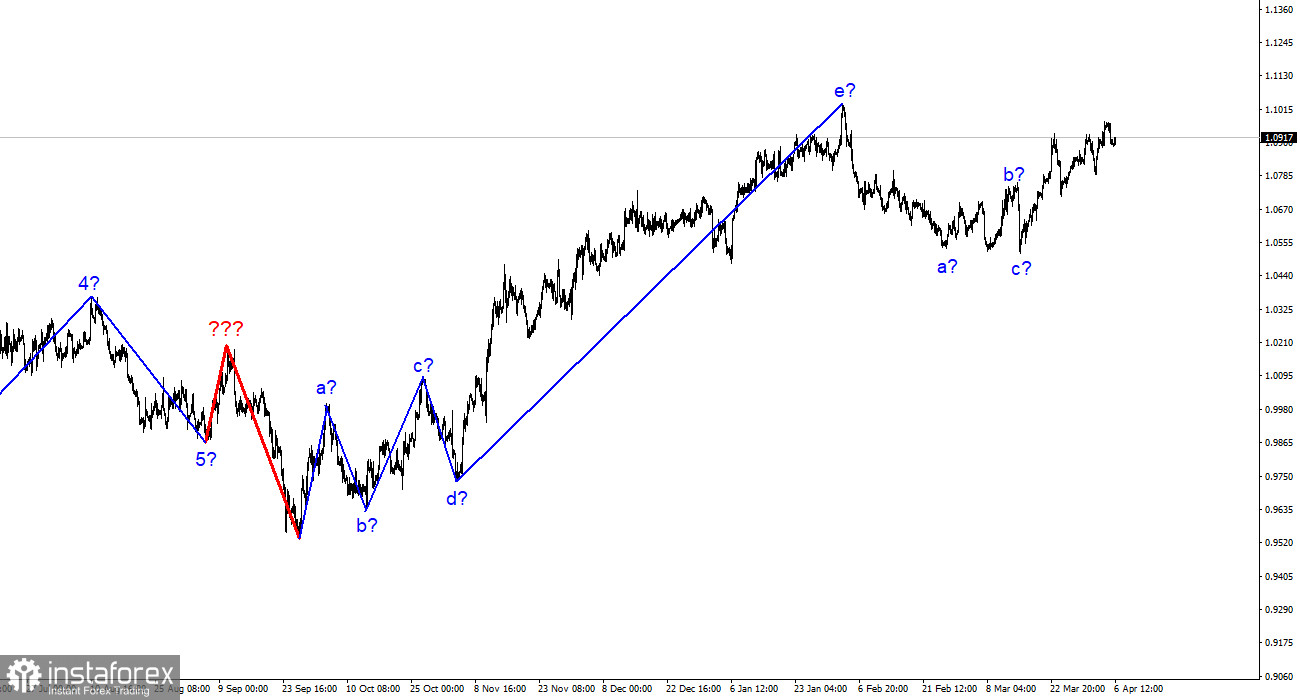

On the older wave scale, the ascending trend section's wave analysis has taken on an extended form but is likely complete. We observed five ascending waves, which most likely followed the a-b-c-d-e pattern. Forming a downward section of the trend may still need to be finished, and it could take any shape or size.