The EUR/USD currency pair on Thursday showed no interest in movements. For most of the day, the pair stood in one place. Interestingly, it decided to take a break when it found itself near the moving average line. It would be logical to assume that the pair would either overcome the moving average on Thursday or bounce off it. By the end of the day, one can conclude that it "bounced" more than it overcame. And this means that the euro currency again failed to change the trend and show a noticeable correction, even against the movement we have observed in the last three weeks. Thus, nothing changes in the foreign exchange market. It is still unclear why the US currency strengthened on Wednesday when there were objectively no reasons. However, the pair's movements have been illogical for a long time. The European currency should show another round of downward correction on the 24-hour TF, at least 500–600 points. But the market is only showing its readiness to buy so far.

What else can be said about the technical picture now? The only hope remains the Fibonacci level of 50.0% on the daily TF. So far, it has not been overcome, so the pair can start a new decline, which would be maximally logical. But the market does not consider the fundamental background at the moment. For example, ECB Chief Economist Philip Lane said yesterday that decisions to raise the key rate will now be made from meeting to meeting based on incoming information. This suggests that the regulator is still prepared to raise the rate by 0.5% every time. Therefore, the pace of tightening will be slowed to a minimum, like the Fed. However, the US economy is stronger, inflation is lower, and core inflation is falling. Even if the market factored in the possibility of a stronger ECB rate hike in 2023, this factor is already accounted for in the quotes.

What can we expect from non-farm payrolls and unemployment?

First of all, it should be noted that the Fed rate has risen to 5%, which is very high and something traders have not seen since 2008. Therefore, assuming that the economy will not react to such a significant tightening would be naive. Hence, the worsening situation in the US labor market and rising unemployment are normal under the current circumstances. Despite a slowdown in job creation rates, the labor market is still in excellent condition. Unemployment is hardly growing, remaining at its 50-year low. What else is needed? This is expected even if the indicators start to deteriorate in the coming months. The question is, how will the market react to this data?

All possible negative factors for the dollar have already been considered three times over. Even in the case of non-farm payroll failure, the dollar could strengthen today because it has been unfairly falling for a long time. At the same time, if the market has yet to be saturated with purchases, weak US statistics may provoke a new round of US dollar decline. After all, the market recently only needed a reason to sell the US currency. Thus, even a very unambiguous value of non-farm payrolls and unemployment reports can cause an illogical market reaction. We should be prepared for such an outcome. There needs to be more logic in the market right now. The ADP labor market report, which came out on Wednesday, was weak, but non-farm payrolls and ADP rarely coincide with each other in nature or result. Therefore, it is not a fact that we will see weak reports from across the ocean today. Weak data can be considered below 200 thousand non-farms and above 3.6% unemployment.

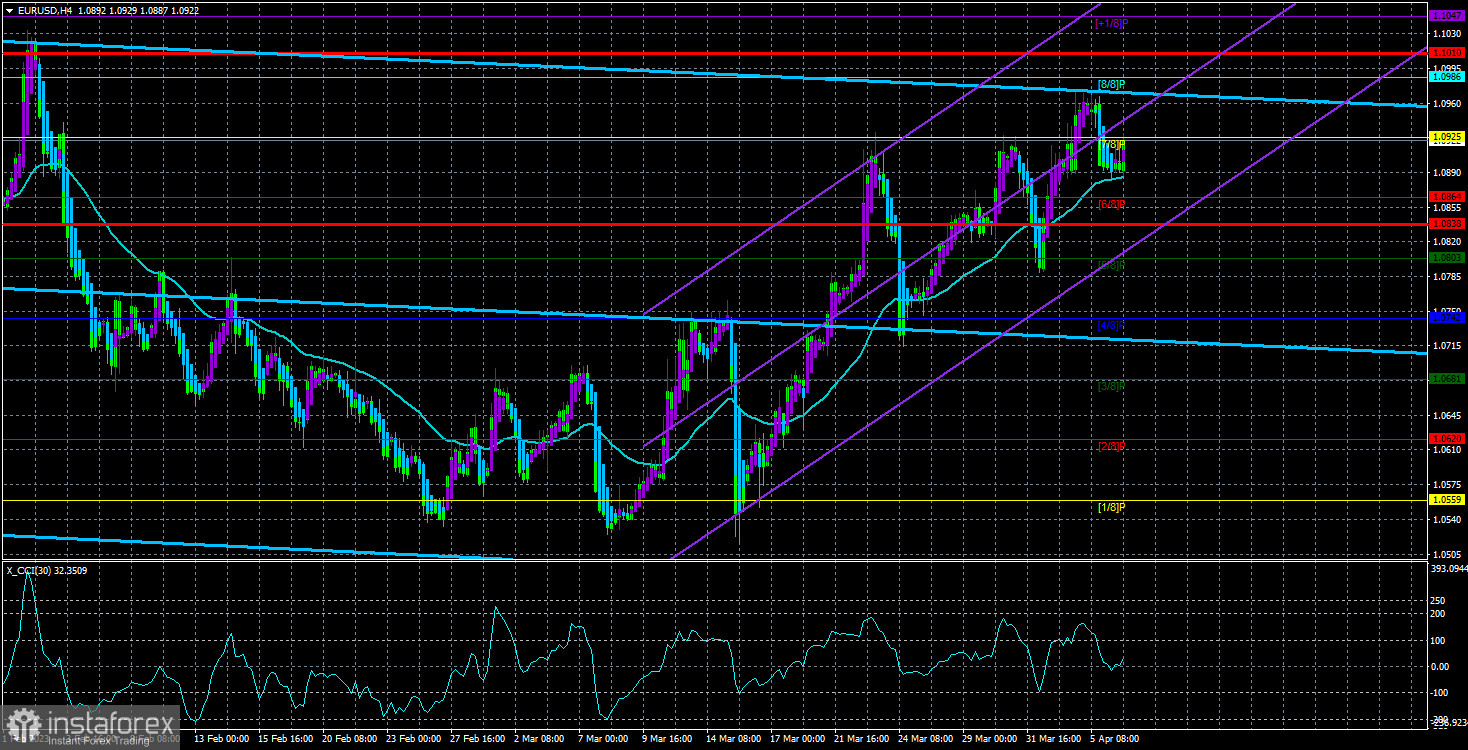

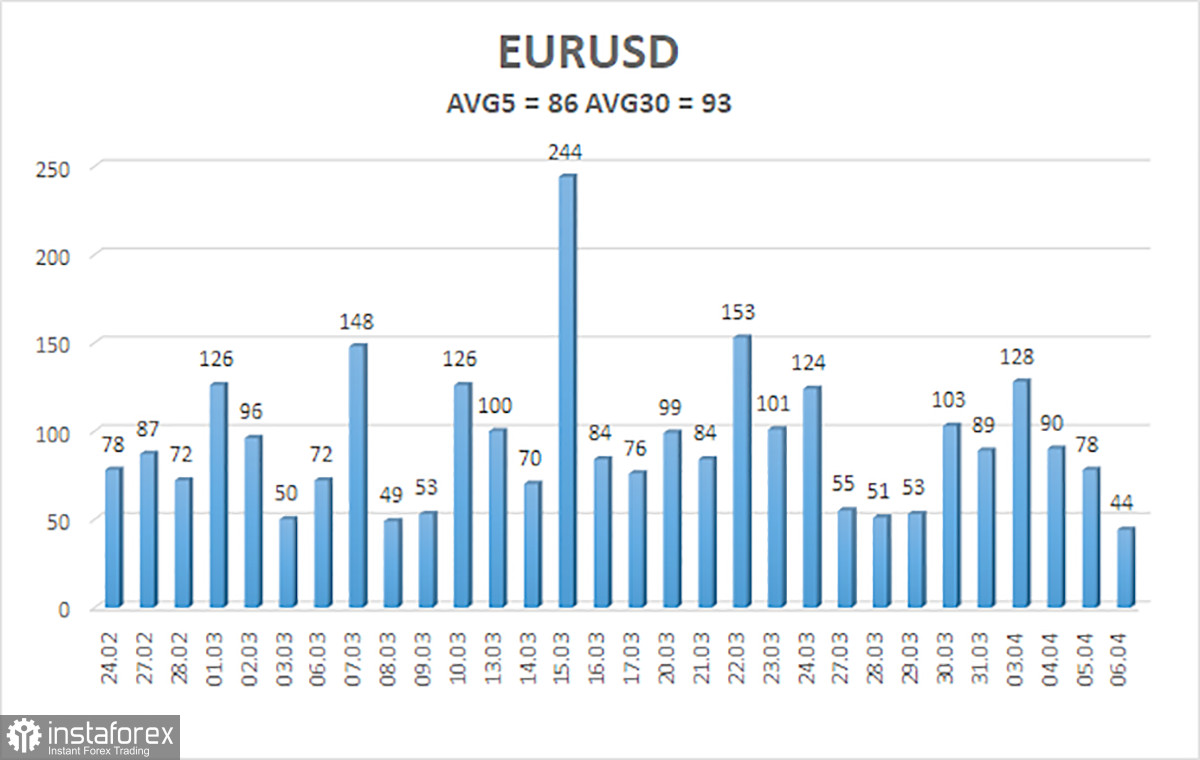

The average volatility of the EUR/USD currency pair for the last five trading days as of April 7 is 86 points and is characterized as "average." Thus, we expect the pair to move between levels 1.0838 and 1.1010 on Friday. The reversal of the Heiken Ashi indicator back up will indicate the resumption of the upward movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0803

S3 – 1.0742

Nearest resistance levels:

R1 – 1.0925

R2 – 1.0986

R3 – 1.1047

Trading recommendations:

The EUR/USD pair remains above the moving average line. New long positions can be considered with targets of 1.0986 and 1.1010 if the Heiken Ashi indicator is reversed upward or if the price bounces from the moving average. New short positions can be opened after the price consolidates below the moving average line, with targets of 1.0838 and 1.0803.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is strong now.

Moving average line (settings 20,0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.