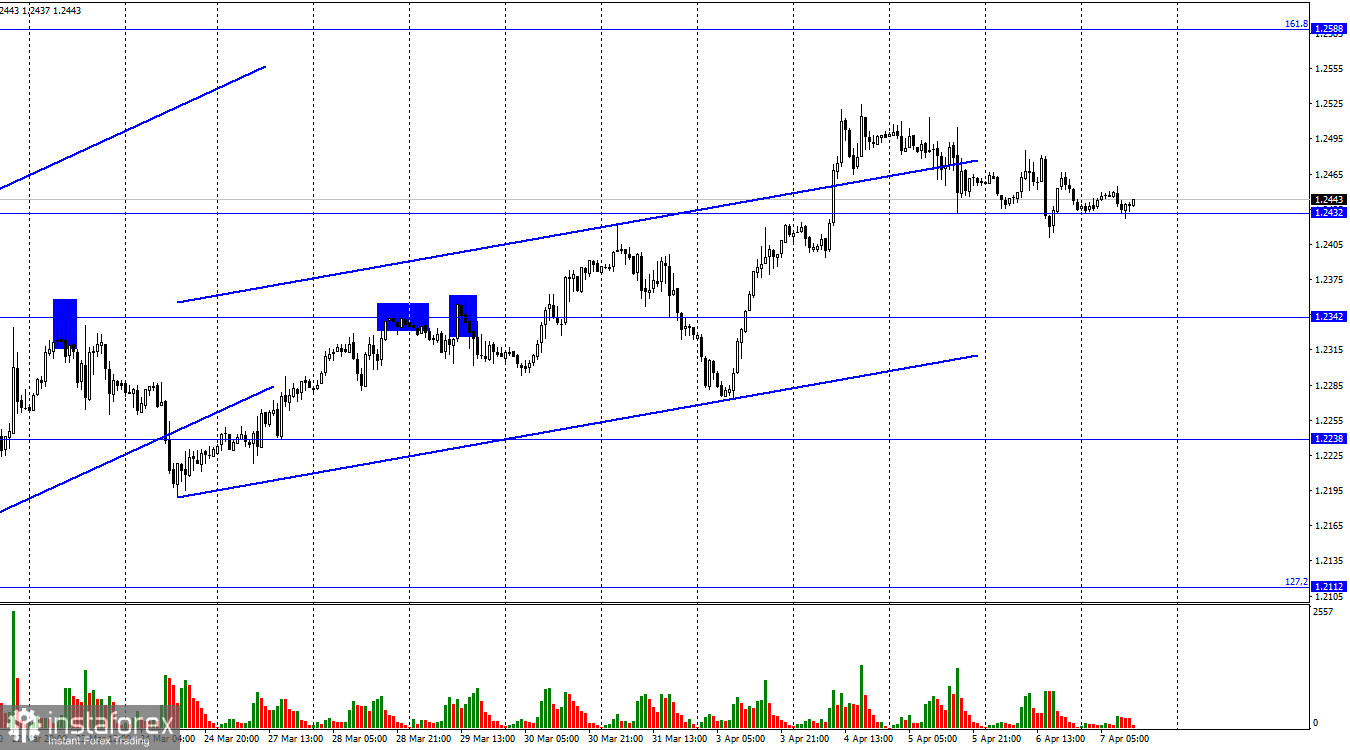

On the hourly chart, the GBP/USD pair on Thursday continued its decline towards the 1.2432 level until it encountered it. A bounce off this level will allow traders to count on a reversal in favor of the British pound and some growth toward the corrective level of 161.8% (1.2588). Fixing the pair's rate below the 1.2432 level will increase the probability of a further decline toward the 1.2342 level.

As mentioned, today is Good Friday, and the market is practically standing still. There is hope that the situation will change slightly in a couple of hours with the release of statistics in the US, but I would not count on strong movements today. At the beginning of the week, the market was waiting for Friday, as the other days had a not-too-strong informational background. But today, it is clear that traders are not expecting anything this week. If you look at the charts, a very weak movement on Wednesday and Thursday is noticeable. On Monday and Tuesday, the British pound rose for no apparent reason. Thus, waiting for the end of the current not-very-ordinary week is necessary. The ascending trend corridor continues to characterize traders' sentiment as "bullish." At 12:30 UTC, be prepared for a surge in activity, but it is not a fact that it will happen.

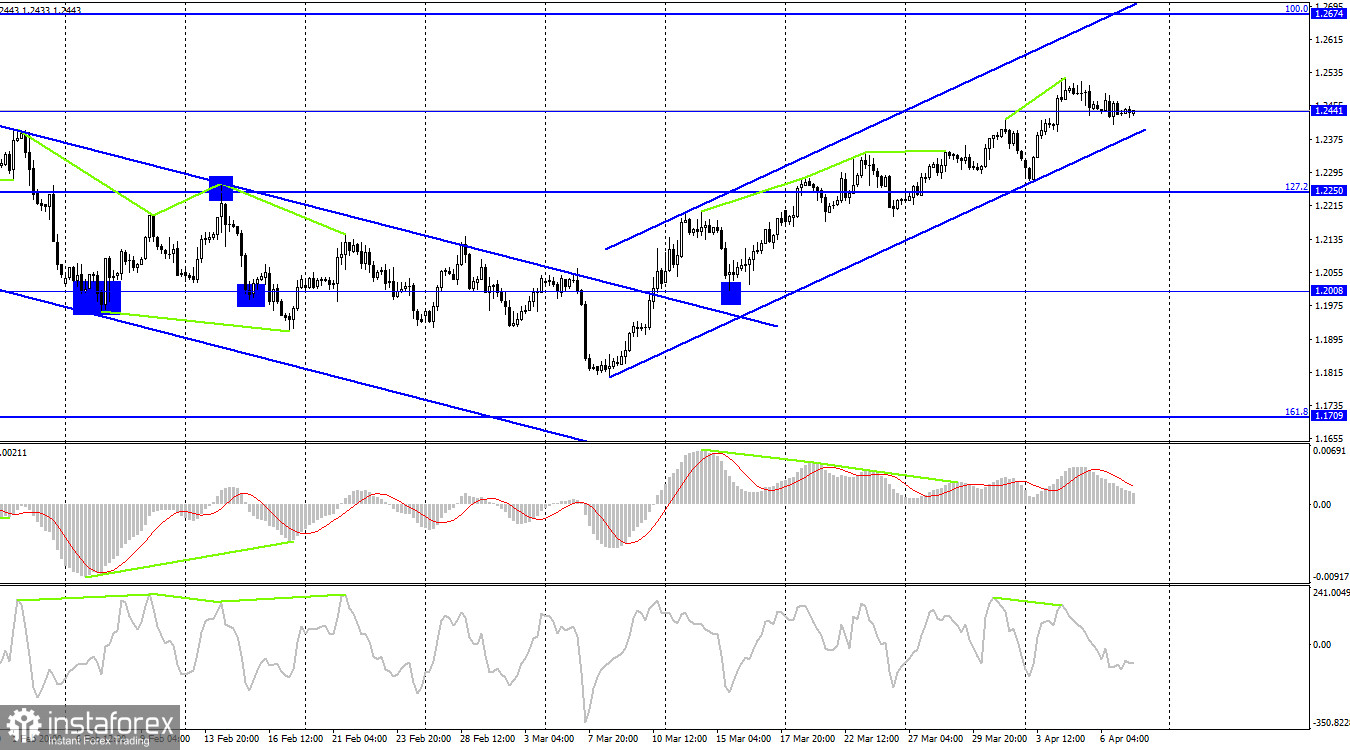

On the 4-hour chart, the pair reversed in favor of the British currency and resumed the growth process, closing above the 1.2441 level. A new "bearish" divergence was formed at the CCI indicator, but the three previous "bearish" divergences did not lead to a strong decline in the British pound. As we can see, there have been enough sell signals lately, but the bears went on vacation. The British pound may target the Fibonacci level of 100.0% (1.2674) in case of a rebound from 1.2441. Otherwise, the decline may continue.

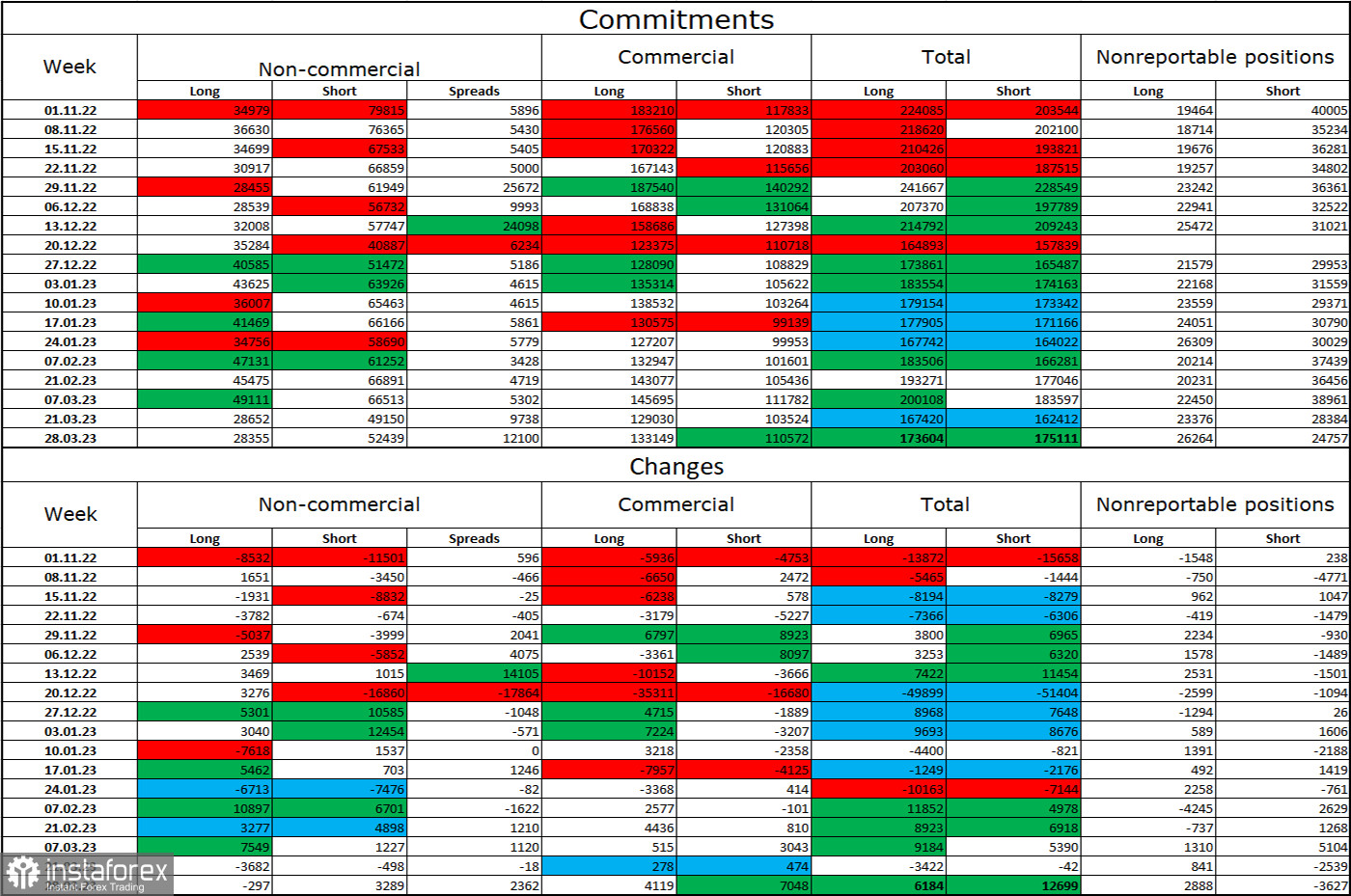

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" category of traders did not change much during the last reporting week. The number of long contracts held by speculators decreased by 297 units, while the number of short contracts increased by 3,289. Overall, the big players are still "bearish," and the number of short contracts still outnumbers the number of long contracts by a large amount. Over the past few months, the situation has continuously changed in favor of the British pound. However, the difference between the number of long and short contracts speculators hold remains significant. Thus, the prospects for the pound are improving, but the British pound has not grown or fallen in recent months. On the 4-hour chart, there was a breakout from the descending corridor, and this moment could support the pound. However, many factors contradict each other now, and the informational background does not provide much support for the pound.

Economic calendar for the US and UK:

US - average hourly earnings (12:30 UTC).

US - Nonfarm employment change (12:30 UTC).

US - unemployment rate (12:30 UTC).

On Friday, the economic events calendar contains only reports from the US, which will be released in a couple of hours. The influence of the informational background on traders' sentiment today may be strong, but the traders themselves may be absent from the market.

GBP/USD forecast and trading advice:

I advise selling the British pound if it closes below the 1.2432 level on the hourly chart, targeting 1.2342. Buying the British pound is now unsafe because it has grown significantly, and we have had many sell signals lately.