Despite the three-day peak of GBPUSD, the pound is still the most effective G10 currency. Since the beginning of the year, GBP has strengthened against the USD by 2.8%, and over the past month, by 3.4%. What are the reasons for its success? The energy crisis in the eurozone was not as bad as it was painted, the British economy is performing well, and its banking system seemed more stable to investors than those in Europe or the US. Add to that the high chances of the Bank of England maintaining its aggressive interest rate hikes, and everything falls into place.

Let's remember the sentiment that the pound had when it entered 2023. The disastrous consequences of Liz Truss' mini-budget, which caused GBPUSD to plummet to a historic low, were behind us, but the pair's prospects seemed grim. The IMF predicted that, along with Russia, Britain would become a major economy that would fall into recession in 2023. The BoE expected a prolonged decline.

Despite the sharp deterioration in macro data, persistent inflation growth, and the cost-of-living crisis, Sterling was under pressure throughout the winter. However, spring arrived, the weather warmed up, and the bulls spread their wings.

The dynamics of economic surprises, GDP, and inflation in Britain

The string of positive business activity and retail sales data calls into question whether the UK economy faced stagflation after growing 0.3% in January. While mass strikes may have limited the recovery, the existing positive momentum is likely to continue.

Along with better-than-expected economic performance, the fact that inflation persists at elevated levels has prompted the BoE to maintain its resolve. In the short-term, the market is certain that the BoE will proceed with monetary tightening, with the REPO rate expected to rise by 25 bps in May to 4.5%, which is one of the drivers of the GBPUSD rally. Furthermore, the pound recently retreated due to the increased probability that the Federal Reserve would probably do the same thing in May, as chances have risen from less than 50% in early March to the current 70% in April.

Dynamics of GDP forecasts and monetary policy divergence

In my opinion, the long-term prospects for GBPUSD are bullish, but in the short-term, the fate of the pair will depend on the March US inflation report. According to Bloomberg estimates, consumer prices will slow down from 6% to 5.2%, but the core indicator will rise from 5.5% to 5.6%. The persistence of high inflationary pressure forces the Fed to continue tightening monetary policy and supports the USD index, albeit temporarily.

On the other hand, if US inflation does not meet expectations, the pound will continue to strengthen against the US dollar.

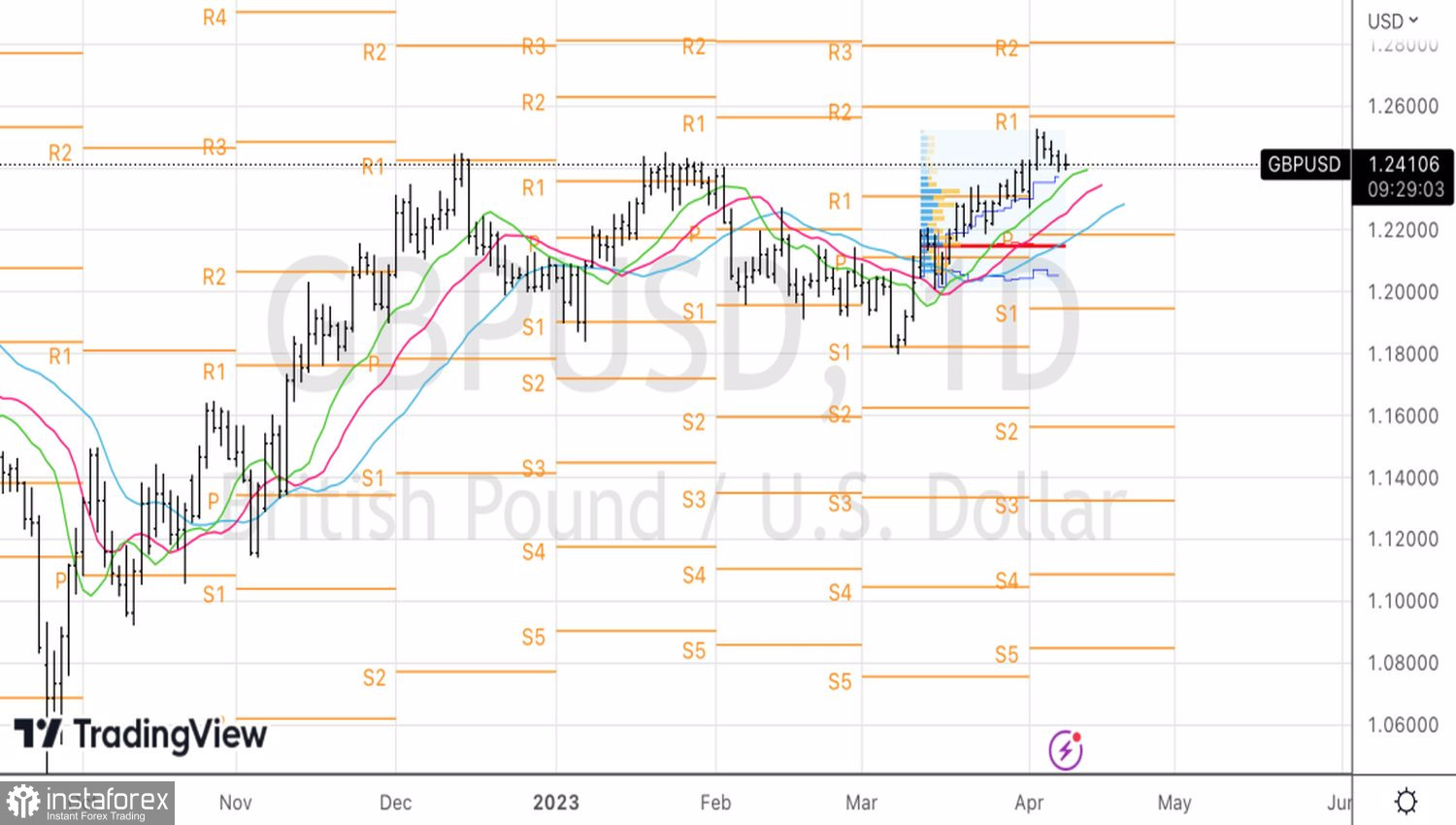

Technically, on the daily chart, GBPUSD is experiencing a correction towards the uptrend. A rebound from dynamic supports in the form of moving averages and pivot levels at 1.2355 and 1.2315 will create an opportunity to open long positions towards 1.26 and 1.28.